Strategies for a balanced mind and body

In the digital age, integrating gaming education into mental and physical harmony practices offers a revolutionary approach. This blog delves into the significance of maintaining equilibrium between mind and body, highlighting how gaming education can be a pivotal tool. It unveils comprehensive strategies to harness the power of games for enhancing cognitive skills and promoting physical wellbeing. With gaming education’s unique ability to engage and educate, it’s poised to redefine traditional methods, making the quest for mental and physical balance not only more effective but also engaging. Explore how to seamlessly integrate gaming into your wellness regime for optimum health.

Minimalist living: Benefits and tips

In today’s fast-paced world, embracing minimalism through urban gardening has gained popularity, offering a way to live more fulfilling lives with less. This lifestyle choice not only simplifies existence but also integrates nature into urban settings, providing environmental and mental health benefits. Through urban gardening, individuals can create serene, green spaces in busy cities, enhancing their wellbeing while contributing to sustainability. This practice allows for a harmonious blend of simplicity and nature, reflecting a profound shift towards a more purposeful and eco-friendly way of living. Discover how urban gardening is revolutionizing minimalism in urban areas.

Minimalism in digital life: Reducing screen time

In today’s screen-dominated world, embracing minimalism for enhanced well-being is crucial. This guide, focusing on strategies to minimize screen time, inadvertently highlights the significance of autonomous vehicles. As we strive for digital minimalism, autonomous vehicles emerge as a tool facilitating this goal by potentially reducing our reliance on screens even in transit. Discover how adopting minimalist practices in our digital experiences, alongside advancements like autonomous vehicles, can lead to a healthier, more balanced life.

Adopting a minimalist wardrobe

Embracing a minimalist wardrobe significantly enhances life in the gig economy, simplifying personal style and supporting a flexible lifestyle. This fashion approach, ideal for individuals in the gig economy, promotes efficiency, reduces decision fatigue, and mirrors the fluidity of gig work. Adopting minimalism in your wardrobe can lead to a more focused and sustainable way of living, perfectly aligning with the dynamic demands of the gig economy. This lifestyle choice not only benefits your personal aesthetic but also supports the adaptability required in modern work environments.

How to declutter your space effectively

In our fast-paced world, maintaining sleep health is crucial. This blog post delves into the significance of tranquility and organization in our personal spaces for enhancing overall well-being and sleep quality. By exploring effective strategies for simplifying and organizing our surroundings, we provide essential tips that anyone can implement. These practical steps not only aim to create a serene environment conducive to rest but also to improve sleep health significantly. Discover how minor adjustments to your daily routine and space can lead to major improvements in your sleep patterns and overall life quality.

E-learning trends shaping the future of education

In the ever-evolving digital landscape, e-learning has become a key aspect of modern education, revolutionizing the acquisition and dissemination of knowledge. This transformation is largely fueled by the integration of cutting-edge technologies and effective pedagogical approaches. A crucial component underpinning this shift is the implementation of leadership strategies in e-learning development. These strategies are essential for fostering an environment that encourages innovation, engagement, and the continuous improvement of educational frameworks. By prioritizing leadership in the realm of e-learning, educators and institutions are better positioned to meet the diverse needs of learners in this digital age.

Personalized learning through AI technologies

In the era of technological revolution, educational VR enhances personalized learning through artificial intelligence (AI), revolutionizing education. This transformative approach allows students to engage with content in unprecedented ways, offering a tailored educational experience. By integrating educational VR with AI technologies, learning becomes more interactive and immersive, catering specifically to individual learning styles. This method marks a significant leap towards a more effective and engaging educational system, leveraging the power of modern technology to reshape traditional learning paradigms.

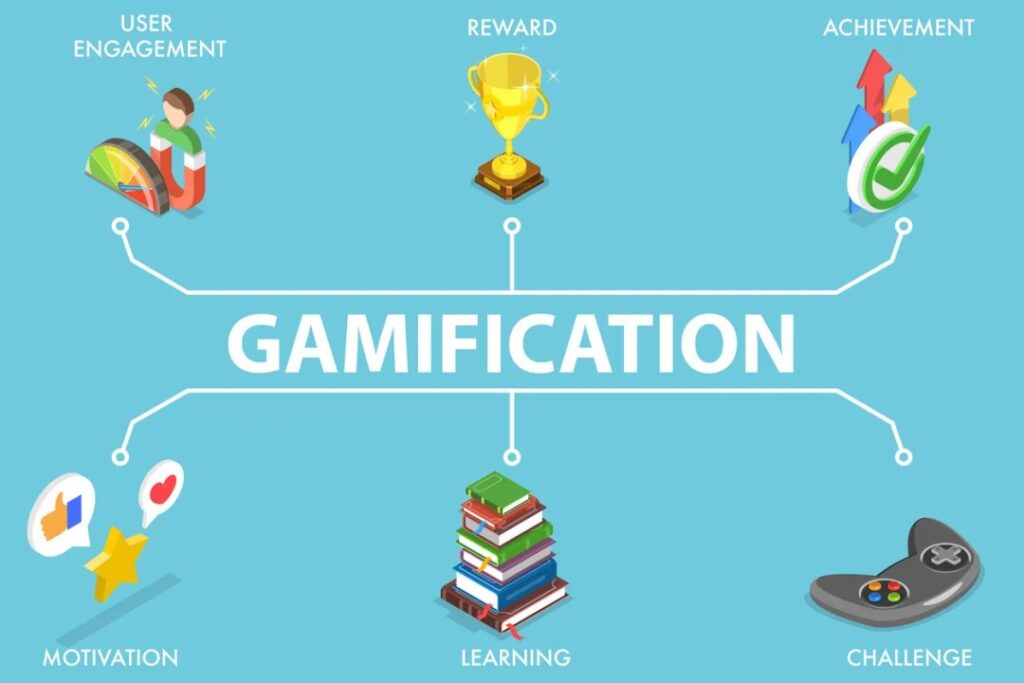

Gamification in learning: A new approach

In the educational sphere, a groundbreaking approach has emerged, seamlessly blending leisure elements with learning processes. This method has significantly transformed learner engagement, taking advantage of the vast capabilities of social media analytics. By incorporating analytical insights from social platforms, educators can tailor content to meet diverse learning needs and preferences, enhancing the overall educational experience. This innovative strategy not only supports the personalization of learning but also leverages the power of social media analytics to create a more interactive and engaging learning environment.

The impact of VR on remote education

In this blog post, we explore how Virtual Reality (VR) technology is revolutionizing education in our era, with a particular focus on its synergy with quantum computing. As remote learning becomes increasingly prevalent, VR has emerged as a pivotal tool in transforming how students interact with and comprehend complex subjects. Especially when integrated with quantum computing, VR has the potential to enhance the educational experience by providing immersive and interactive learning environments. This combination paves the way for a more engaging and effective way of understanding intricate concepts, making it a game-changer in the realm of education technology.

Leveraging SEO for business growth in 2024

In the dynamic digital realm of 2024, mastering Search Engine Optimization (SEO) is essential for businesses aiming to thrive. Integrating SEO with email marketing strategies offers a competitive edge, ensuring brands stand out in crowded markets. By tailoring email marketing content with SEO best practices, businesses can increase their visibility, drive traffic, and ultimately boost growth. This synergy between SEO and email marketing not only enhances a brand’s online presence but also maximizes the effectiveness of digital marketing campaigns, making it a key element for success in today’s digital landscape.