Understanding the stock market

Understanding financial markets is crucial for enhancing your savings strategy. Our blog delves into the essentials of the stock market, simplifying complex concepts for beginners. With a focus on the mechanisms driving global economies and personal wealth, we aim to empower readers to make informed decisions. By demystifying the stock market, we help you unlock potential avenues to save and grow your funds efficiently. Whether you’re a novice or looking to brush up on your knowledge, our guide is the foundation you need to navigate financial markets confidently.

Emergency savings: How much is enough?

Setting aside the right amount for a robust emergency savings fund is essential to prepare for unforeseen financial challenges, but “How much is enough?” This blog post delves into the intricacies of determining the extra financial cushion required to navigate unexpected crises. Understanding the balance between over-saving and having enough can protect you from financial stress, ensuring you’re prepared for any situation. Explore the strategies for calculating the ideal emergency fund size, making your financial planning both effective and efficient.

Where to keep your emergency fund

In today’s unpredictable financial landscape, understanding where to keep your emergency savings is crucial for ensuring financial stability. This post explores the essential practices for safeguarding your funds against life’s unexpected events. By grasping the importance of proper savings placement, individuals can create a solid safety net that bolsters their financial resilience. Discover key strategies and insights to enhance your financial planning and secure your economic well-being.

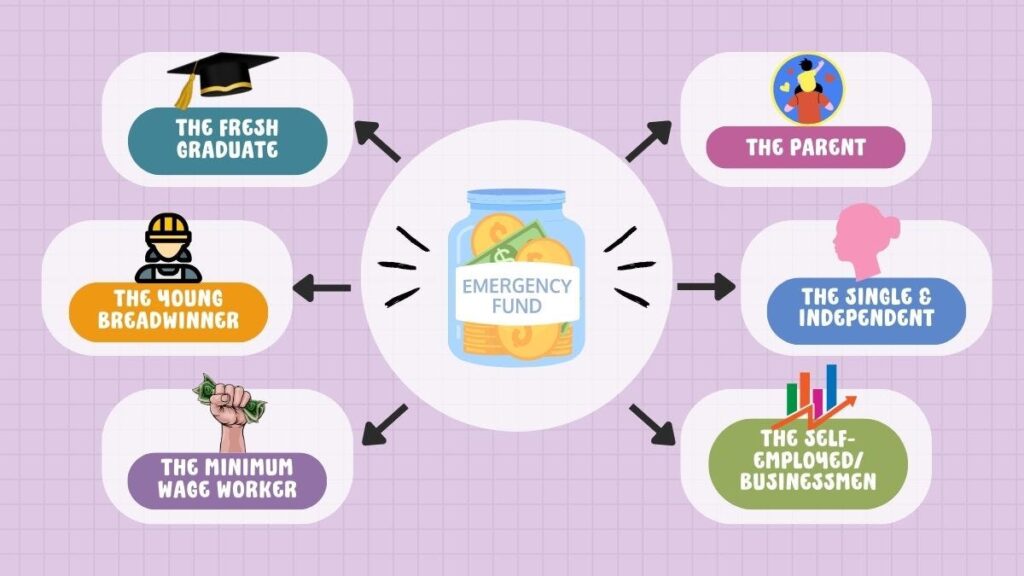

Tips for building your emergency savings quickly

Establishing a solid financial safety net is essential in navigating today’s volatile world. An emergency fund serves as a crucial buffer against financial hardships caused by unforeseen expenses or abrupt income loss. This blog post focuses on comparing different strategies for building an emergency fund, emphasizing the importance of finding a method that suits your unique financial situation. By comparing various approaches, readers can make informed decisions about how to protect themselves from potential financial distress and ensure financial stability in uncertain times.

Calculating your emergency fund needs

Understanding how to compute your safety net is key in navigating today’s unpredictable financial landscape. This guide delves into automating your safety net calculation, an essential strategy for managing unforeseen expenses without depending on credit. By automating this process, individuals ensure they’re always prepared for the unexpected, enhancing their financial resilience and security. Join our discussion to learn more about this crucial financial planning tool and how it can safeguard your economic well-being.

Where to keep your emergency savings for easy access

In today’s unpredictable economy, building and maintaining emergency savings is essential. Knowing the best storage options for your financial safety net ensures quick access when needed. This guide delves into the most optimal places to keep your emergency funds, balancing security with accessibility. Understanding where to store your emergency savings can make a significant difference in managing unforeseen financial challenges, providing peace of mind in turbulent times.

How to start saving for an emergency fund

In today’s unpredictable world, the importance of saving for an emergency fund cannot be overstated. Building a financial buffer is crucial for financial security, and this guide is your roadmap to starting one. By focusing on the essentials of setting up an emergency fund, you’ll learn practical steps to safeguard your future. With a focus on saving emergency funds, this guide ensures you’re prepared for any unexpected financial challenges, making it an indispensable tool for anyone looking to secure their financial well-being in today’s ever-changing environment.

Why an emergency fund is crucial for financial health

Understanding the importance of a contingency reserve is crucial for financial health. This post emphasizes the necessity of safeguarding your financial well-being through strategic planning. Highlighting the benefits of a contingency reserve, it provides key insights into maintaining robust financial health. By preparing for unforeseen expenses, individuals and businesses can ensure stability and peace of mind. Explore how to fortify your economic resilience, emphasizing the critical role of strategic financial planning in achieving long-term financial health.

Building an emergency fund from scratch

Creating an emergency fund is crucial in today’s unpredictable economy, offering financial security and peace of mind during unexpected events. This guide provides practical tips for building a safety net from scratch, highlighting the importance of being prepared. In ensuring your financial well-being, starting an emergency fund paves the way for stability, even amidst financial uncertainties. Learn how to establish and grow your emergency fund effectively, safeguarding your future against unforeseen challenges.

Budgeting for emergency fund

In this article on emergency fund budgeting, we explore the critical nature of being financially prepared for life’s unpredictability. It provides in-depth guidance on establishing a financial safety net, underscoring the importance of having a cushion to reduce stress and uncertainty. By focusing on the essentials of emergency fund budgeting, readers can learn practical steps to effectively prepare for unforeseen events, ensuring financial stability and peace of mind. This piece is a must-read for anyone looking to secure their financial future against the unpredictable twists and turns of life.