Mobile banking security: innovations and tips

In the digital age, mobile banking security is paramount. As managing finances via smartphones becomes ubiquitous, safeguarding transactions is crucial. This blog post explores cutting-edge innovations aimed at protecting your financial data. It highlights how technology is evolving to offer robust defenses against cyber threats, ensuring that your money and personal information remain secure. Learn about the latest security measures and how they are reshaping the landscape of mobile banking, keeping your assets safe in an increasingly digital world.

Innovations in online payment processing

In the dynamic world of digital commerce, advancements in online payment processing are revolutionizing the shopping experience. This exploration delves into the latest innovations, from the integration of blockchain technology to the implementation of AI-driven solutions. These advancements not only streamline transactions but also bolster security and trust in online shopping. The continuous evolution in online payment processing is setting new benchmarks, offering seamless and efficient experiences for both consumers and merchants. This shift marks a significant leap forward, promising an even more connected and convenient future in digital commerce transactions.

Innovations in digital insurance platforms

In today’s fast-paced digital transformation, the insurance sector is evolving with digital insurance platforms leading the change. Traditional insurance practices are being replaced by tech-driven solutions, making processes more efficient and user-friendly. This shift towards digital insurance platforms signifies a crucial evolution in the industry, adapting to the digital-first world. As these platforms continue to grow, understanding their development and impact is essential for anyone looking to stay ahead in the digital insurance landscape. This summary highlights the importance of embracing digital insurance solutions in a world increasingly dependent on technology.

Crowdfunding for tech innovations

In the rapidly changing tech industry, tech crowdfunding has emerged as a pivotal method for entrepreneurs and inventors to secure funds for innovation. This approach simplifies the process of raising capital, offering a redefined pathway for those aiming to bring groundbreaking technologies to the market. By leveraging the power of community and online platforms, tech crowdfunding opens up new opportunities, making it easier for innovative projects to find the support they need.

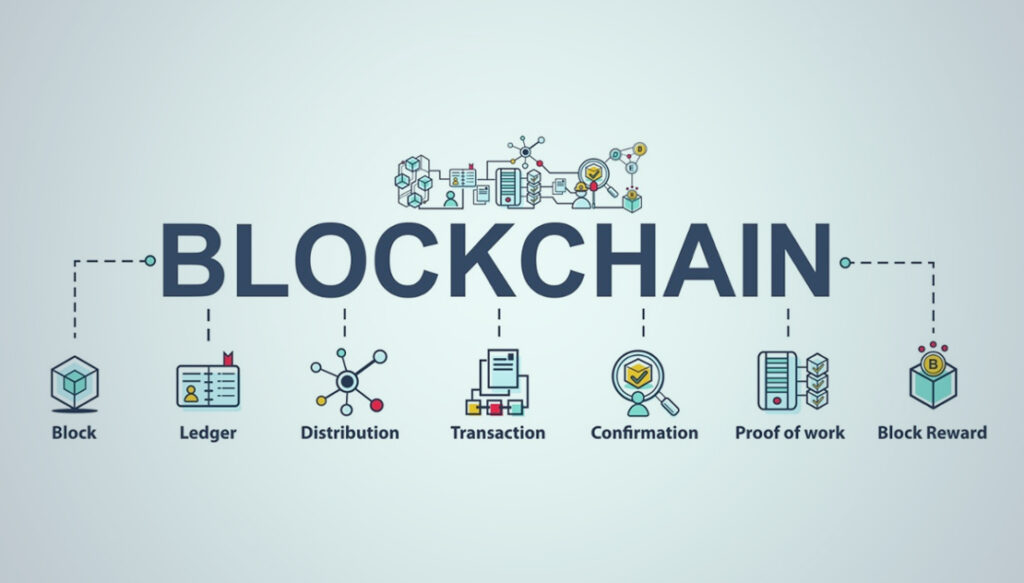

Innovations in blockchain for finance

In recent years, blockchain finance has revolutionized the financial landscape, marking a period of significant growth and modernization. This innovative wave, driven by technology, merges traditional financial systems with the robust, secure features of blockchain, bringing forth efficiency, transparency, and enhanced security. As blockchain finance continues to evolve, it paves the way for more accessible, reliable financial transactions, promising a transformative future for the global economy. This blend of technology and finance not only highlights the potential for a more interconnected financial world but also underscores the importance of adaptability and innovation in the digital age.

Fintech innovations in lending

Fintech lending has revolutionized the borrowing landscape, offering efficient, personalized loan solutions. This innovative approach caters to individuals and corporations alike, making financial services more accessible. By leveraging technology, fintech lending eliminates traditional banking hurdles, providing a smoother, faster loan process. This shift not only enhances user experience but also broadens financial inclusion, marking a significant advancement in how financial transactions are conducted in the modern era.