Tax planning basics for wealth management

“Choosing the right strategies for tax planning is essential for optimizing financial health and boosting long-term wealth. Understanding the fundamentals of managing taxes can significantly influence your overall financial success. This blog post aims to provide an insight into the basics of tax planning, emphasizing the vital role it plays in effective wealth management. By choosing appropriate tax planning techniques, individuals can ensure they maximize their financial potential while adhering to legal obligations, ultimately leading to a more prosperous financial future.”

Understanding asset protection basics

In today’s financial landscape, understanding asset protection and rebalancing strategies is crucial for safeguarding one’s assets and ensuring financial security. This post aims to demystify the basics of asset protection, emphasizing the importance of rebalancing your portfolio as a key practice. Rebalancing helps in aligning your investment strategy with your financial goals, reducing risk, and potentially increasing returns over time. By regularly reviewing and adjusting your assets, you can maintain an optimal investment mix, demonstrating the significance of rebalancing in asset protection.

Basics of cryptocurrency investment

Entering the world of digital currencies offers a mixture of excitement and challenges. Our latest blog post is designed to guide beginners through setting up their cryptocurrency investment journey. By focusing on crucial basics, we aim to equip you with the necessary knowledge to confidently navigate the volatile landscape of digital currencies. Whether you’re looking to understand market trends or seeking investment strategies, this guide is your first step towards mastering the complexities of the crypto world. Dive into our post for an informative journey into cryptocurrency investment, ensuring you’re well-prepared for the dynamic world of digital finance.

Budgeting basics for smarter spending

In today’s challenging times, protecting your financial future is vital. Key to this is mastering budgeting basics, which helps in making informed decisions about resource allocation. Understanding how to manage your finances effectively can lead to sustainable financial stability. Embracing these principles is the first step towards safeguarding your economic well-being, ensuring you’re better prepared for any financial uncertainties ahead.

Basics of affiliate marketing success

Achieving success in affiliate marketing is a crucial aspect of enhancing your retirement planning strategy. This guide delves into the complexities of affiliate marketing, offering practical advice and insights to transform it into a lucrative venture. By focusing on strategic planning and an understanding of the marketplace, individuals can seamlessly integrate affiliate marketing into their retirement planning efforts. The guide not only simplifies the process but also emphasizes the potential financial benefits, making it an indispensable resource for anyone looking to secure their financial future.

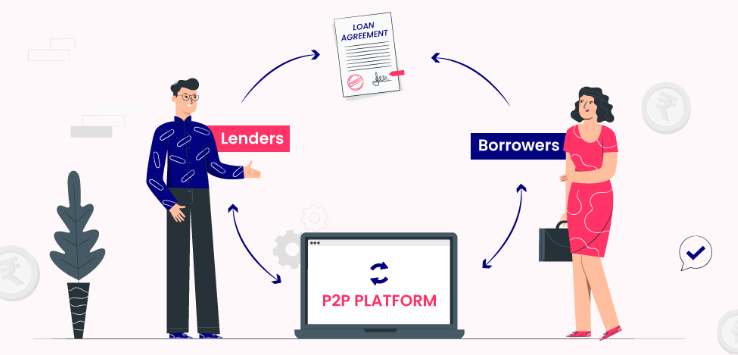

The basics of peer-to-peer lending as an investment

Peer-to-peer lending revolutionizes investment options by directly connecting borrowers with investors, bypassing traditional financial intermediaries. This groundbreaking method offers potential high returns, diversifying portfolios away from conventional markets. Understanding peer-to-peer lending is vital for those seeking innovative investment avenues. It opens doors to varied investment opportunities, enabling personalized risk management and contributing to a dynamic financial ecosystem. By embracing this model, investors gain access to a broader spectrum of borrowers, promising a blend of risk and reward tailored to individual preferences in the evolving landscape of investment strategies.

Understanding stock market basics

Understanding market basics is crucial for anyone entering the world of trading and investment. This blog post serves as a comprehensive guide to the fundamental principles of the stock market, aiming to equip you with the knowledge needed for financial literacy and independence. By exploring the elementary aspects of trading and investment, readers will gain insight into how the stock market operates, making their first step into the financial world less daunting. Whether you’re a beginner or looking to refresh your understanding, this guide on market basics is an essential resource for navigating the complexities of the stock market.

The basics of achieving FIRE

Embarking on the path to achieving FIRE basics is essential for anyone aiming to gain financial independence and early retirement. It involves a transformative approach to managing personal finances, emphasizing the importance of understanding the fundamentals behind the concept. Achieving FIRE basics requires dedication, strategic planning, and a deep dive into efficient financial practices. This journey not only secures one’s financial future but also offers an enlightening perspective on personal finance management.

Stock market basics for first-time investors

Discovering stock market basics is pivotal for beginners entering the equity markets. This guide is dedicated to demystifying the core principles, empowering novices to navigate investment decisions confidently. We delve into the operation of stock markets, emphasizing the importance of understanding before investing. By grasping these fundamentals, beginners can set a strong foundation for their investment journey, ensuring a more informed and strategic approach to entering the stock market.

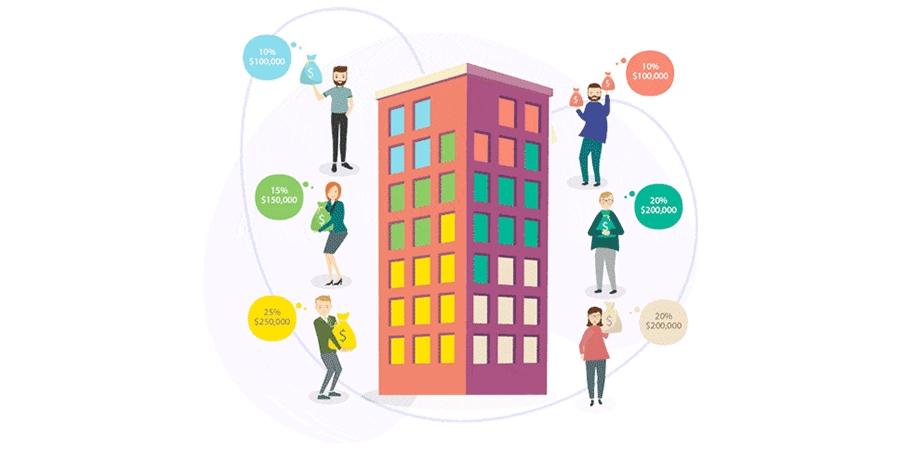

The basics of investing in real estate syndications

Understanding the real estate syndications basics is crucial for investors looking to diversify their portfolios through collective property ventures. Real estate syndication offers an opportunity to invest in large-scale properties without needing to manage the properties directly. This blog post highlights the fundamental aspects of real estate syndications, including the structure, benefits, and considerations for potential investors. By familiarizing themselves with these basics, investors can make informed decisions and potentially reap the rewards of participating in real estate syndications.