Maximizing profits in small businesses

In the competitive world, small businesses must adopt strategic measures to enhance profitability amidst challenges such as limited resources and intense competition. Focusing on effective strategies can significantly impact their success, ensuring they maximize gains and remain competitive. By prioritizing innovative solutions and efficient practices, small businesses can navigate the dynamic business landscape effectively, securing a stronger position in the market.

Navigating market fluctuations: Tips for entrepreneurs

In the dynamic entrepreneurial landscape, adapting to market shifts is essential. This post emphasizes the critical role of E-learning in navigating these changes. With a unique perspective, it guides entrepreneurs on maximizing E-learning platforms to enhance their skills and adaptability. Highlighting the importance of continuous learning, it presents E-learning as a key tool for entrepreneurs to stay competitive and thrive. Essential for any entrepreneur looking to leverage educational advancements, this content bridges the gap between traditional business strategies and the digital age’s demands.

The role of analytics in risk management

In today’s business world, integrating analytics into risk management is crucial for enhancing decision-making and establishing a robust framework. This practice, known as analytics risk management, allows organizations to navigate the rapidly changing business landscape more effectively. By leveraging analytical tools, companies can identify potential risks, assess their impact, and make informed decisions to mitigate them. Incorporating analytics into risk management strategies not only improves operational efficiency but also contributes to more resilient and adaptable business operations.

Sustainable investing through robo-advisors

Robo-advisors sustainable investing is significantly changing the way we manage our finances with a focus on the environment. This innovative approach provides a viable option for those aiming to secure their financial future while also making a positive impact on the planet. By leveraging advanced technology, sustainable robo-advisors make it easier for individuals to invest in eco-friendly and socially responsible companies. This method combines the efficiency of algorithm-based financial planning with the growing demand for ethical investment opportunities, making robo-advisors sustainable investing a key player in the future of personal finance and environmental stewardship.

Aligning your portfolio with your values

Values-based investing is reshaping the investment landscape, providing a pathway for individuals to align their portfolios with their ethical and environmental values. This strategy not just focuses on financial returns but also on making a positive impact on society. It empowers investors to support companies that adhere to their values, pushing for a more sustainable and fairer world. As values-based investing gains momentum, it’s becoming a critical tool for those looking to invest with purpose and make a difference beyond traditional financial gains. This approach marks a significant shift towards more conscious and responsible investing practices.

Robo-advisors and the rise of green investments

The surge in green investments reflects a growing trend among investors prioritizing ethical and sustainable options. As environmentally conscious decisions become increasingly paramount, green investments have become a favored avenue for those looking to align their financial choices with their ecological values. This shift is notably supported by the rise of automated financial advisors, optimizing portfolios for sustainability. The emphasis on green investments not only marks a pivotal change in investment strategies but also highlights the broader commitment to environmental stewardship in the financial sector.

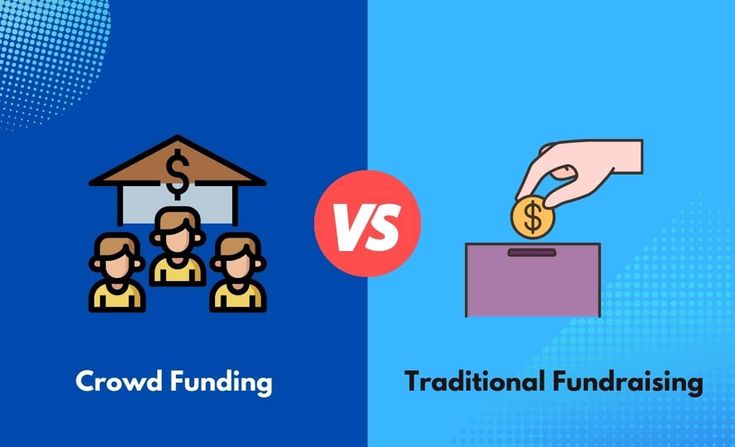

Crowdfunding for startups

Crowdfunding startups are revolutionizing the way entrepreneurs secure financial support, offering an alternative to traditional funding sources. This innovative approach enables young companies to tap into the power of community funding, thereby democratizing the investment process. By leveraging crowdfunding, startups can access a wider pool of investors and gain the capital needed to bring their ideas to life. This shift is not only transforming the funding landscape but also empowering a new generation of entrepreneurs to realize their ventures with greater ease and flexibility.

