Setting rates for freelancing services

When setting rates for your freelance services, it’s crucial to establish a price that mirrors the worth of your talents, particularly if your expertise is in the hobbies sector. This guide helps freelancers navigate the thin line between valuing their skills and maintaining an attractive offer for potential clients. Balancing these aspects is essential for fostering a thriving and durable career. Equally important is understanding how to adjust your rates as your experience and portfolio in the hobbies niche grow, ensuring your pricing strategy evolves alongside your professional development.

Finding your first freelancing gig

Embarking on a freelance career can be both exciting and challenging. This blog post delves into finding your first freelance opportunity with a keen focus on passive income streams. We will guide you through the strategies for identifying and securing projects that not only match your skills but also offer the potential for passive earnings. From leveraging online platforms to networking effectively, discover how you can kickstart your freelance journey with passive income opportunities. This essential guide offers practical advice for freelancers eager to establish a solid foundation in their career.

Understanding and using balance transfer credit cards

Understanding balance transfer credit cards is pivotal for managing and reducing debt efficiently. This guide explores how to select and use these financial tools effectively. With the right balance transfer credit card, you can consolidate debt, lower interest rates, and navigate your way to financial freedom. This post covers all you need to acknowledge about making the most of balance transfer opportunities, ensuring you’re equipped to make informed decisions that benefit your financial situation.

Tips for using balance transfer cards to get out of debt

In this comprehensive guide, we delve into the intricacies of transfer debt strategies, focusing on how balance transfer cards can be a pivotal tool for those looking to navigate the maze of financial products and reduce their debt. The guide aims to illuminate the pathway towards financial freedom by utilizing balance transfer cards effectively, offering hope and practical advice for individuals striving to manage and overcome their debt challenges. Learn the essential tips and strategies to leverage transfer debt techniques for a healthier financial future.

How to choose the best balance transfer card

Selecting the ideal transfer card is essential for effective debt management and reduction. This guide provides key insights to assist in making an informed decision that aligns with your financial requirements. Understanding the nuances of various transfer cards can vastly improve your strategy for tackling debt, ensuring you choose a solution that perfectly fits your needs. Discover how to leverage the benefits of transfer cards for optimal financial health.

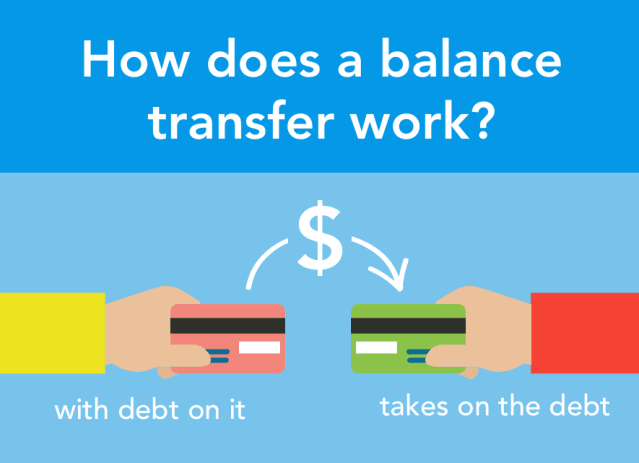

What are balance transfer credit cards?

Understanding balance transfers on credit cards is key to managing debt and enhancing financial flexibility. This guide explains the functionality and benefits of balance transfers, offering insights into how they can be a strategic option for debt management. By exploring the nuances of these financial tools, individuals can gain control over their finances, reduce interest payments, and potentially improve their credit scores. Engaging with balance transfers wisely can lead to significant financial advantages and smarter debt handling.

Financial planning for singles: managing money on your own

Navigating financial planning on your own doesn’t have to be overwhelming. Our guide provides valuable insights, strategies, and resources specifically designed for those undertaking their financial journey independently. Whether you’re budgeting, saving, or investing, our tips will help you make informed decisions, setting you on the path to financial empowerment. Embrace the challenge of managing your finances solo with our expert advice on financial planning – your roadmap to achieving financial success and security on your own terms.

Investing and financial planning without a partner

Embarking on the journey of financial planning and asset management solo can seem daunting, but with the right guide, it’s an empowering adventure. This comprehensive guide dives deep into the essentials of managing your finances independently, ensuring you have the knowledge and tools to take control. Whether you’re navigating investments, savings, or budgeting, our expert advice helps you understand the intricacies of financial planning. Perfect for those seeking to master their economic destiny solo, this guide is your first step towards financial freedom and savvy asset management. Let’s begin this journey to financial self-sufficiency together.

Saving for the future as a single person

Securing a stable financial future, especially for individuals managing life independently, requires the crucial practice of saving. Emphasizing the importance of saving for the future not only reflects wisdom but is essential for achieving financial security. This approach guarantees a worry-free transition into the later stages of life, highlighting the significance of proactive financial planning. With the focus on saving future, the content underscores the need for individuals to prioritize their financial well-being, ensuring a secure and stable lifestyle ahead.

Budgeting tips for single income households

Navigating the complexities of managing finances on a single income can seem daunting. However, with the right budgeting tips, it’s possible to thrive in a one-income household. Our blog offers invaluable advice on how best to maximize your financial resources, providing practical strategies that can significantly improve your financial health. From understanding your spending habits to identifying areas where you can cut costs without compromising your quality of life, these budgeting tips are essential for anyone looking to make the most of their financial situation in a single-income environment.