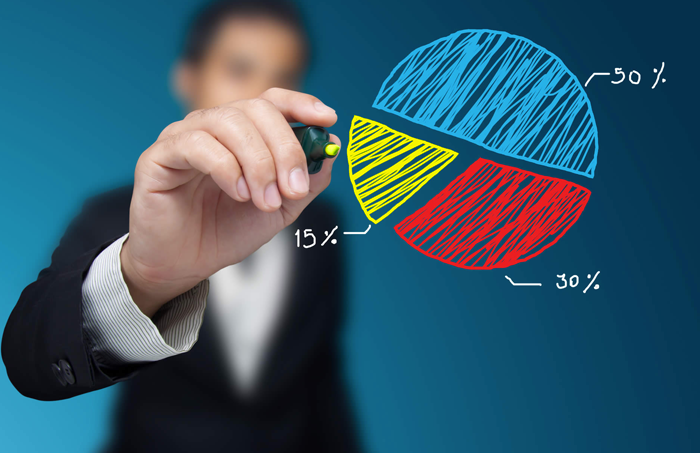

Different ways to diversify your investments

In today’s uncertain market, it’s essential to diversify investments to mitigate risks and improve returns. This guide delves into various strategies to spread your financial portfolio across different assets, ensuring a safer and potentially more profitable investment journey. By exploring multiple avenues, investors can protect themselves against market volatility and increase their chances for financial success. Learn how to effectively diversify your investments in today’s challenging financial landscape for a more secure financial future.

The importance of investment diversification

Exploring diverse investment avenues is crucial for building a robust financial portfolio. Getting into varied types of investments not only expands financial holdings but also plays a vital role in safeguarding assets against unforeseen market volatilities. Embracing this strategy is key to achieving financial stability and growth over time. By getting involved in different investment opportunities, investors can mitigate risks and enhance their potential for generating wealth. This approach is fundamental for anyone looking to secure their financial future in an unpredictable economic landscape.

How to negotiate a higher salary and benefits

In today’s competitive job market, achieving a higher salary and better benefits is key to career advancement and financial security. This guide provides strategic tips for effectively negotiating for a higher salary, emphasizing preparation, understanding your value, and clear communication. Whether you’re seeking a new position or aiming to increase your earnings in your current role, mastering these negotiation techniques can significantly enhance your compensation package. Learn to navigate these discussions confidently and secure the financial recognition you deserve.

What to do if your salary negotiation is unsuccessful

Navigating an unsuccessful negotiation, especially after a salary discussion, demands resilience and strategic preparation. This guide delves into essential steps and practical advice for both rebounding from a recent letdown and proactively bracing for potential disappointments. By focusing on the aftermath of an unsuccessful salary negotiation, it provides actionable strategies to regain confidence, reassess one’s approach, and effectively prepare for future negotiations. Learn to turn a negotiation unsuccessful into a valuable learning experience, ensuring readiness and improved outcomes in your next negotiation endeavor.

Tips for negotiating benefits and perks

Negotiating benefits is crucial when securing a job offer, often holding as much significance as the salary discussion. It’s essential to understand the importance of benefits and perks in your overall compensation package. To effectively negotiate these, one must be prepared to engage in detailed discussions with potential employers, emphasizing the value of a comprehensive benefits package. This approach not only enhances your employment terms but also demonstrates your knowledge in maximizing the value of your employment offer. Remember, negotiating benefits is a key step to ensuring your job satisfaction and financial wellness.

Preparing for a salary negotiation

Mastering the art of salary negotiation is essential for advancing your career and securing a better compensation package. This article offers in-depth strategies to effectively negotiate your salary, providing crucial insights into preparation and the negotiation process itself. By adopting these strategies, you can enhance your negotiation skills and confidently approach discussions about your compensation. Effective salary negotiation not only boosts your immediate financial situation but also sets a positive trajectory for future earnings. Learn the key tactics to succeed in your next salary negotiation and secure the compensation you deserve.

Planning a financially savvy wedding on a budget

Planning a savvy wedding while maintaining a frugal mindset requires creativity, flexibility, and a solid strategy. It’s entirely possible to celebrate your big day without breaking the bank.

In this guide, we’ll explore actionable strategies to help you organize an unforgettable marriage ceremony and reception that align perfectly with your financial boundaries.

Prioritizing expenses for your big day

Planning your dream wedding doesn’t have to break the bank. Mastering the management of wedding expenses is key to blending your vision with financial practicality. Our guide offers invaluable insights on budgeting smartly, making informed choices, and prioritizing expenses without compromising the essence of your big day. Dive into proven strategies to keep your wedding expenses in check while ensuring your celebration is everything you’ve envisioned. Transform the challenge of financial planning into a fulfilling part of your wedding journey with our expert tips and make your special day both memorable and affordable.

Creative ways to save money on your wedding

Planning a wedding can often lead to financial stress, but with creative solutions, couples can significantly save on their special day. This post delves into innovative strategies for a budget-friendly celebration, ensuring the beauty and significance of the occasion aren’t compromised. From choosing off-peak dates to DIY decor, we’ve gathered a wealth of tips to help you save on your wedding expenses. Whether you’re looking to trim the guest list or opt for a less traditional venue, our guide provides practical advice for every couple eager to celebrate their love without breaking the bank.

How to set a wedding budget and stick to it

Planning a matrimony on a budget can be a challenge, but it’s an essential step for couples looking to celebrate their union without breaking the bank. This guide offers practical advice on setting a realistic wedding budget, ensuring that financial constraints don’t overshadow the joy of your special day. From prioritizing expenses to identifying cost-saving opportunities, you’ll learn how to orchestrate a memorable wedding that reflects your values and love without overspending. Start your journey together on solid financial ground by mastering the art of budgeting for your wedding.