Crowdfunding vs traditional funding

In today’s fast-paced entrepreneurial landscape, exploring various funding avenues is crucial. Crowdfunding funding emerges as a leading option, juxtaposed against traditional funding methods. This approach offers unique advantages, making it an attractive choice for new entrepreneurs. Crowdfunding allows for direct interaction with potential investors and customers, providing valuable feedback and establishing a robust community around a project. Unlike traditional funding, which often involves rigorous vetting and strict criteria, crowdfunding presents a more accessible and versatile option. Entrepreneurs looking to navigate the complex world of startup financing can benefit significantly from understanding the nuances of crowdfunding funding, a key player in modern business growth strategies.

Strategies for a successful startup campaign

“In the competitive realm of startups, securing capital is crucial for success. This guide delves into the essentials of startup crowdfunding, offering entrepreneurs actionable insights to catapult their funding campaigns to success. By understanding the nuances of strategic crowdfunding, startups can significantly enhance their visibility and attract the necessary financial backing. Whether you’re just beginning or looking to expand, mastering the art of crowdfunding is key to unlocking your startup’s full potential. Dive into the world of startup crowdfunding and transform your innovative ideas into reality.”

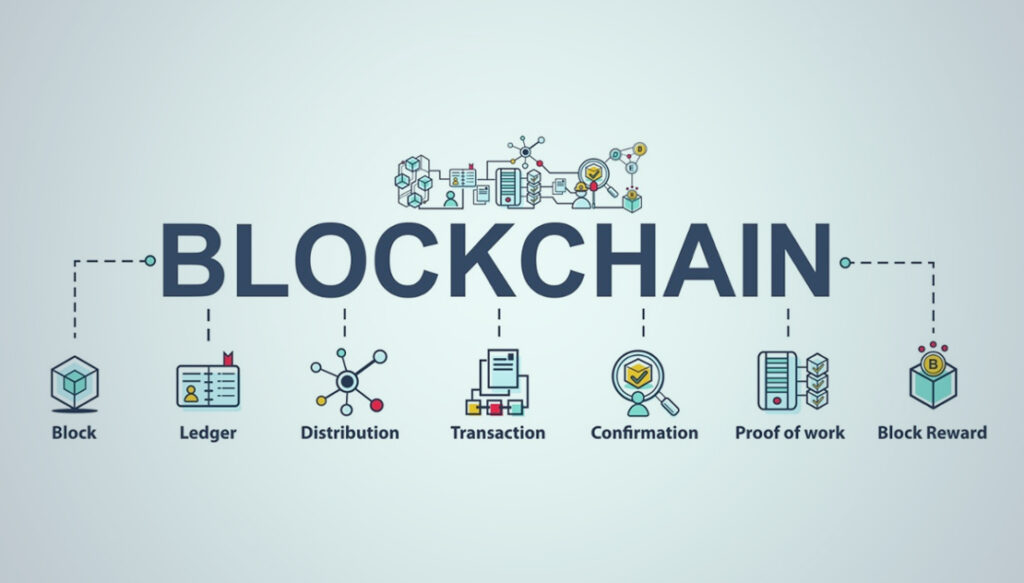

Blockchain’s role in fintech

The integration of blockchain in fintech has revolutionized the financial industry by significantly enhancing security, improving transparency, and boosting efficiency. This innovative technology offers a myriad of benefits, from streamlined transactions to reduced fraud, marking its indispensability in modern finance. As blockchain fintech continues to evolve, it paves the way for a more secure and efficient financial future, demonstrating its crucial role in reshaping financial services. This advancement underscores the transformative impact of blockchain on the sector, signaling its potential to redefine traditional financial paradigms.

Blockchain and the future of transactions

In the rapidly evolving digital landscape, blockchain technology is revolutionizing the foundation of financial transactions. This innovative technology promises a future characterized by enhanced transparency and unparalleled security. By facilitating secure, transparent blockchain transactions, it is reshaping the way we think about digital finance. As a cornerstone of the digital economy, blockchain is not just a trend; it’s the future of secure and transparent transactions in the digital world.

How blockchain is enhancing security

In the digital era, blockchain security has emerged as a revolutionary solution to counter data breaches and cyber-attacks. This blog explores how blockchain technology is transforming digital security, offering a robust defense against online threats. By leveraging blockchain’s decentralized and immutable nature, it ensures data integrity and enhances security protocols, making it an invaluable asset in safeguarding online information. Blockchain security stands at the forefront of digital protection, promising a more secure internet landscape.

Innovations in blockchain for finance

In recent years, blockchain finance has revolutionized the financial landscape, marking a period of significant growth and modernization. This innovative wave, driven by technology, merges traditional financial systems with the robust, secure features of blockchain, bringing forth efficiency, transparency, and enhanced security. As blockchain finance continues to evolve, it paves the way for more accessible, reliable financial transactions, promising a transformative future for the global economy. This blend of technology and finance not only highlights the potential for a more interconnected financial world but also underscores the importance of adaptability and innovation in the digital age.

The future of peer-to-peer payments

The future of P2P payments indicates a major shift in personal finance and commerce, promising simplified and more seamless transactions. With the integration of these payments systems into daily activities, P2P payments are set to redefine how we manage money, making financial exchanges more direct and user-friendly. This evolution not only enhances convenience but also broadens the accessibility of digital finance, marking a significant leap towards innovative financial solutions. As P2P payments continue to grow, they are expected to play a pivotal role in the future of economic transactions.

Integrating P2P payments in daily life

In today’s fast-paced environment, Peer-to-Peer (P2P) payments have revolutionized the way we handle transactions, showcasing significant advances in financial technology. P2P payments have become integral to daily life, streamlining the process of transferring money and fostering a more efficient economy. This adoption not only demonstrates the convenience and efficiency these platforms offer but also underscores their growing importance in our digital world.

The advantages of peer-to-peer payments

The shift towards digital finance has significantly spotlighted Peer-to-Peer (P2P) payments, offering a convenient method for conducting transactions. This blog post delves into the multifaceted advantages of P2P payments, showcasing how they streamline financial exchanges between individuals. With the rise of digital transactions, P2P payments emerge as a forefront solution, enhancing user experience by promoting ease, speed, and security in monetary exchanges. As digital finance evolves, understanding the benefits of P2P payments becomes crucial for embracing efficient and modern transaction methods.

How P2P payments are simplifying transactions

Peer-to-Peer (P2P) payments are revolutionizing the financial landscape, offering a seamless and efficient way for individuals and businesses to conduct transactions. In this era focused on convenience and speed, P2P payments stand out by enabling immediate digital money transfers without the intermediation of traditional financial institutions. This innovative payment method is not only reshaping our approach to personal and commercial dealings but also promoting a more connected and streamlined economic environment. As P2P payments continue to gain popularity, they represent a pivotal shift in the way we manage our financial interactions, emphasizing the value of simplicity and immediacy in the digital age.