Real estate investment tips for beginners

“Embarking on the real estate journey may feel daunting for newcomers, yet, with the correct approach, it offers great rewards. This blog post sheds light on vital beginner real estate tips, providing a roadmap for those eager to start their investment adventure successfully. From understanding market trends to financial planning, these insights are designed to equip novices with the confidence and knowledge needed to make informed decisions. Dive into the world of real estate with us and transform the overwhelming into the achievable.”

How to choose a credit card that suits your lifestyle

Choosing a lifestyle suitable credit card is crucial for effective financial management. This guide offers valuable insights to align your card choice with your spending habits and financial goals. With numerous options available, understanding how to select a card that complements your lifestyle can significantly enhance your financial well-being. By focusing on cards that offer rewards and benefits tailored to your spending patterns, you can maximize your financial resources and achieve your financial aspirations more efficiently.

Money management for financial well-being

In today’s fast-paced environment, effective financial well-being management plays a pivotal role in achieving financial health. It goes beyond mere savings, emphasizing the importance of making informed financial decisions. Understanding the principles of managing your finances can lead to enhanced financial stability and well-being. By prioritizing financial well-being management, individuals can navigate the complexities of the financial world more adeptly, ensuring a more secure and prosperous future.

Achieving the FIRE dream: Investment strategies

Achieving financial independence and retiring early, commonly known as FIRE, is a goal within reach for those willing to embrace rigorous planning, disciplined saving, and astute investing. This guide delves into effective FIRE investment strategies, emphasizing the importance of creating a well-rounded portfolio. By focusing on smart financial practices, anyone looking to realize their dream of early retirement can find valuable insights and practical advice on navigating their journey toward financial freedom. Through strategic investment moves, disciplined approaches, and clear financial goals, attaining FIRE is not just a dream but an achievable reality.

Stock investment planning for long-term growth

Embarking on your stock long-term growth planning journey is essential for securing a financial future. This blog post offers insights and strategies for cultivating a robust investment portfolio. We delve into the importance of diversification, understanding market trends, and patience in the evolution of your investments. With a focus on long-term growth, we guide you through making informed decisions that align with your financial goals. Discover actionable tips for stock long-term growth planning, designed to help you build and maintain a strong investment portfolio over time.

Generating passive income through photography

In our visually-driven world, creating a photography passive income has become an enticing option for photographers aiming to monetize their passion. This concept not only offers a sustainable financial pathway but also allows individuals to capitalize on their creative skills. By utilizing various platforms for selling photos, entering into stock photography, or even teaching photography online, individuals can establish a steady income stream. This approach to generating passive income through photography not only benefits the creator financially but also expands their reach and impact in the digital space, providing an effective means to thrive in today’s digital economy.

Investing wisely for a comfortable retirement

In the article on crafting strategies for comfortable retirement investing, readers are guided towards ensuring a serene post-career phase. It highlights the importance of a strategic plan to secure a comfortable retirement, emphasizing essential strategies for a worry-free golden period. By integrating these key approaches, individuals are encouraged to not just envision but live their envisioned golden years comfortably, marking it as a crucial read for anyone looking to invest wisely for a comfortable retirement.

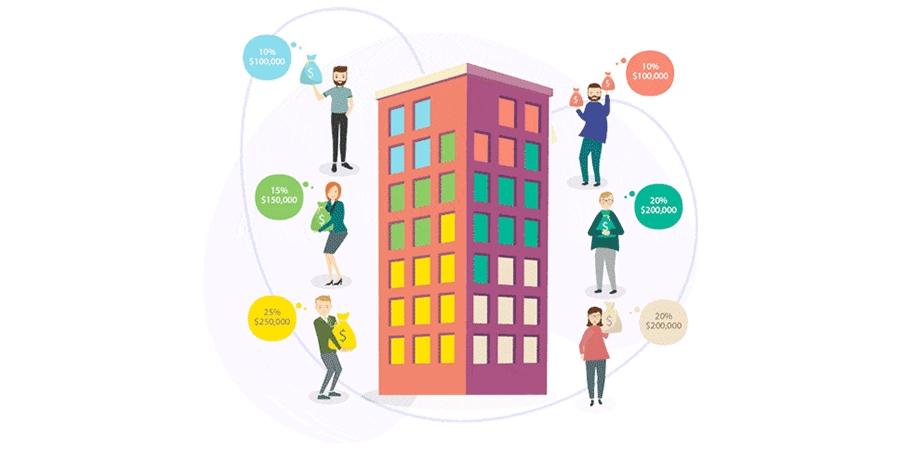

The basics of investing in real estate syndications

Understanding the real estate syndications basics is crucial for investors looking to diversify their portfolios through collective property ventures. Real estate syndication offers an opportunity to invest in large-scale properties without needing to manage the properties directly. This blog post highlights the fundamental aspects of real estate syndications, including the structure, benefits, and considerations for potential investors. By familiarizing themselves with these basics, investors can make informed decisions and potentially reap the rewards of participating in real estate syndications.

Credit cards: Tips for first-time users

Navigating the maze of first-time credit cards can be daunting for beginners. Our comprehensive guide on first-time credit card tips delves into effective strategies to manage your new financial tool with confidence. Learn how to understand your credit score and employ these essential tips to make informed decisions, ensuring a smooth introduction into the world of credit. This guide is a must-read for anyone looking to master their first credit card and build a strong financial foundation.

Budgeting for life’s unexpected events

In this essential guide on “unexpected event budgeting,” we delve into effective strategies to maintain financial stability amidst life’s uncertainties. Discover actionable advice tailored to help you anticipate and plan for unforeseen events, ensuring you’re always one step ahead. Embracing unexpected event budgeting is not just a smart choice but a vital one for securing your financial future in an ever-evolving world. Learn to navigate the unpredictable with confidence, safeguarding your financial well-being against the unexpected.