Hybrid learning models post-pandemic

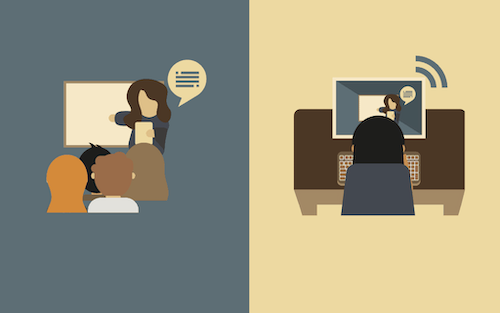

The global pandemic has significantly transformed the educational landscape, merging in-person and digital learning platforms. This shift not only accommodates various learning preferences but also integrates e-commerce strategies, revolutionizing how educational content and resources are accessed and purchased. As the sector evolves, e-commerce becomes a crucial element in distributing educational materials, offering a convenient, efficient, and adaptable means to meet learner’s needs. This blend of education and e-commerce paves the way for a more inclusive and flexible learning environment, making education more accessible to a broader audience worldwide.

Challenges and solutions in hybrid learning

In the evolving landscape of education, the shift towards hybrid models of learning has significantly impacted the integration of business AI. This article explores the various challenges and opportunities faced by educators and learners in adapting to mixed learning environments. With the focus on enhancing interactive and personalized learning experiences, business AI plays a pivotal role in redefining educational methodologies. It emphasizes the need for continuous adaptation and the adoption of advanced technologies to meet the demands of modern learners, preparing them for the future job market. The article highlights how business AI can be a game-changer in achieving a seamless and effective educational experience in hybrid learning settings.

Tech tools that are reshaping education

Innovative technological tools in education are revolutionizing the learning landscape, marking a significant shift in knowledge dissemination and absorption. This transformation not only boosts the learning experience but also prepares students with essential skills for the future. As startup funding increasingly focuses on the education sector, these technologies are receiving the support needed to develop and reach a broader audience. This trend highlights the crucial role of startup funding in driving educational innovations, ensuring that learning is more accessible, engaging, and effective for students worldwide.

Balancing online and in-person education

In today’s educational landscape, blending digital and traditional classroom settings is essential for maximizing learning outcomes. This balance enhances team collaboration, a vital component for success in both environments. As educators reevaluate methods to integrate online and in-person learning, fostering effective team collaboration emerges as a key strategy. This approach not only prepares students for the future workspace but also enriches their learning experience by leveraging diverse perspectives and skills. Ultimately, bridging the gap between digital and conventional classrooms through team collaboration is pivotal in the evolution of education.

The role of analytics in risk management

In today’s business world, integrating analytics into risk management is crucial for enhancing decision-making and establishing a robust framework. This practice, known as analytics risk management, allows organizations to navigate the rapidly changing business landscape more effectively. By leveraging analytical tools, companies can identify potential risks, assess their impact, and make informed decisions to mitigate them. Incorporating analytics into risk management strategies not only improves operational efficiency but also contributes to more resilient and adaptable business operations.

Financial literacy in the digital age

In the digital era, financial literacy has become an essential skill for managing personal finances effectively. With technology transforming the way we handle money, understanding financial concepts is more crucial than ever. This blog explores the evolution of financial literacy, highlighting its importance in navigating the dynamic digital landscape. As individuals strive to make informed financial decisions, embracing digital financial literacy is key to achieving financial well-being in today’s tech-driven world.

Leveraging fintech for debt management

In the current financial landscape, leveraging fintech for debt management has revolutionized the approach to handling financial commitments. Fintech debt management provides cutting-edge solutions for efficiently managing and eliminating debt, streamlining the process for individuals looking to regain financial stability. This breakthrough in fintech debt management not only simplifies the repayment process but also offers personalized strategies to help users achieve their financial goals faster. As a result, fintech has become a key player in transforming debt management practices, making it easier for individuals to navigate their financial obligations in the modern ecosystem.

Music projects and the power of the crowd

In the ever-changing digital landscape, crowdfunding music projects have become a key factor in transforming the music industry. This innovative method empowers artists, allowing them to independently fund their projects while connecting directly with their audience. By harnessing the power of the crowd, musicians can now bypass traditional funding barriers, bringing their creative visions to life with the support of fans worldwide. Crowdfunding music not only democratizes the production process but also strengthens the relationship between artists and listeners, marking a significant shift in how music is created, funded, and shared in the modern era.

The future of personal finance management

In the modern era, the future of financial management is being reshaped by technology, with robo-advisors in personal finance playing a significant role. These advancements are set to revolutionize the way we manage our finances, making the process more efficient and user-friendly. The integration of robo-advisors allows for personalized financial advice at a fraction of the cost of traditional financial advisors. This technological evolution in the financial sector signifies a major shift towards automated, smart financial planning, promising a more streamlined approach to managing personal finances.

Tax planning basics for wealth management

“Choosing the right strategies for tax planning is essential for optimizing financial health and boosting long-term wealth. Understanding the fundamentals of managing taxes can significantly influence your overall financial success. This blog post aims to provide an insight into the basics of tax planning, emphasizing the vital role it plays in effective wealth management. By choosing appropriate tax planning techniques, individuals can ensure they maximize their financial potential while adhering to legal obligations, ultimately leading to a more prosperous financial future.”