Chase sapphire reserve®: the ultimate premium credit card

Explore the luxurious world of travel with the Chase Sapphire Reserve®, your ultimate passport to exclusive perks and adventures. Aimed at globe-trotters and savvy spenders, this upscale credit card goes beyond ordinary, offering unparalleled access to luxury experiences. Whether it’s lavish getaways or unique benefits, the Chase Sapphire Reserve® stands out as a premium choice for those seeking more than just a trip, but an extraordinary journey. Discover the difference and elevate your travel experiences with this exceptional piece of plastic that promises more than just rewards.

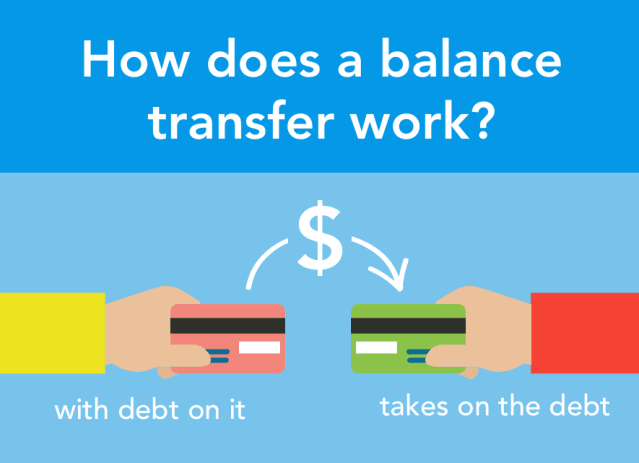

Understanding and using balance transfer credit cards

Understanding balance transfer credit cards is pivotal for managing and reducing debt efficiently. This guide explores how to select and use these financial tools effectively. With the right balance transfer credit card, you can consolidate debt, lower interest rates, and navigate your way to financial freedom. This post covers all you need to acknowledge about making the most of balance transfer opportunities, ensuring you’re equipped to make informed decisions that benefit your financial situation.

Tips for using balance transfer cards to get out of debt

In this comprehensive guide, we delve into the intricacies of transfer debt strategies, focusing on how balance transfer cards can be a pivotal tool for those looking to navigate the maze of financial products and reduce their debt. The guide aims to illuminate the pathway towards financial freedom by utilizing balance transfer cards effectively, offering hope and practical advice for individuals striving to manage and overcome their debt challenges. Learn the essential tips and strategies to leverage transfer debt techniques for a healthier financial future.

How to choose the best balance transfer card

Selecting the ideal transfer card is essential for effective debt management and reduction. This guide provides key insights to assist in making an informed decision that aligns with your financial requirements. Understanding the nuances of various transfer cards can vastly improve your strategy for tackling debt, ensuring you choose a solution that perfectly fits your needs. Discover how to leverage the benefits of transfer cards for optimal financial health.

What are balance transfer credit cards?

Understanding balance transfers on credit cards is key to managing debt and enhancing financial flexibility. This guide explains the functionality and benefits of balance transfers, offering insights into how they can be a strategic option for debt management. By exploring the nuances of these financial tools, individuals can gain control over their finances, reduce interest payments, and potentially improve their credit scores. Engaging with balance transfers wisely can lead to significant financial advantages and smarter debt handling.

Maximizing credit card cashback

Discover the ultimate secrets to maximizing your credit card cashback rewards with our comprehensive guide. Learn effective strategies to enhance your financial well-being by optimizing your spending habits. Unlock the potential of every purchase by exploring the best practices in leveraging credit card cashback perks. Whether you’re a seasoned spender or a budget-conscious shopper, this guide reveals the key to amplifying rewards and making the most of your credit card usage. Dive into our insights and transform your spending into earning.

Choosing the best credit cards for rewards

Choosing the best credit cards for maximizing rewards involves a careful evaluation of offers in relation to your spending habits. To navigate this complex landscape, focus on cards that complement your lifestyle and financial objectives, ensuring every purchase yields the highest possible benefit. By carefully selecting among the best credit cards, you can transform routine buying into a strategic advantage, optimizing rewards and minimizing potential drawbacks. Remember, the key is to match the card’s features with your specific needs, maximizing returns on everyday expenses.