Tailoring your financial plan with technology

In the ever-evolving financial landscape, the emergence of robo-advisors finance services marks a significant transformation. These automated platforms provide personalized management solutions, streamlining the process of investing and financial planning. By leveraging advanced technology, robo-advisors offer efficient, tailored services that cater to individual needs, making them an essential tool in today’s personal finance management. This innovation not only enhances the user experience but also democratizes access to financial advice, ensuring more people can achieve their financial goals with confidence.

Choosing the right savings plan for education

“Planning for your child’s future education is crucial, and with tuition costs soaring, finding the right education fund is essential. This guide provides key insights into selecting the best fund to secure your child’s educational journey. Beyond saving, engaging in educational activities plays a vital role in their development. Learn how to incorporate activities that enhance learning, ensuring a well-rounded education. From savings strategies to enriching educational activities, this guide covers everything parents need to know about future-proofing their child’s education.”

Starting a savings plan on a tight budget

Embarking on creating a savings plan with limited resources can be challenging yet achievable. This guide outlines effective strategies that can lead one towards financial security, emphasizing discipline and smart approaches. By adopting the right methods, individuals can navigate their way to a stable financial future, showcasing that even with minimal funds, creating a robust savings plan is entirely within reach. With focused effort and guidance, anyone can start their journey towards saving success, proving that financial limitations don’t have to hinder one’s goals of financial stability.

Health insurance: choosing the right plan

Selecting the right health insurance plan is pivotal for your financial and health wellbeing. This guide explores essential aspects to consider, ensuring you make an informed decision that aligns with your needs and budget. With a focus on health insurance, it emphasizes the importance of understanding coverage options, deductibles, premiums, and out-of-network charges. By considering these factors, you are better equipped to choose a health insurance plan that not only provides comprehensive coverage but also fits your financial situation, ensuring peace of mind and security for you and your family.

Creating a saving and investment plan for early retirement

Achieving early retirement is a growing dream for many, urging the need to focus on a solid saving plan coupled with strategic investments. Central to realizing this aspiration is the implementation of robust saving strategies, which serve as the backbone for accumulating wealth over time. By diligently adhering to a well-structured saving plan and making informed investment choices, individuals can pave the way to financial freedom and the possibility of retiring earlier than traditionally anticipated. This approach not only enhances financial security but also opens up new opportunities for enjoying life’s later stages with ample resources.

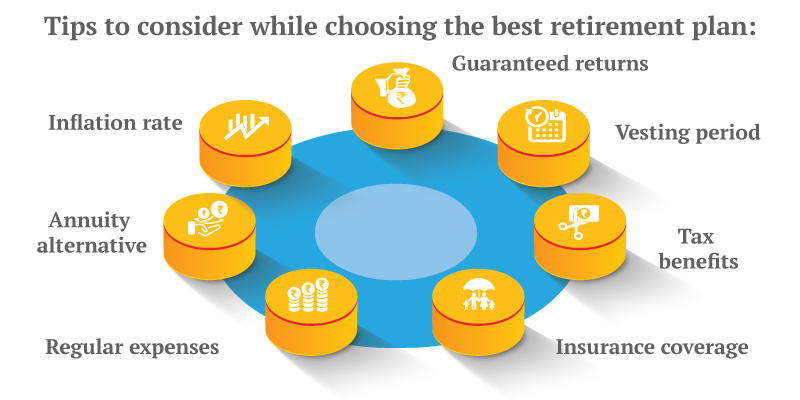

Choosing the right retirement savings plan

Choosing the right savings plan for retirement doesn’t have to be complicated. This blog post offers a comprehensive guide through the various retirement savings plans available, making it easier to find a strategy that suits your needs. Whether you’re just starting to save or looking to optimize your current savings, we’ve got you covered. By making informed decisions about your retirement savings plan, you can ensure a secure and enjoyable golden years.