The role of digital ID in financial security

In the digital era, the transition of financial activities online mandates stringent security. Digital ID finance systems stand out as pivotal advancements, ensuring a secure environment for online transactions. These systems not only enhance protection against fraud but also streamline user verification processes, marking a substantial leap in financial security. As digital ID finance technologies evolve, they are set to redefine the landscape of online financial activities, promising a safer and more efficient future for digital transactions.

Streamlining KYC processes with technology

In today’s financial realm, the significance of Know Your Customer (KYC) practices is paramount. Traditional KYC processes, however, are known for their time-consuming and labor-intensive nature. This blog delves into the technological advancements revolutionizing KYC procedures. By focusing on KYC technology, financial institutions can streamline operations, enhance security, and improve customer experiences. This overview highlights the critical role KYC technology plays in modernizing financial services, ensuring that businesses stay ahead in the rapidly evolving financial landscape.

Personalizing insurance through technology

In the era of technological progress, the insurance industry is evolving with technology insurance leading the charge. This new wave of personalization, fueled by cutting-edge technology, is transforming the creation, offering, and management of insurance policies. As technology insurance becomes increasingly crucial, it ensures policies are more tailored and efficient, benefiting both providers and consumers. This advancement signifies a significant shift towards a more dynamic and customized approach in the insurance sector, reflecting the broader impact of technology on industry standards and practices.

The future of AI in financial decision-making

The intertwining of artificial intelligence (AI) in financial strategy is revolutionizing AI financial decision-making processes. This fusion enhances both accuracy and efficiency, transforming how decisions are made within the financial industry. Through AI’s advanced analytical capabilities, financial strategies are now more informed, allowing for better risk assessment and opportunity recognition. This innovative approach to financial decision-making signifies a leap towards more intelligent, data-driven resolutions in finance, marking a paradigm shift in how financial entities approach problem-solving and strategy development. AI’s role in reshaping the financial landscape underscores its importance in the modern financial decision-making toolkit.

How AI is improving financial security

In the era of digital transformation, financial institutions are increasingly utilizing artificial intelligence (AI) to enhance AI financial security. This innovative shift towards AI is revolutionizing the way financial security is perceived and implemented. By incorporating advanced AI technologies, these institutions are not only improving their security measures but also setting a new standard in the financial industry. This adaptation demonstrates a significant move towards more robust and efficient financial security solutions, highlighting the critical role of AI in safeguarding against digital threats in the financial sector.

AI-driven personalization in finance

AI personalization in finance is reshaping the industry, offering a deep personal touch in transactions by tailoring services and products to individual consumer needs. This revolution in the financial sector highlights the significance of leveraging artificial intelligence to provide a more personalized and efficient customer experience. AI personalization finance strategies ensure that consumers receive highly customized financial advice, product recommendations, and service offerings, leading to increased customer satisfaction and loyalty in a competitive market landscape.

Cultural influences on mobile payment technology

In the digital realm, mobile payment technology emerges as a transformative force, drastically altering global transaction methods. This innovation is not only a reflection of technological advancements but is also deeply intertwined with cultural influences. As the world shifts towards digital solutions, understanding the impact of cultural factors on the adoption and evolution of mobile payment technology is paramount. This exploration reveals how cultural diversity shapes the global financial landscape, fostering a nuanced approach to implementing and embracing mobile payment solutions.

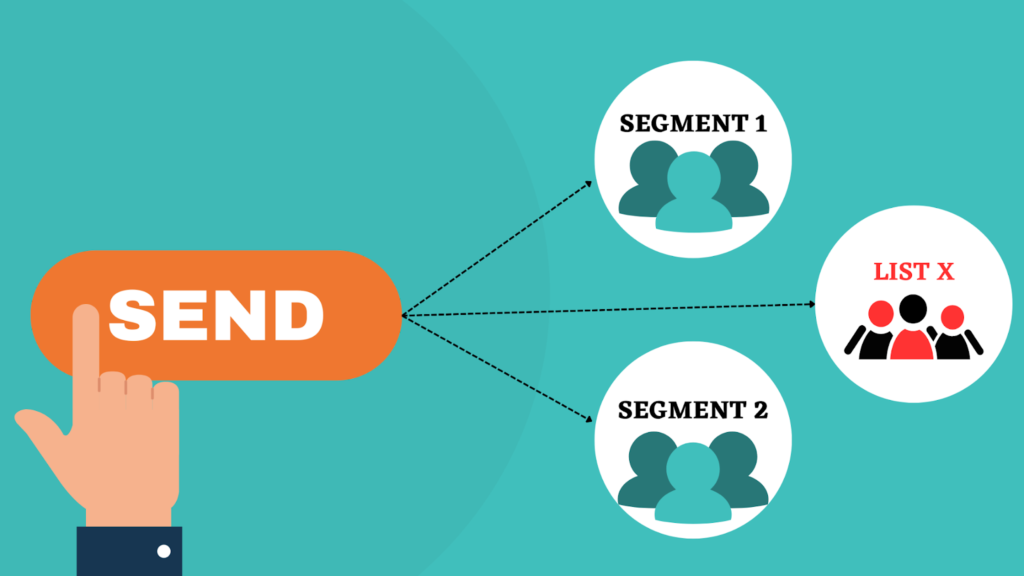

How to launch a successful crowdfunding campaign

Launching a successful crowdfunding campaign in the digital era offers a promising avenue for individuals and startups to secure funding for their projects. Yet, navigating the challenges to reach your funding goal requires strategic planning. This guide provides essential tips to enhance your campaign’s visibility and success. By focusing on impactful storytelling, engaging marketing tactics, and leveraging social media, you can boost your project’s appeal to potential backers. Discover effective strategies to achieve your crowdfunding objectives and bring your innovative ideas to life.

The revolution of mobile payments

In this blog post, we delve into the digital era’s profound transformation of financial transactions, highlighting the revolution of mobile payments. This technological advancement has significantly changed consumer behavior, offering a convenient and secure way to handle money. As we explore the evolution and impact of mobile payments, it becomes clear that this innovation is not just about convenience but also about the broader implications for the future of financial transactions. Embrace the shift towards a cashless society with the advent of mobile payment solutions.

Navigating the rise of financial technology

Fintech innovation is revolutionizing the global economy by transforming our daily financial interactions and understanding of finance. This shift, driven by technology, represents a significant change in the economic landscape, offering new opportunities and reshaping traditional financial services. By focusing on fintech innovation, individuals and businesses can navigate this changing world more effectively, leveraging technology to enhance their financial operations and strategies.