How to create a budget that works for you

Creating a budget that aligns with your lifestyle and financial objectives is crucial for achieving financial freedom. This guide offers valuable insights on how to craft a personalized spending plan that reflects your financial situation and goals. By learning to create a budget, you can manage your finances effectively, setting the path toward a secure financial future. Tailored budgeting strategies provided here will empower you to take control of your spending and savings, ensuring that your financial actions support your long-term ambitions.

How to negotiate lower interest rates on loans

Securing lower rates on loans is essential for easing financial burdens. This comprehensive guide offers strategic advice on negotiating better terms to reduce interest payments. By understanding loan intricacies, borrowers can empower themselves to achieve more favorable financial conditions. With the right approach, achieving lower rates on your borrowing becomes a tangible goal, leading to significant savings and better financial health. Implementing these strategies can make a meaningful difference in your financial journey.

How to start saving for an emergency fund

In today’s unpredictable world, the importance of saving for an emergency fund cannot be overstated. Building a financial buffer is crucial for financial security, and this guide is your roadmap to starting one. By focusing on the essentials of setting up an emergency fund, you’ll learn practical steps to safeguard your future. With a focus on saving emergency funds, this guide ensures you’re prepared for any unexpected financial challenges, making it an indispensable tool for anyone looking to secure their financial well-being in today’s ever-changing environment.

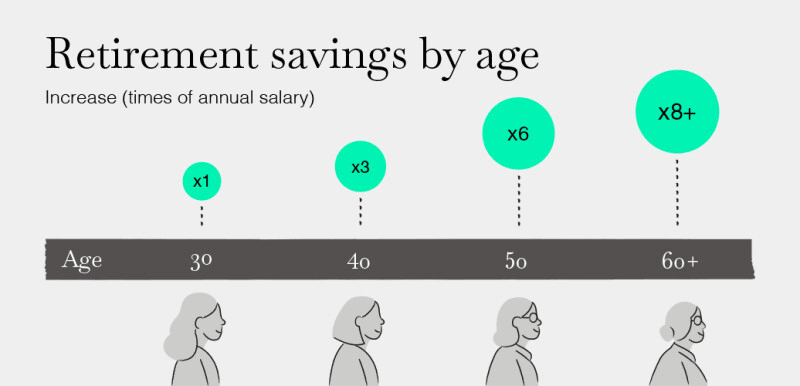

How much should you save for retirement?

Determining the right amount to save for retirement is essential for a comfortable future. This guide delves into crucial factors that influence how much you need to save. By understanding these aspects, you can tailor your retirement savings plan to ensure a secure and comfortable lifestyle post-retirement. Whether you’re just starting or nearing retirement, it’s never too late to adjust your savings strategy. Embrace the journey towards a financially secure retirement by making informed decisions today. Save retirement wisely to enjoy your golden years with peace of mind.

How to invest in the stock market for beginners

Embarking on stock market investments can seem daunting for beginners. However, with proper guidance and understanding, it can be a rewarding journey. This blog post is designed to equip new investors with the essential knowledge needed to navigate the stock market confidently. By covering the basics of equities and offering practical tips, we aim to demystify the process and encourage more individuals to explore the potential of stock market investments. Join us as we dive into the world of stocks and learn how to make informed decisions that could lead to financial success.

How to retire early with FIRE

Embarking on the journey towards early retirement FIRE (Financial Independence, Retire Early) is a rewarding yet challenging path. This guide aims to simplify the principles and strategies needed to achieve financial freedom ahead of traditional retirement ages. By focusing on saving aggressively, investing wisely, and living frugally, individuals can unlock the secrets to retiring early. Whether you’re a seasoned investor or just starting, understanding the core tenets of early retirement FIRE can set the stage for a future where work is optional, and financial security is a reality.

How to start investing in stocks with little money

Starting your journey in stocks investing with little money is achievable and can lead to substantial growth over time. This guide emphasizes that even with a limited budget, you can navigate the stock market successfully. The key is to focus on smart, strategic investments and utilize resources efficiently to maximize your capital’s potential. By adopting the right approaches and tools, beginners can embark on stocks investing with little money, turning modest sums into significant assets. This strategy encourages individuals to not let financial constraints deter them from entering the world of stocks and highlights the importance of informed, disciplined investing practices.

How to choose a credit card that suits your lifestyle

Choosing a lifestyle suitable credit card is crucial for effective financial management. This guide offers valuable insights to align your card choice with your spending habits and financial goals. With numerous options available, understanding how to select a card that complements your lifestyle can significantly enhance your financial well-being. By focusing on cards that offer rewards and benefits tailored to your spending patterns, you can maximize your financial resources and achieve your financial aspirations more efficiently.

How to analyze stock investments

In today’s dynamic investing landscape, understanding stock analysis techniques is key to making informed decisions. This blog explores the essential methodologies and tools that investors can employ to effectively scrutinize stock investments. By mastering these stock analysis techniques, individuals can enhance their investment strategy, making more educated choices in the ever-changing financial markets. Whether you’re a seasoned investor or just starting out, this guide provides valuable insights into the critical aspects of analyzing stocks, helping you to navigate the complexities of the investment world with confidence.