The advantages of peer-to-peer payments

The shift towards digital finance has significantly spotlighted Peer-to-Peer (P2P) payments, offering a convenient method for conducting transactions. This blog post delves into the multifaceted advantages of P2P payments, showcasing how they streamline financial exchanges between individuals. With the rise of digital transactions, P2P payments emerge as a forefront solution, enhancing user experience by promoting ease, speed, and security in monetary exchanges. As digital finance evolves, understanding the benefits of P2P payments becomes crucial for embracing efficient and modern transaction methods.

How P2P payments are simplifying transactions

Peer-to-Peer (P2P) payments are revolutionizing the financial landscape, offering a seamless and efficient way for individuals and businesses to conduct transactions. In this era focused on convenience and speed, P2P payments stand out by enabling immediate digital money transfers without the intermediation of traditional financial institutions. This innovative payment method is not only reshaping our approach to personal and commercial dealings but also promoting a more connected and streamlined economic environment. As P2P payments continue to gain popularity, they represent a pivotal shift in the way we manage our financial interactions, emphasizing the value of simplicity and immediacy in the digital age.

Blockchain technology in peer-to-peer lending

Blockchain technology is revolutionizing the finance industry, especially in the realm of peer-to-peer (P2P) lending. This innovative approach is reshaping traditional financial processes, allowing for more secure, efficient, and transparent operations. By leveraging the inherent security and trust protocols of blockchain, P2P lending platforms are able to offer users a more reliable and seamless borrowing and lending experience. This transformation is not only enhancing the way individuals engage with financial services but is also setting new standards for the future of finance. Discover how blockchain P2P lending is paving new paths in the financial world.

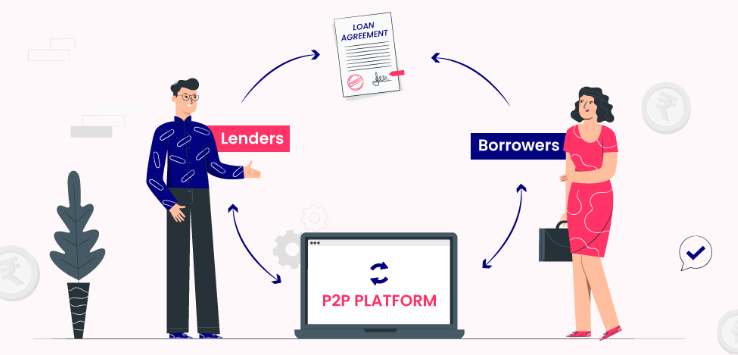

The essentials of peer-to-peer lending

P2P lending, also known as peer-to-peer lending, is transforming the financial landscape by allowing direct transactions between individuals, bypassing the need for traditional banks. This innovative approach not only democratizes investing and borrowing but also offers potentially higher returns for investors and more accessible loans for borrowers. By leveraging technology, P2P lending platforms connect people who need money with those looking to invest, making financial transactions more efficient and inclusive. This blog post explores the core aspects of P2P lending, demonstrating its potential to reshape the world of finance by offering an alternative to conventional methods.

P2P lending: a guide for borrowers

In the evolving finance landscape, Peer-to-Peer (P2P) lending stands out as an appealing option for borrowers desiring funds beyond conventional banks. This guide is tailored for P2P lending borrowers, offering them insights on efficiently navigating the P2P lending environment. It encompasses key strategies and tips to maximize the benefits while minimizing the risks associated with P2P lending. Perfect for individuals looking for flexible lending solutions, this resource aims to empower borrowers with the knowledge needed to make informed decisions in the P2P lending space.

Choosing the right P2P lending platform

Selecting the appropriate P2P lending platform is essential for individuals aiming to enhance their financial prospects. With the increasing number of peer-to-peer lending platforms, making an informed choice has become both easier and more complex. To navigate this landscape successfully, borrowers and investors must carefully evaluate each platform’s features, including interest rates, fees, risk management practices, and user reviews. By prioritizing these criteria, one can find a platform that aligns with their financial goals, ultimately optimizing the benefits of participating in the P2P lending market.

Peer-to-peer lending: risks and rewards

“P2P lending stands out in the investment and finance sector as a cutting-edge alternative to conventional banking, facilitating direct financial transactions between individuals. This platform democratizes lending, giving investors and borrowers more control and potentially higher returns and more personalized loan terms, respectively. However, with its distinctive advantages, P2P lending also involves unique risks that participants should consider. Understanding these risks is crucial for anyone looking to dive into this innovative investment opportunity.”

The basics of peer-to-peer lending as an investment

Peer-to-peer lending revolutionizes investment options by directly connecting borrowers with investors, bypassing traditional financial intermediaries. This groundbreaking method offers potential high returns, diversifying portfolios away from conventional markets. Understanding peer-to-peer lending is vital for those seeking innovative investment avenues. It opens doors to varied investment opportunities, enabling personalized risk management and contributing to a dynamic financial ecosystem. By embracing this model, investors gain access to a broader spectrum of borrowers, promising a blend of risk and reward tailored to individual preferences in the evolving landscape of investment strategies.

How to get started with peer-to-peer lending

Embarking on the journey of peer lending can be an exciting yet intimidating experience for beginners. Our guide simplifies this innovative investment form, providing step-by-step advice to engage successfully. Discover essential tips and strategies to navigate the world of peer lending effectively, unlocking potential financial benefits. This beginner-friendly guide ensures a smooth start in peer lending, highlighting its opportunities and considerations for new investors.

Risks and rewards of investing in peer-to-peer loans

Exploring the world of investing loans, especially via peer-to-peer (P2P) lending, presents lucrative opportunities for investors. This rapidly growing segment allows individuals to directly lend to one another, bypassing traditional financial institutions. It’s essential, however, for potential investors to approach P2P lending with a thorough understanding of the risks and rewards involved. With careful consideration and strategic planning, investing in loans through P2P platforms can offer significant returns. This investment strategy requires diligence in selecting loans and understanding market dynamics to successfully navigate and capitalize on the unique advantages of P2P lending.