Understanding and using balance transfer credit cards

Understanding balance transfer credit cards is pivotal for managing and reducing debt efficiently. This guide explores how to select and use these financial tools effectively. With the right balance transfer credit card, you can consolidate debt, lower interest rates, and navigate your way to financial freedom. This post covers all you need to acknowledge about making the most of balance transfer opportunities, ensuring you’re equipped to make informed decisions that benefit your financial situation.

Tips for using balance transfer cards to get out of debt

In this comprehensive guide, we delve into the intricacies of transfer debt strategies, focusing on how balance transfer cards can be a pivotal tool for those looking to navigate the maze of financial products and reduce their debt. The guide aims to illuminate the pathway towards financial freedom by utilizing balance transfer cards effectively, offering hope and practical advice for individuals striving to manage and overcome their debt challenges. Learn the essential tips and strategies to leverage transfer debt techniques for a healthier financial future.

How to choose the best balance transfer card

Selecting the ideal transfer card is essential for effective debt management and reduction. This guide provides key insights to assist in making an informed decision that aligns with your financial requirements. Understanding the nuances of various transfer cards can vastly improve your strategy for tackling debt, ensuring you choose a solution that perfectly fits your needs. Discover how to leverage the benefits of transfer cards for optimal financial health.

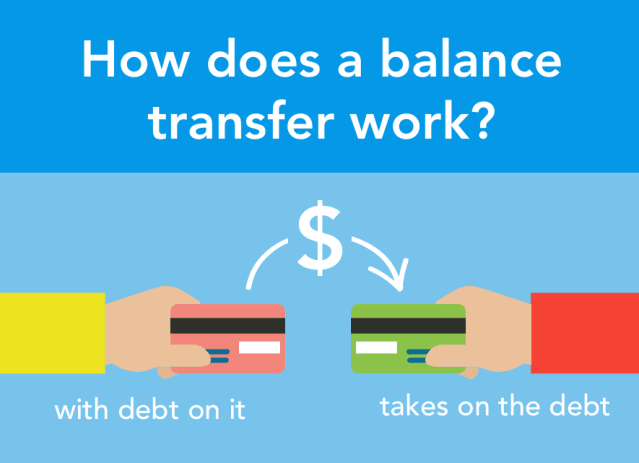

What are balance transfer credit cards?

Understanding balance transfers on credit cards is key to managing debt and enhancing financial flexibility. This guide explains the functionality and benefits of balance transfers, offering insights into how they can be a strategic option for debt management. By exploring the nuances of these financial tools, individuals can gain control over their finances, reduce interest payments, and potentially improve their credit scores. Engaging with balance transfers wisely can lead to significant financial advantages and smarter debt handling.

Understanding the benefits of credit card insurance

“In today’s fast-paced society, understanding credit card insurance benefits is crucial for financial security. This protective layer, often overlooked, offers a safety net against unexpected events. As the prevalence of credit card use continues to rise, it’s essential to be informed about the insurance coverage that accompanies these financial tools. By delving into the intricacies of credit card insurance, users can ensure they are fully leveraging the benefits available to them, safeguarding their financial well-being against unforeseen circumstances. Stay informed and make the most out of your credit card insurance benefits for a more secure financial future.”

Credit card strategies for maximizing rewards

Discover the best credit card rewards strategies to unlock the full potential of your plastic companions. Beyond just making purchases, this guide delves into the most effective methods to maximize the value you receive from every transaction. By focusing on practical tips and impactful approaches, you’ll learn how to enhance your spending power and enjoy greater benefits. Whether you’re looking to optimize points, cash back, or travel rewards, these strategies will elevate your financial savvy and make every swipe count.

The best credit cards for everyday spending

Discover the best everyday spending credit cards to elevate your financial savvy. This guide showcases top picks that stand out for their exceptional benefits, rewards, and savings opportunities tailored to daily expenses. Whether looking to maximize cashback, earn points on every purchase, or enjoy unique perks, these cards are designed to enhance your spending efficiency. Dive into our comprehensive exploration to find your perfect plastic companion for daily expenses, making smart financial management an accessible reality.

How to choose a credit card that suits your lifestyle

Choosing a lifestyle suitable credit card is crucial for effective financial management. This guide offers valuable insights to align your card choice with your spending habits and financial goals. With numerous options available, understanding how to select a card that complements your lifestyle can significantly enhance your financial well-being. By focusing on cards that offer rewards and benefits tailored to your spending patterns, you can maximize your financial resources and achieve your financial aspirations more efficiently.

Credit cards: Tips for first-time users

Navigating the maze of first-time credit cards can be daunting for beginners. Our comprehensive guide on first-time credit card tips delves into effective strategies to manage your new financial tool with confidence. Learn how to understand your credit score and employ these essential tips to make informed decisions, ensuring a smooth introduction into the world of credit. This guide is a must-read for anyone looking to master their first credit card and build a strong financial foundation.

Managing credit card debt effectively

Managing credit card debt is essential for maintaining financial health. The ease of overspending with credit cards can quickly escalate into significant financial issues. However, adopting strategic planning and disciplined actions can help overcome this challenge. By carefully managing credit card debt, individuals can avoid the pitfalls of excessive borrowing and foster a healthier financial future. It involves understanding the importance of budgeting, the benefits of paying more than the minimum balance, and the impact of high interest rates. Effective management of credit card debt not only helps in reducing financial stress but also in building a strong credit score.