The shift from physical to digital banking

The evolution from traditional banking to digital wallets has transformed financial management, marking a rapid shift to innovative digital solutions. This transition highlights a significant change in how we handle our money, moving away from physical banking practices to embracing the convenience and efficiency of digital wallets. As consumers increasingly rely on these modern platforms for their financial transactions, understanding this evolution becomes crucial. This post delves into the transformative journey, underscoring the pivotal role of digital wallets in today’s banking landscape.

Comparing convenience, security, and accessibility

In the digital age, the balance between convenience, security, and accessibility in digital banking services is crucial. This blog post delves into how digital transformation influences these aspects, comparing various services to highlight the best practices in the industry. As we navigate the challenges and opportunities of digital banking, understanding these elements becomes essential for consumers and providers alike. Stay informed to make the most out of digital banking in this rapidly evolving landscape.

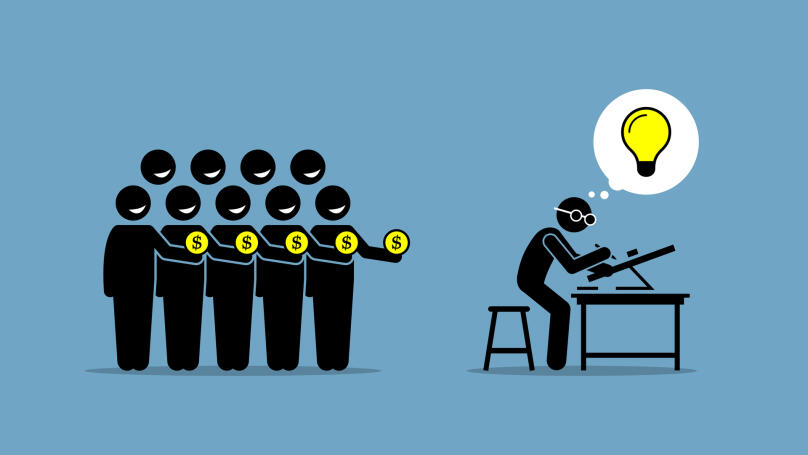

Investment crowdfunding for beginners

Investment crowdfunding provides a gateway for beginners to explore investment opportunities. This strategy allows people to support ventures by pooling small investments from a broad audience. Ideal for those new to investing, investment crowdfunding simplifies entering the financial market. It offers a chance to back projects with potential for growth, making it a smart option for novice investors seeking to diversify their portfolio. With its emphasis on community funding, it highlights the power of collective investment in driving innovation and fostering entrepreneurial ventures.

Risks and rewards of crowdfunding investments

Crowdfunding investments offer a novel way to diversify investment portfolios, merging potential high rewards with certain risks. This guide explores the intricacies of this modern investment strategy, providing insights into navigating the complexities of the crowdfunding investment landscape. With a focus on understanding both the opportunities and challenges, investors can make informed decisions in this evolving realm.

How to participate in investment crowdfunding

Exploring investment crowdfunding offers a unique opportunity to support promising businesses while aiming for potential returns. This guide delves into essential strategies and insights for engaging effectively in this growing field. Learn the basics of investment crowdfunding, the benefits of diversifying your portfolio, and how to identify promising opportunities. With the right approach and knowledge, investors can navigate the investment crowdfunding realm, making informed decisions that align with their financial goals and interests. This overview serves as a starting point for anyone interested in the dynamic world of investment crowdfunding.

Understanding equity crowdfunding

Equity crowdfunding presents a dynamic landscape for entrepreneurs and investors, democratizing traditional investment avenues. This model significantly amplifies opportunities for startups, allowing them to access capital more efficiently while offering investors the chance to become part of potentially lucrative ventures. By exploring equity crowdfunding, participants engage with a more inclusive financial ecosystem, fostering innovation and growth in the startup community. This approach benefits both creators and investors, making it a pivotal aspect of the modern investment landscape.

The role of fintech in global trade

In today’s business landscape, fintech global trade stands as a groundbreaking force, reshaping international commerce. This evolution marks a shift from traditional methods to digitized, efficient systems facilitated by financial technology. As globalization cements itself into the fabric of modern business, fintech emerges as a crucial element, enabling seamless transactions across borders. This article explores the dynamic impact of fintech on global trade, highlighting how it streamlines operations, enhances accessibility, and fosters economic growth worldwide. Through fintech, businesses can now navigate the complexities of international trade with unprecedented ease, illustrating the sector’s vital role in the contemporary global market.

The impact of digital finance on trade efficiency

In recent years, digital finance has significantly influenced trading efficiency, revolutionizing global trade practices. This shift towards digitization has streamlined operations, enhancing the way trade is conducted worldwide. By optimizing processes and making transactions faster, digital finance has opened new avenues for traders, facilitating more efficient and effective trade mechanisms. With digital finance at the forefront, the future of trade looks promising, offering unprecedented opportunities for growth and innovation in the global market.

Fintech solutions for international businesses

In today’s global economy, fintech solutions are transforming the landscape of international business, offering unparalleled opportunities for cross-border enterprises. These technological innovations are pivotal in facilitating efficient, secure, and fast transactions on a global scale. With fintech at the forefront, businesses can navigate the complexities of international markets with greater ease, ensuring a more connected and financially inclusive world. Fintech’s role in international business is indispensable, shaping the future of global commerce with its cutting-edge solutions.

Simplifying cross-border transactions with fintech

In today’s interconnected world, fintech cross-border transactions are revolutionizing the way businesses and individuals handle international exchanges. By leveraging innovative technology, fintech is making these processes faster, more secure, and cost-effective. This post delves into the mechanisms through which fintech streamlines cross-border dealings, offering insights into its impact on the global economy and the future of international trade. As fintech continues to evolve, it’s clear that its role in facilitating efficient cross-border transactions will only grow, transforming global commerce in unprecedented ways.