Balancing risk in online income streams

In today’s digital age, generating income online, especially within the grocery sector, offers immense opportunities yet comes with its own set of challenges. Navigating the hazards in online revenue channels is essential for maintaining long-term success. By focusing on safe and effective strategies in the online grocery market, individuals and businesses can ensure a steady income stream while minimizing risks. Understanding the balance between potential risks and rewards is key to thriving in the ever-evolving digital landscape, particularly for those looking to capitalize on the growing demand in the online grocery sphere.

Tips for successful online investments

In today’s digital finance landscape, smart investments are key to wealth growth. This post delves into mastering successful online investments, emphasizing the potential of subscriptions. With subscriptions becoming a crucial element in the digital economy, understanding how to leverage this model for investment can significantly enhance your financial strategy. By focusing on the versatility and potential of subscriptions, investors can unlock new opportunities for generating income and expanding their investment portfolio in the digital age.

Best online platforms for passive income

In the digital era, securing financial stability and growth is crucial, and diversifying income streams is key. With a focus on budgeting, exploring passive income ventures offers a promising avenue for revenue generation with minimal effort. These strategies not only enhance budget management but also contribute to long-term financial health. By prioritizing budgeting, individuals can navigate the complexities of the digital economy, ensuring sustainable financial growth through thoughtfully selected passive income opportunities.

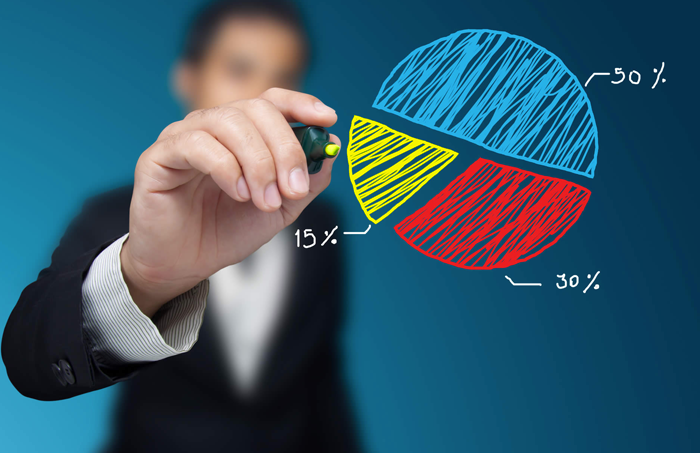

Strategies for diversifying your investment portfolio

Diversifying investments remains a cornerstone approach for those aiming at financial stability and growth. By allocating funds across different asset classes, investors not only mitigate risks but also enhance opportunities for substantial returns. Embracing this strategy enables a balanced portfolio that can weather market volatilities. In essence, diversifying investments is not just about spreading wealth, but strategically positioning it to capitalize on varying financial landscapes, ensuring a more stable and prosperous financial future.

How to assess the risk and return of your portfolio

Understanding portfolio risk and its counterpart, potential returns, is essential for optimizing investments. This guide explores strategies to assess and balance risk versus reward, ensuring investors can make informed decisions. By evaluating portfolio risk, individuals can tailor their investment approaches to meet financial goals while mitigating potential losses. This high-value content offers insights into creating a balanced investment strategy that aligns with personal risk tolerance and return expectations, empowering investors with the knowledge to build a resilient portfolio.

Different ways to diversify your investments

In today’s uncertain market, it’s essential to diversify investments to mitigate risks and improve returns. This guide delves into various strategies to spread your financial portfolio across different assets, ensuring a safer and potentially more profitable investment journey. By exploring multiple avenues, investors can protect themselves against market volatility and increase their chances for financial success. Learn how to effectively diversify your investments in today’s challenging financial landscape for a more secure financial future.

The importance of investment diversification

Exploring diverse investment avenues is crucial for building a robust financial portfolio. Getting into varied types of investments not only expands financial holdings but also plays a vital role in safeguarding assets against unforeseen market volatilities. Embracing this strategy is key to achieving financial stability and growth over time. By getting involved in different investment opportunities, investors can mitigate risks and enhance their potential for generating wealth. This approach is fundamental for anyone looking to secure their financial future in an unpredictable economic landscape.

Protecting your investments from market volatility

In the ever-changing financial landscape, choosing the right strategies to safeguard your investments is crucial. This post explores various methods to secure your capital against market unpredictability, emphasizing the importance of strategic planning. By choosing informed investment strategies, you can protect your assets and ensure long-term growth, even in volatile markets. The key to successful investment lies in careful planning and adapting to market changes, proving that choosing the right approach can make all the difference in securing your financial future.

When to rebalance or adjust your investment strategy

Understanding when and how to rebalance your investment portfolio is essential for achieving investment success and reaching your financial goals. Rebalancing is a dynamic process that ensures your investment allocations remain aligned with your risk tolerance and objectives. By periodically reviewing and adjusting your portfolio, you can maintain the desired level of diversification and mitigate risk. This practice not only helps in optimizing returns but also plays a crucial role in financial health maintenance. Embrace rebalancing as a fundamental strategy to guide you towards your financial aspirations efficiently.

Tools for monitoring investment risk

Navigating the volatile world of investing requires leveraging the right tools to manage and monitor potential risks effectively. This blog post dives into essential tools that empower investors to make informed decisions, ensuring their financial future is secure despite market uncertainties. Discover how to confidently tackle investment challenges and optimize your portfolio for success. Learn the key to safeguarding your investments and staying ahead in the ever-changing financial landscape with our expert insights on the best investment tools.