Getting started with real estate investment

Embarking on the journey of property investment is a crucial step for beginners. This guide demystifies the process, offering a roadmap for successful real estate investments. Central to this guide is the importance of choosing the right property, highlighting how crucial selection is to profitability and long-term success. It emphasizes research, analysis, and strategic planning in the selection process, ensuring beginners are well-equipped to make informed decisions. For any novice looking to navigate the complex world of property investments, understanding the process of choosing the right property is key to unlocking potential opportunities and achieving investment goals.

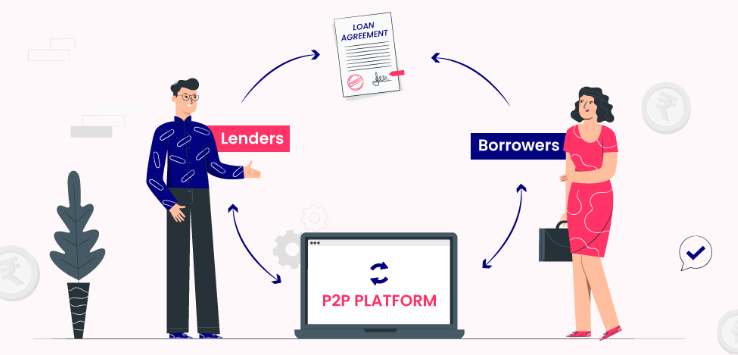

The basics of peer-to-peer lending as an investment

Peer-to-peer lending revolutionizes investment options by directly connecting borrowers with investors, bypassing traditional financial intermediaries. This groundbreaking method offers potential high returns, diversifying portfolios away from conventional markets. Understanding peer-to-peer lending is vital for those seeking innovative investment avenues. It opens doors to varied investment opportunities, enabling personalized risk management and contributing to a dynamic financial ecosystem. By embracing this model, investors gain access to a broader spectrum of borrowers, promising a blend of risk and reward tailored to individual preferences in the evolving landscape of investment strategies.

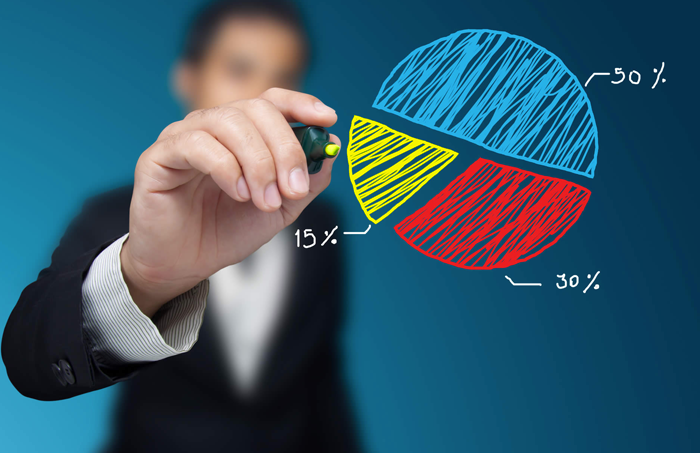

Strategies for diversifying your investment portfolio

Diversifying investments remains a cornerstone approach for those aiming at financial stability and growth. By allocating funds across different asset classes, investors not only mitigate risks but also enhance opportunities for substantial returns. Embracing this strategy enables a balanced portfolio that can weather market volatilities. In essence, diversifying investments is not just about spreading wealth, but strategically positioning it to capitalize on varying financial landscapes, ensuring a more stable and prosperous financial future.

The importance of investment diversification

Exploring diverse investment avenues is crucial for building a robust financial portfolio. Getting into varied types of investments not only expands financial holdings but also plays a vital role in safeguarding assets against unforeseen market volatilities. Embracing this strategy is key to achieving financial stability and growth over time. By getting involved in different investment opportunities, investors can mitigate risks and enhance their potential for generating wealth. This approach is fundamental for anyone looking to secure their financial future in an unpredictable economic landscape.

Investment options to beat inflation

In a climate where the purchasing power of money decreases, it’s crucial to find strategies to beat inflation. This post delves into diverse investment opportunities aimed at preserving and increasing wealth, ensuring your savings not only withstand but also surpass inflationary pressures. From stocks to real estate, and bonds to commodities, understanding how to strategically diversify your portfolio can lead to financial resilience and growth despite economic uncertainties. Learn how to make informed choices that help you outsmart inflation and secure your financial future.

Creating a saving and investment plan for early retirement

Achieving early retirement is a growing dream for many, urging the need to focus on a solid saving plan coupled with strategic investments. Central to realizing this aspiration is the implementation of robust saving strategies, which serve as the backbone for accumulating wealth over time. By diligently adhering to a well-structured saving plan and making informed investment choices, individuals can pave the way to financial freedom and the possibility of retiring earlier than traditionally anticipated. This approach not only enhances financial security but also opens up new opportunities for enjoying life’s later stages with ample resources.

When to rebalance or adjust your investment strategy

Understanding when and how to rebalance your investment portfolio is essential for achieving investment success and reaching your financial goals. Rebalancing is a dynamic process that ensures your investment allocations remain aligned with your risk tolerance and objectives. By periodically reviewing and adjusting your portfolio, you can maintain the desired level of diversification and mitigate risk. This practice not only helps in optimizing returns but also plays a crucial role in financial health maintenance. Embrace rebalancing as a fundamental strategy to guide you towards your financial aspirations efficiently.

Tools for monitoring investment risk

Navigating the volatile world of investing requires leveraging the right tools to manage and monitor potential risks effectively. This blog post dives into essential tools that empower investors to make informed decisions, ensuring their financial future is secure despite market uncertainties. Discover how to confidently tackle investment challenges and optimize your portfolio for success. Learn the key to safeguarding your investments and staying ahead in the ever-changing financial landscape with our expert insights on the best investment tools.

The beginner’s guide to cryptocurrency investment

Embarking on the journey of cryptocurrency investment can be both exhilarating and overwhelming for beginners. However, armed with the right knowledge and tools, navigating the digital currency market can transform into a beneficial endeavor. This guide is specifically designed to demystify the complexities of the cryptocurrency world for novices, equipping them with the necessary insights to make informed decisions. By focusing on essential strategies and tips, this resource aims to pave the way for successful cryptocurrency investment, empowering beginners to confidently step into the digital finance landscape.

Risks and rewards of cryptocurrency investment

“Investing in the volatile world of digital currencies entails understanding the balance between cryptocurrency risks and rewards. Navigating the fluctuating market demands caution, emphasizing the importance of grasping the concept of cryptocurrency risks. Investors aiming to delve into this sphere must equip themselves with comprehensive knowledge to adeptly manage potential pitfalls and capitalize on opportunities. Acknowledging the inherent volatility helps in making informed decisions, crucial for anyone looking to explore the dynamic and unpredictable nature of digital currencies.”