Crowdfunding vs traditional funding

In today’s fast-paced entrepreneurial landscape, exploring various funding avenues is crucial. Crowdfunding funding emerges as a leading option, juxtaposed against traditional funding methods. This approach offers unique advantages, making it an attractive choice for new entrepreneurs. Crowdfunding allows for direct interaction with potential investors and customers, providing valuable feedback and establishing a robust community around a project. Unlike traditional funding, which often involves rigorous vetting and strict criteria, crowdfunding presents a more accessible and versatile option. Entrepreneurs looking to navigate the complex world of startup financing can benefit significantly from understanding the nuances of crowdfunding funding, a key player in modern business growth strategies.

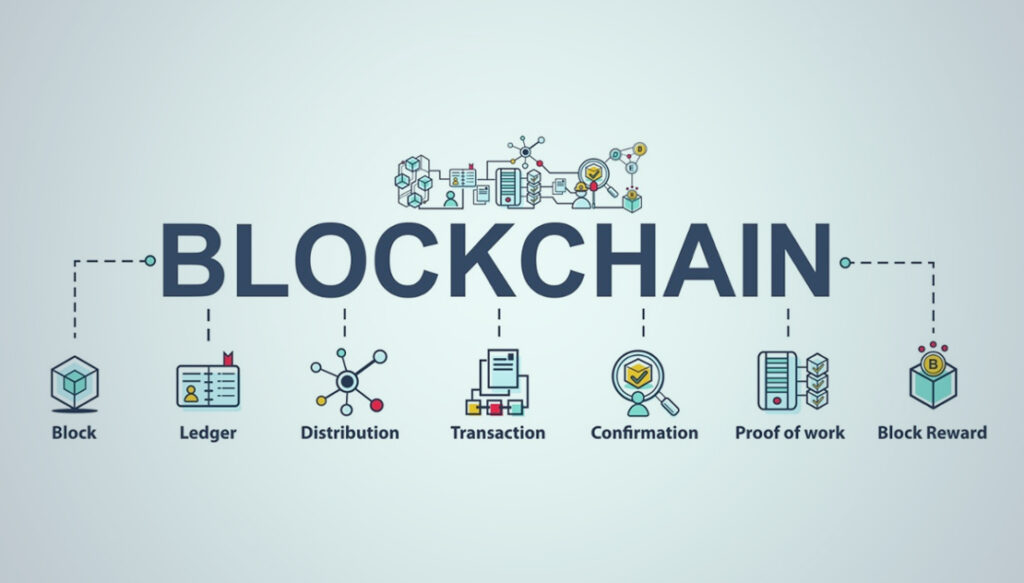

Innovations in blockchain for finance

In recent years, blockchain finance has revolutionized the financial landscape, marking a period of significant growth and modernization. This innovative wave, driven by technology, merges traditional financial systems with the robust, secure features of blockchain, bringing forth efficiency, transparency, and enhanced security. As blockchain finance continues to evolve, it paves the way for more accessible, reliable financial transactions, promising a transformative future for the global economy. This blend of technology and finance not only highlights the potential for a more interconnected financial world but also underscores the importance of adaptability and innovation in the digital age.

Big data’s impact on financial services

In the era of information-driven economies, big data in financial services has become a game-changer, revolutionizing traditional methodologies and fostering innovation. This blog delves into the comprehensive influence of big data, highlighting its role in reshaping financial practices and creating opportunities for growth. By leveraging extensive datasets, financial institutions can enhance decision-making, improve customer experiences, and achieve operational efficiency. Big data’s integration into financial services not only streamlines processes but also paves the way for novel approaches in managing finances, underscoring its critical impact on the sector’s evolution.