Fintech solutions for small business finance

In today’s fast-paced business world, managing small business finance becomes a challenge. Fintech solutions offer a transformative approach, simplifying operations and streamlining management. This blog delves into how these solutions equip small enterprises with the tools needed to navigate the complex financial landscape effectively. With fintech solutions, businesses can enhance efficiency, improve financial management, and secure a competitive edge. Discover the power of fintech in revolutionizing small business finance, ensuring your enterprise stays ahead in the game.

The future of personal finance management

In the modern era, the future of financial management is being reshaped by technology, with robo-advisors in personal finance playing a significant role. These advancements are set to revolutionize the way we manage our finances, making the process more efficient and user-friendly. The integration of robo-advisors allows for personalized financial advice at a fraction of the cost of traditional financial advisors. This technological evolution in the financial sector signifies a major shift towards automated, smart financial planning, promising a more streamlined approach to managing personal finances.

Tailoring your financial plan with technology

In the ever-evolving financial landscape, the emergence of robo-advisors finance services marks a significant transformation. These automated platforms provide personalized management solutions, streamlining the process of investing and financial planning. By leveraging advanced technology, robo-advisors offer efficient, tailored services that cater to individual needs, making them an essential tool in today’s personal finance management. This innovation not only enhances the user experience but also democratizes access to financial advice, ensuring more people can achieve their financial goals with confidence.

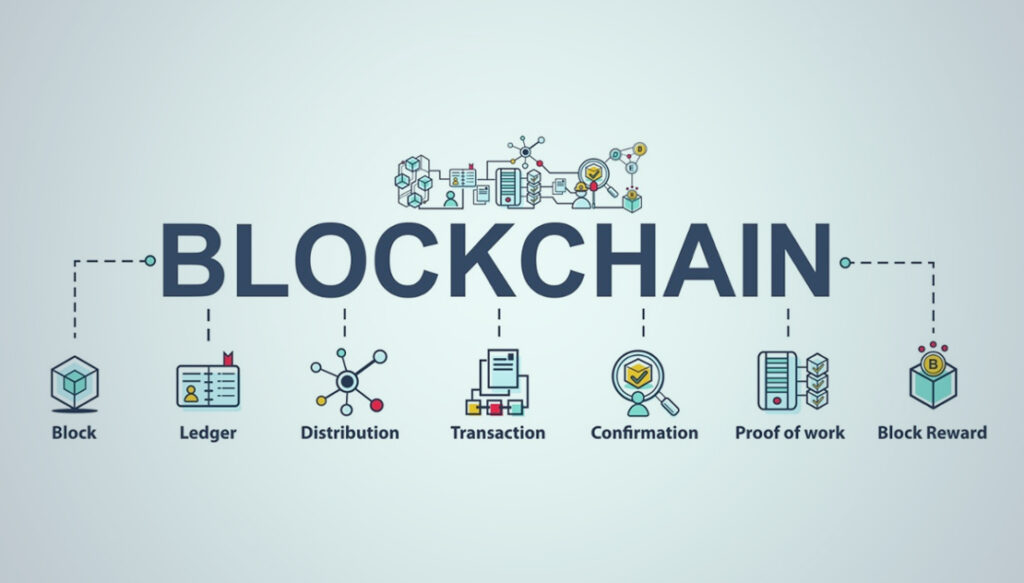

Innovations in blockchain for finance

In recent years, blockchain finance has revolutionized the financial landscape, marking a period of significant growth and modernization. This innovative wave, driven by technology, merges traditional financial systems with the robust, secure features of blockchain, bringing forth efficiency, transparency, and enhanced security. As blockchain finance continues to evolve, it paves the way for more accessible, reliable financial transactions, promising a transformative future for the global economy. This blend of technology and finance not only highlights the potential for a more interconnected financial world but also underscores the importance of adaptability and innovation in the digital age.

The impact of technology on financeon finance

The integration of fintech technology into the financial sector marks a transformative shift, reshaping how businesses and consumers interact with financial services. This exploration delves into the significant impact and advancements introduced by fintech, demonstrating its pivotal role in modernizing and streamlining operations within the finance industry. By leveraging innovative digital solutions, fintech technology not only enhances user experiences but also increases accessibility, efficiency, and security in financial transactions, establishing a forward-thinking approach to banking and financial management.

Deductions and credits for reducing tax liability

In this insightful blog, we explore essential tips for lowering your tax bill, focusing on the strategic use of deductions and credits to minimize tax liabilities. Discover key strategies that are pivotal in personal finance management, helping you save money and optimize your financial health. Whether you’re a seasoned taxpayer or new to the process, these practical tips form a cornerstone for anyone aiming to effectively reduce their taxes and enhance their financial well-being.

Tax planning basics for wealth management

“Choosing the right strategies for tax planning is essential for optimizing financial health and boosting long-term wealth. Understanding the fundamentals of managing taxes can significantly influence your overall financial success. This blog post aims to provide an insight into the basics of tax planning, emphasizing the vital role it plays in effective wealth management. By choosing appropriate tax planning techniques, individuals can ensure they maximize their financial potential while adhering to legal obligations, ultimately leading to a more prosperous financial future.”

Estate planning to secure your legacy

Securing your legacy through thoughtful estate planning is crucial for asset management and distribution. This guide explores the essential aspects of estate planning, emphasizing the importance of research. By diving into the details of how to safeguard your assets, it offers insights into making informed decisions for your legacy’s future. Research plays a key role in understanding the different components of estate planning, ensuring your assets are handled according to your wishes.

Choosing executors and trustees

Selecting the right executors and trustees is crucial for managing your estate and trust effectively, ensuring your legacy thrives. Our guide offers essential strategies to aid in this crucial decision, emphasizing the importance of professional expertise, trustworthiness, and alignment with your legacy’s objectives. By focusing on these strategies, you can secure a seamless transition of your assets to your beneficiaries, safeguarding their well-being and the integrity of your estate. Dive into our strategies for choosing executors and trustees to maintain control and peace of mind over your legacy’s future.

The importance of a will and estate planning

Understanding the importance of a last will and testament is crucial in ensuring your legacy and assets are distributed as per your wishes after your demise. It emphasizes the need for a comprehensive estate plan, safeguarding your interests and providing peace of mind for you and your heirs. This guide underscores the significance of drafting a clear and legally-binding document that reflects your final wishes, highlighting the impact on your estate’s management and the well-being of your loved ones. Stay informed and proactive in securing your legacy with a well-thought-out will and estate plan.