What is peer-to-peer lending?

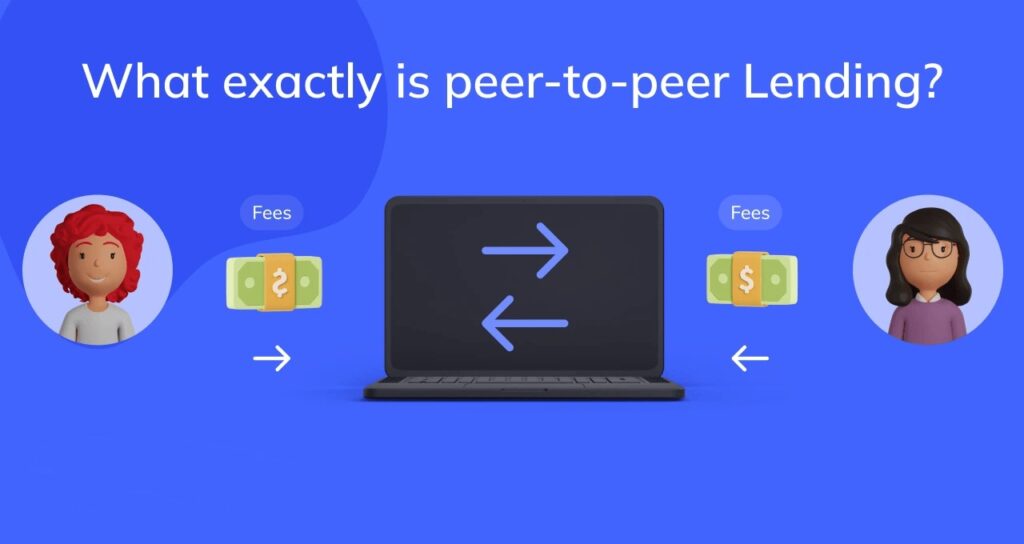

Peer-to-peer (P2P) lending has emerged as a modern financial phenomenon, marking a shift from traditional financial systems fraught with complexities and barriers. This innovative lending and borrowing method has gained significant traction, offering a streamlined alternative for individuals seeking financial services outside the conventional banking framework. P2P lending facilitates direct transactions between individuals, bypassing traditional financial intermediaries, and thereby, reducing costs and increasing accessibility for both lenders and borrowers. This system not only democratizes financial services but also introduces a more personalized and efficient way of handling loans and investments.