How to choose the right property for investment

To make a profitable property investment, strategic planning and careful consideration are essential. This guide dives into the crucial tips and advice needed to navigate the complexities of the real estate market. Understanding the dynamics of the industry is key to finding the right real estate asset that will yield significant returns. With focus on property investment, we outline practical strategies to help you make well-informed decisions, ensuring your investment is both wise and fruitful.

Benefits of real estate investment

In the realm of investment, diversification is paramount for mitigating risk and boosting returns. Estate investment emerges as a popular option, illustrating the significant benefits of property investment. This blog post delves into the myriad advantages of incorporating estate investment into one’s portfolio, highlighting its role in achieving financial stability and growth. By underscoring the importance of property investment, investors are guided on how to effectively diversify their investments, making estate investment a cornerstone of a robust investment strategy.

Strategies for paying off credit card debt

Eliminating credit card debt can seem daunting, but it’s achievable with the right approach. This guide dives into effective strategies to reduce credit balances, offering valuable insights into managing and eventually paying off credit debt. By implementing the suggested methods, individuals can take control of their financial situation, paving the way to a debt-free life. These practical tips are tailored to help anyone struggling with credit debt to understand and navigate their way out of financial hardship efficiently.

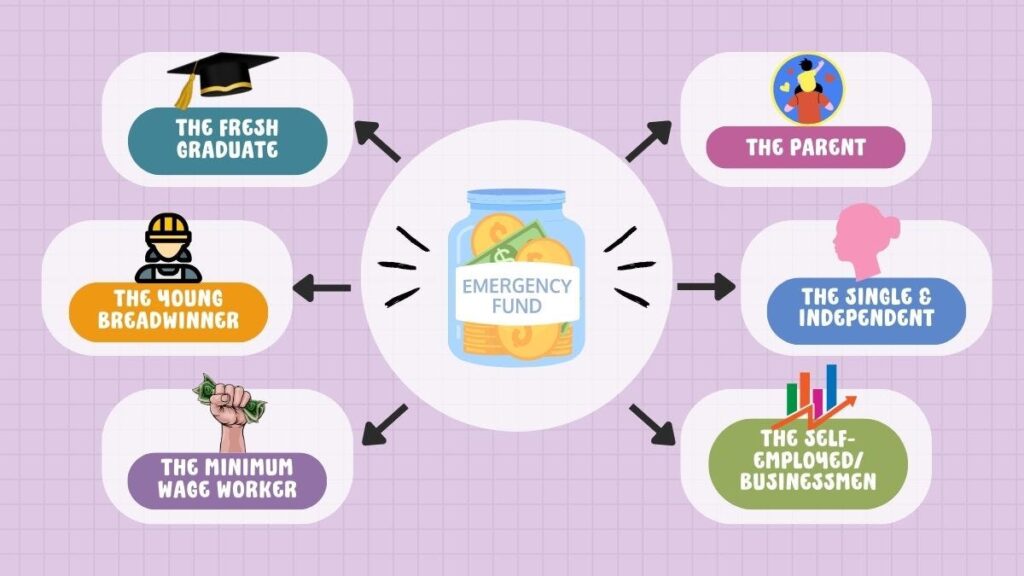

Where to keep your emergency savings for easy access

In today’s unpredictable economy, building and maintaining emergency savings is essential. Knowing the best storage options for your financial safety net ensures quick access when needed. This guide delves into the most optimal places to keep your emergency funds, balancing security with accessibility. Understanding where to store your emergency savings can make a significant difference in managing unforeseen financial challenges, providing peace of mind in turbulent times.

How to start saving for an emergency fund

In today’s unpredictable world, the importance of saving for an emergency fund cannot be overstated. Building a financial buffer is crucial for financial security, and this guide is your roadmap to starting one. By focusing on the essentials of setting up an emergency fund, you’ll learn practical steps to safeguard your future. With a focus on saving emergency funds, this guide ensures you’re prepared for any unexpected financial challenges, making it an indispensable tool for anyone looking to secure their financial well-being in today’s ever-changing environment.

