Financial planning for singles: managing money on your own

Navigating financial planning on your own doesn’t have to be overwhelming. Our guide provides valuable insights, strategies, and resources specifically designed for those undertaking their financial journey independently. Whether you’re budgeting, saving, or investing, our tips will help you make informed decisions, setting you on the path to financial empowerment. Embrace the challenge of managing your finances solo with our expert advice on financial planning – your roadmap to achieving financial success and security on your own terms.

Investing and financial planning without a partner

Embarking on the journey of financial planning and asset management solo can seem daunting, but with the right guide, it’s an empowering adventure. This comprehensive guide dives deep into the essentials of managing your finances independently, ensuring you have the knowledge and tools to take control. Whether you’re navigating investments, savings, or budgeting, our expert advice helps you understand the intricacies of financial planning. Perfect for those seeking to master their economic destiny solo, this guide is your first step towards financial freedom and savvy asset management. Let’s begin this journey to financial self-sufficiency together.

Saving for the future as a single person

Securing a stable financial future, especially for individuals managing life independently, requires the crucial practice of saving. Emphasizing the importance of saving for the future not only reflects wisdom but is essential for achieving financial security. This approach guarantees a worry-free transition into the later stages of life, highlighting the significance of proactive financial planning. With the focus on saving future, the content underscores the need for individuals to prioritize their financial well-being, ensuring a secure and stable lifestyle ahead.

Budgeting tips for single income households

Navigating the complexities of managing finances on a single income can seem daunting. However, with the right budgeting tips, it’s possible to thrive in a one-income household. Our blog offers invaluable advice on how best to maximize your financial resources, providing practical strategies that can significantly improve your financial health. From understanding your spending habits to identifying areas where you can cut costs without compromising your quality of life, these budgeting tips are essential for anyone looking to make the most of their financial situation in a single-income environment.

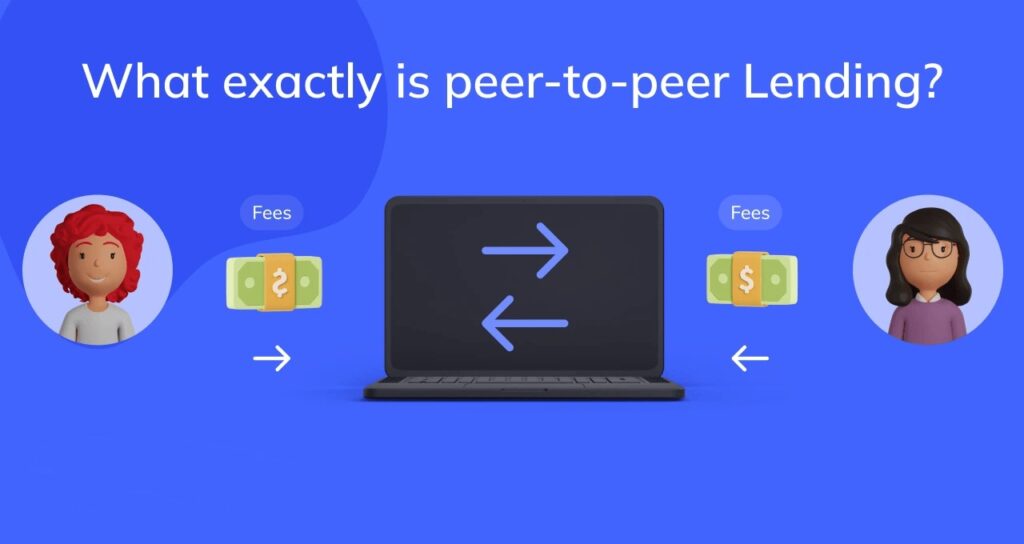

The basics of peer-to-peer lending as an investment

Peer-to-peer lending revolutionizes investment options by directly connecting borrowers with investors, bypassing traditional financial intermediaries. This groundbreaking method offers potential high returns, diversifying portfolios away from conventional markets. Understanding peer-to-peer lending is vital for those seeking innovative investment avenues. It opens doors to varied investment opportunities, enabling personalized risk management and contributing to a dynamic financial ecosystem. By embracing this model, investors gain access to a broader spectrum of borrowers, promising a blend of risk and reward tailored to individual preferences in the evolving landscape of investment strategies.

How to get started with peer-to-peer lending

Embarking on the journey of peer lending can be an exciting yet intimidating experience for beginners. Our guide simplifies this innovative investment form, providing step-by-step advice to engage successfully. Discover essential tips and strategies to navigate the world of peer lending effectively, unlocking potential financial benefits. This beginner-friendly guide ensures a smooth start in peer lending, highlighting its opportunities and considerations for new investors.

Risks and rewards of investing in peer-to-peer loans

Exploring the world of investing loans, especially via peer-to-peer (P2P) lending, presents lucrative opportunities for investors. This rapidly growing segment allows individuals to directly lend to one another, bypassing traditional financial institutions. It’s essential, however, for potential investors to approach P2P lending with a thorough understanding of the risks and rewards involved. With careful consideration and strategic planning, investing in loans through P2P platforms can offer significant returns. This investment strategy requires diligence in selecting loans and understanding market dynamics to successfully navigate and capitalize on the unique advantages of P2P lending.

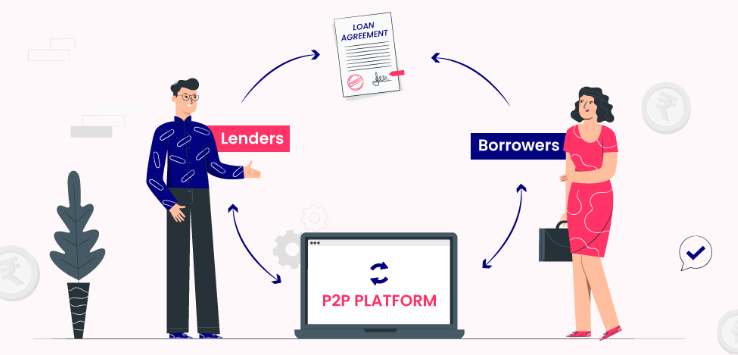

What is peer-to-peer lending?

Peer-to-peer (P2P) lending has emerged as a modern financial phenomenon, marking a shift from traditional financial systems fraught with complexities and barriers. This innovative lending and borrowing method has gained significant traction, offering a streamlined alternative for individuals seeking financial services outside the conventional banking framework. P2P lending facilitates direct transactions between individuals, bypassing traditional financial intermediaries, and thereby, reducing costs and increasing accessibility for both lenders and borrowers. This system not only democratizes financial services but also introduces a more personalized and efficient way of handling loans and investments.

Saving money on travel: tips and tricks

Unlock the secrets to saving travel expenses with our comprehensive guide. Discover practical tips on securing the best airfare deals and sourcing budget accommodations without compromising on the adventure. This guide ensures your travels remain unforgettable and affordable, blending exciting explorations with savvy saving techniques. Make every journey count by mastering the art of cost-effective travel. Whether you’re a seasoned traveler or planning your first trip, this guide is your ultimate resource for making memorable trips that won’t break the bank.

Saving on food and activities while traveling

Discover cost-effective strategies for saving food and money on your next adventure with our guide. Learn how to slash meal and entertainment expenses without sacrificing the joy of exploring new destinations. From smart sustenance savings to economical enjoyment, our tips help travelers make the most of their journeys. Embrace these practical recommendations and enjoy the wonders of the world without breaking the bank. Perfect for those seeking to indulge in exploration while maintaining a budget.