The importance of investment diversification

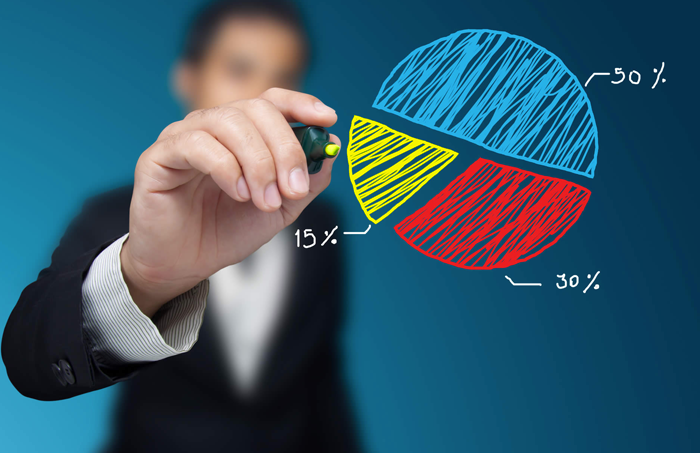

Investment diversification is a cornerstone strategy for risk reduction and return maximization. This approach involves spreading assets across various financial vehicles, enabling investors to mitigate potential losses without sacrificing significant returns. Emphasizing the importance of investment diversification, this strategy ensures a balanced portfolio, reducing the impact of market volatility. Through careful asset allocation, investors can achieve a more stable financial future, highlighting the necessity of diversification in investment planning.

The importance of investment diversification

Exploring diverse investment avenues is crucial for building a robust financial portfolio. Getting into varied types of investments not only expands financial holdings but also plays a vital role in safeguarding assets against unforeseen market volatilities. Embracing this strategy is key to achieving financial stability and growth over time. By getting involved in different investment opportunities, investors can mitigate risks and enhance their potential for generating wealth. This approach is fundamental for anyone looking to secure their financial future in an unpredictable economic landscape.

The importance of diversification in retirement planning

Understanding retirement planning diversification is crucial for a secure financial future. It’s not solely about the act of saving but significantly involves where and how these savings are allocated. This detailed exploration sheds light on the essence of diversification within retirement planning. By employing strategic diversification, individuals can mitigate risks and enhance potential returns, ensuring a robust financial foundation for their retirement years. Thus, mastering retirement planning diversification becomes a pivotal element of successful retirement preparation.