Why an emergency fund is crucial for financial health

Understanding the importance of a contingency reserve is crucial for financial health. This post emphasizes the necessity of safeguarding your financial well-being through strategic planning. Highlighting the benefits of a contingency reserve, it provides key insights into maintaining robust financial health. By preparing for unforeseen expenses, individuals and businesses can ensure stability and peace of mind. Explore how to fortify your economic resilience, emphasizing the critical role of strategic financial planning in achieving long-term financial health.

Building an emergency fund from scratch

Creating an emergency fund is crucial in today’s unpredictable economy, offering financial security and peace of mind during unexpected events. This guide provides practical tips for building a safety net from scratch, highlighting the importance of being prepared. In ensuring your financial well-being, starting an emergency fund paves the way for stability, even amidst financial uncertainties. Learn how to establish and grow your emergency fund effectively, safeguarding your future against unforeseen challenges.

Tips for maximizing your retirement savings

In this detailed guide on maximizing savings for a comfortable retirement, we explore essential strategies to bolster your financial independence journey. Discover practical tips for enhancing your retirement nest egg, ensuring a secure future. From smart investments to budgeting techniques, learn how to build a substantial savings account that will support you in your golden years. Start today to ensure a financially stable tomorrow.

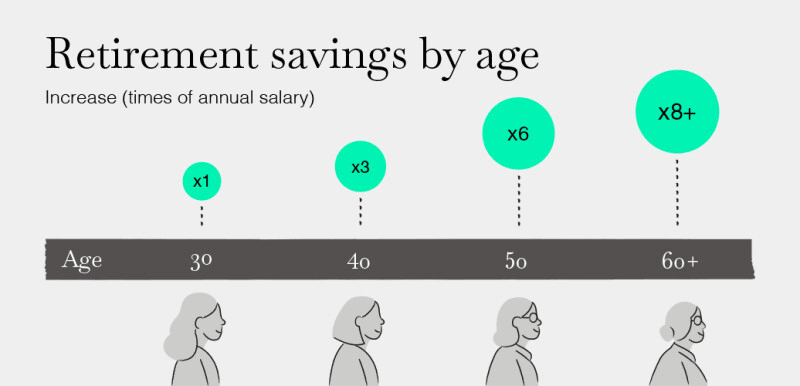

How much should you save for retirement?

Determining the right amount to save for retirement is essential for a comfortable future. This guide delves into crucial factors that influence how much you need to save. By understanding these aspects, you can tailor your retirement savings plan to ensure a secure and comfortable lifestyle post-retirement. Whether you’re just starting or nearing retirement, it’s never too late to adjust your savings strategy. Embrace the journey towards a financially secure retirement by making informed decisions today. Save retirement wisely to enjoy your golden years with peace of mind.

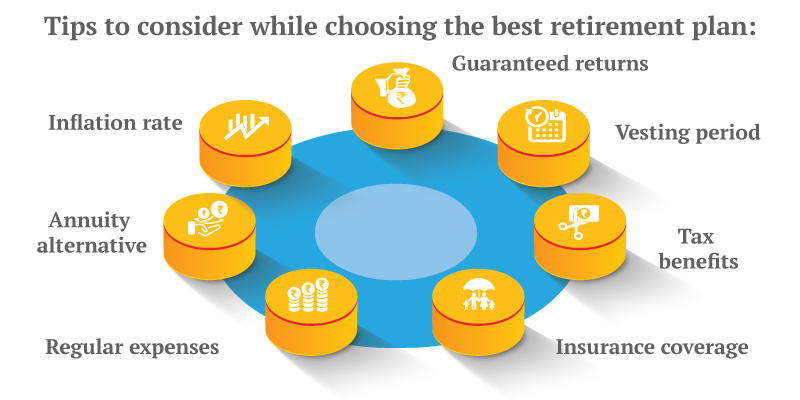

Choosing the right retirement savings plan

Choosing the right savings plan for retirement doesn’t have to be complicated. This blog post offers a comprehensive guide through the various retirement savings plans available, making it easier to find a strategy that suits your needs. Whether you’re just starting to save or looking to optimize your current savings, we’ve got you covered. By making informed decisions about your retirement savings plan, you can ensure a secure and enjoyable golden years.