How AI is improving financial security

In the era of digital transformation, financial institutions are increasingly utilizing artificial intelligence (AI) to enhance AI financial security. This innovative shift towards AI is revolutionizing the way financial security is perceived and implemented. By incorporating advanced AI technologies, these institutions are not only improving their security measures but also setting a new standard in the financial industry. This adaptation demonstrates a significant move towards more robust and efficient financial security solutions, highlighting the critical role of AI in safeguarding against digital threats in the financial sector.

How artists can leverage crowdfunding

In today’s digital era, crowdfunding has become a pivotal platform for creatives seeking financial support, revolutionizing the way artists fund their projects. This comprehensive guide delves into how crowdfunding artists can leverage this strategy to not only realize their vision but also connect with a broader audience. It highlights the transformative potential of crowdfunding in empowering artists to bring their creations to life, ensuring their artistic endeavors are supported and appreciated worldwide. Crowdfunding offers a unique opportunity for artists to secure the necessary resources, fostering a community of supporters and enabling artistic innovation.

How robo-advisors adapt to your financial goals

In the evolving landscape of financial planning, robo-advisors have become a crucial tool for achieving financial goals. These digital advisors are designed to personalize investment strategies, making it easier for individuals to meet their financial targets. By leveraging advanced algorithms and machine learning, robo-advisors analyze your financial situation and tailor a unique strategy that aligns with your objectives. Whether you’re saving for retirement, building an emergency fund, or investing for long-term growth, robo-advisors offer a smart, efficient way to manage your investments and bring you closer to your financial aspirations.

How blockchain is enhancing security

In the digital era, blockchain security has emerged as a revolutionary solution to counter data breaches and cyber-attacks. This blog explores how blockchain technology is transforming digital security, offering a robust defense against online threats. By leveraging blockchain’s decentralized and immutable nature, it ensures data integrity and enhances security protocols, making it an invaluable asset in safeguarding online information. Blockchain security stands at the forefront of digital protection, promising a more secure internet landscape.

How P2P payments are simplifying transactions

Peer-to-Peer (P2P) payments are revolutionizing the financial landscape, offering a seamless and efficient way for individuals and businesses to conduct transactions. In this era focused on convenience and speed, P2P payments stand out by enabling immediate digital money transfers without the intermediation of traditional financial institutions. This innovative payment method is not only reshaping our approach to personal and commercial dealings but also promoting a more connected and streamlined economic environment. As P2P payments continue to gain popularity, they represent a pivotal shift in the way we manage our financial interactions, emphasizing the value of simplicity and immediacy in the digital age.

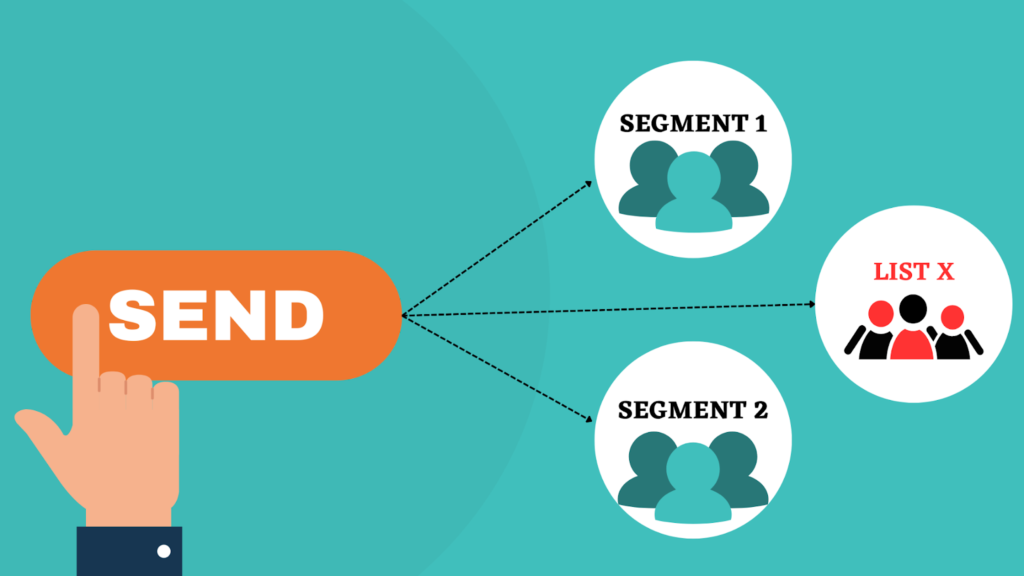

How to create a compelling campaign

Launching a social impact campaign is a highly fulfilling yet challenging endeavor for brands aiming to foster meaningful change. To create a movement that truly resonates, it’s essential to focus on crafting a message that not only drives action but also aligns with your brand’s core values. Engaging storytelling, strategic partnerships, and leveraging social media platforms are key elements in amplifying your campaign’s reach and impact. By meticulously planning and executing a social impact campaign, brands can effectively contribute to positive transformations and build a legacy of making a real difference in the world.

How to launch a successful crowdfunding campaign

Launching a successful crowdfunding campaign in the digital era offers a promising avenue for individuals and startups to secure funding for their projects. Yet, navigating the challenges to reach your funding goal requires strategic planning. This guide provides essential tips to enhance your campaign’s visibility and success. By focusing on impactful storytelling, engaging marketing tactics, and leveraging social media, you can boost your project’s appeal to potential backers. Discover effective strategies to achieve your crowdfunding objectives and bring your innovative ideas to life.

How mobile payments are shaping commerce

In the digital era, the evolution of mobile payments is revolutionizing commerce, drastically changing consumer purchasing habits and business operations. This shift is more than a passing trend; it signifies a fundamental change in how transactions are conducted. By embracing mobile payments, businesses are not only catering to the growing demand for convenience and speed but are also enhancing their operational efficiency and customer satisfaction. As this payment method becomes increasingly integrated into everyday commerce, understanding its impact is essential for staying competitive in the fast-evolving market landscape.

How digital wallets are changing payments

Digital wallets are revolutionizing financial transactions in a digitalizing world, making traditional payment means obsolete. This article delves into the comprehensive impact of electronic wallets, highlighting how they are reshaping commerce and finance. Key benefits discussed include enhanced security, convenience, and faster transactions, positioning digital wallets as pivotal in modern finance’s evolution.

How fintech is reshaping banking

The digital era has revolutionized the financial sector, largely due to the emergence of financial technology, or fintech. Fintech banking is transforming traditional banking operations and reshaping the financial landscape. This innovation streamlines financial services, making transactions faster, easier, and more secure. As fintech continues to evolve, it is clear that its impact on the banking industry is profound, changing how consumers and businesses interact with their finances.