Innovations in blockchain for finance

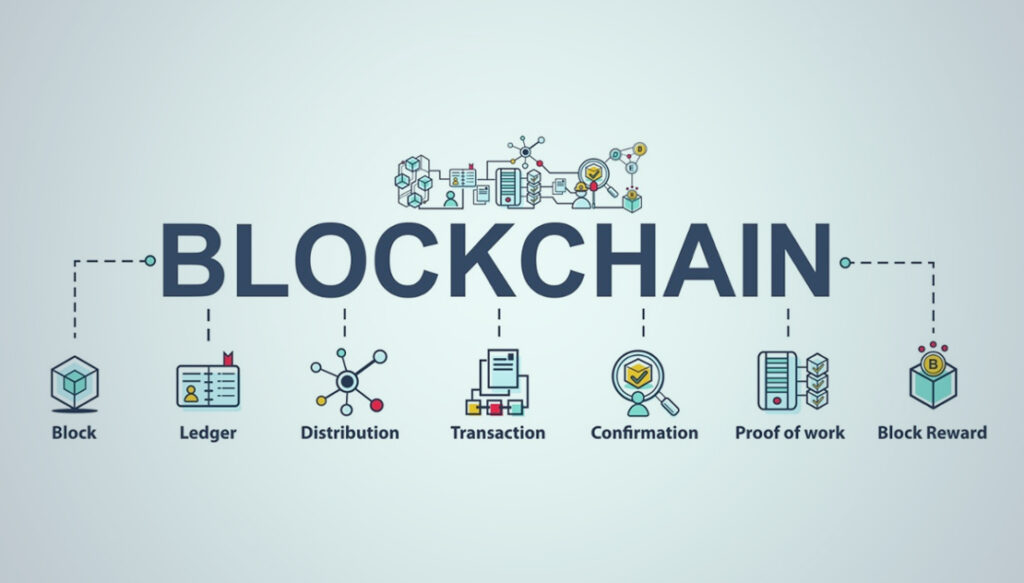

In recent years, blockchain finance has revolutionized the financial landscape, marking a period of significant growth and modernization. This innovative wave, driven by technology, merges traditional financial systems with the robust, secure features of blockchain, bringing forth efficiency, transparency, and enhanced security. As blockchain finance continues to evolve, it paves the way for more accessible, reliable financial transactions, promising a transformative future for the global economy. This blend of technology and finance not only highlights the potential for a more interconnected financial world but also underscores the importance of adaptability and innovation in the digital age.

Big data’s impact on financial services

In the era of information-driven economies, big data in financial services has become a game-changer, revolutionizing traditional methodologies and fostering innovation. This blog delves into the comprehensive influence of big data, highlighting its role in reshaping financial practices and creating opportunities for growth. By leveraging extensive datasets, financial institutions can enhance decision-making, improve customer experiences, and achieve operational efficiency. Big data’s integration into financial services not only streamlines processes but also paves the way for novel approaches in managing finances, underscoring its critical impact on the sector’s evolution.

Estate planning to secure your legacy

Securing your legacy through thoughtful estate planning is crucial for asset management and distribution. This guide explores the essential aspects of estate planning, emphasizing the importance of research. By diving into the details of how to safeguard your assets, it offers insights into making informed decisions for your legacy’s future. Research plays a key role in understanding the different components of estate planning, ensuring your assets are handled according to your wishes.

Estate planning tips for parents

In the article, we explore vital strategies for safeguarding your children’s future through Legal frameworks for estate planning. It emphasizes the importance of establishing a solid legal foundation to manage assets effectively, ensuring a robust and reflective estate plan for parents concerned about their children’s well-being. Essential tips and strategies are discussed to secure a secure financial future for your family, highlighting the significance of Legal considerations in estate planning.

Choosing executors and trustees

Selecting the right executors and trustees is crucial for managing your estate and trust effectively, ensuring your legacy thrives. Our guide offers essential strategies to aid in this crucial decision, emphasizing the importance of professional expertise, trustworthiness, and alignment with your legacy’s objectives. By focusing on these strategies, you can secure a seamless transition of your assets to your beneficiaries, safeguarding their well-being and the integrity of your estate. Dive into our strategies for choosing executors and trustees to maintain control and peace of mind over your legacy’s future.

The importance of a will and estate planning

Understanding the importance of a last will and testament is crucial in ensuring your legacy and assets are distributed as per your wishes after your demise. It emphasizes the need for a comprehensive estate plan, safeguarding your interests and providing peace of mind for you and your heirs. This guide underscores the significance of drafting a clear and legally-binding document that reflects your final wishes, highlighting the impact on your estate’s management and the well-being of your loved ones. Stay informed and proactive in securing your legacy with a well-thought-out will and estate plan.

Protecting your assets from lawsuits

In today’s unpredictable legal landscape, safeguarding your assets is crucial for everyone from seasoned investors to budding entrepreneurs. One effective strategy is to diversify your portfolio, spreading investments across various classes to mitigate risk. This approach not only protects your wealth from unforeseeable legal challenges but also ensures a more stable financial future. Learning how to diversify your assets is essential for anyone looking to secure their hard-earned wealth against potential legal disputes. By embracing diversification, you ensure a safeguarding mechanism for your investments, making asset protection a key component of your financial planning strategy.

Legal tools for asset protection

Managing financial assets securely is pivotal for both personal and commercial success. This blog post delves into the significance of using legal mechanisms as a reliable strategy for safeguarding assets. It highlights how understanding and implementing effective legal measures can not only protect but also enhance the value of financial assets. By exploring the essential legal frameworks, readers can gain insights into managing their financial resources more efficiently, ensuring long-term security and prosperity. This guide serves as a comprehensive resource for anyone looking to fortify their asset management strategies through well-established legal practices.

Strategies for safeguarding your wealth

In the current unpredictable financial landscape, knowing the basics of protecting your assets is vital. This guide offers profound insights into safeguarding your financial future with proven strategies. Learn essential techniques to shield your money effectively and ensure financial stability. Whether you’re a beginner or looking to bolster your financial defense, understanding these basics is the first step towards a secure financial path.

Understanding asset protection basics

In today’s financial landscape, understanding asset protection and rebalancing strategies is crucial for safeguarding one’s assets and ensuring financial security. This post aims to demystify the basics of asset protection, emphasizing the importance of rebalancing your portfolio as a key practice. Rebalancing helps in aligning your investment strategy with your financial goals, reducing risk, and potentially increasing returns over time. By regularly reviewing and adjusting your assets, you can maintain an optimal investment mix, demonstrating the significance of rebalancing in asset protection.