Investing in real estate for passive income

Investing in real estate is a proven strategy to generate passive income and achieve financial growth. It offers the dual benefit of long-term capital gains and immediate cash flow, making it an attractive avenue for investors. Whether you’re new to the investment scene or looking to diversify your portfolio, understanding the fundamentals of real estate investing is crucial. This guide provides insights on how to navigate the market, ensuring you make informed decisions that maximize your investment’s potential. Embrace the opportunity to secure a stable income and build wealth through real estate investments.

Managing your real estate investment for maximum return

Optimizing estate management is crucial for maximizing the yield of your real estate investments. This blog provides strategic insights into effective estate management practices that can amplify returns from your property holdings. By adopting these expert recommendations, investors can enhance the performance of their real estate portfolio, ensuring a more profitable and efficient management process. Whether you’re a seasoned investor or new to the property market, understanding and implementing these estate management strategies can significantly impact your investment outcomes.

Benefits of real estate investment

In the realm of investment, diversification is paramount for mitigating risk and boosting returns. Estate investment emerges as a popular option, illustrating the significant benefits of property investment. This blog post delves into the myriad advantages of incorporating estate investment into one’s portfolio, highlighting its role in achieving financial stability and growth. By underscoring the importance of property investment, investors are guided on how to effectively diversify their investments, making estate investment a cornerstone of a robust investment strategy.

Real estate investment analysis tools

In the dynamic world of property investment, leveraging real estate analysis tools is crucial for strategic decision-making. This guide explores the top instruments and methodologies essential for investors aiming to navigate the market wisely. With a focus on enhancing the accuracy of investment decisions, these tools offer comprehensive insights into market trends, property valuation, and investment potential. By adopting such methodologies, investors can significantly increase their chances of success in the competitive real estate arena, making the use of real estate analysis tools not just beneficial but indispensable for informed investment strategies.

Tips for investing in commercial real estate

Commercial real estate investing involves a strategic approach to generate lucrative returns. Understanding the landscape is essential for success in this type of investment. By embarking on this journey with thorough insights, investors can unlock significant financial advantages. Navigating the terrain of commercial real estate demands a deep dive into market trends, financial analysis, and investment strategies to ensure profitable outcomes. This overview highlights the importance of informed decision-making in the realm of commercial real estate investing, underscoring the potential rewards of well-executed investments.

Making money in real estate with minimal investment

Embarking on a journey through minimal investment real estate offers an exhilarating and profitable path for individuals seeking to generate substantial returns with little upfront capital. This unique approach to property investment emphasizes strategies that minimize the initial financial commitment while maximizing potential earnings. By focusing on minimal investment real estate, investors can explore various avenues to enter the market without the burden of heavy investments, making it an ideal option for beginners or those with limited resources. Discover how to start with minimal investment and potentially reap significant rewards in the world of real estate.

Making money in real estate with minimal investment

Entering the real estate market with minimal investment is now more accessible than ever. Contrary to the traditional belief that only those with deep pockets can participate, the evolving landscape of the industry allows individuals to invest modest amounts and still gain a significant foothold. By tapping into resources and strategies designed for minimal investment, anyone can become a part of the real estate world. This approach opens up opportunities for more people to build wealth through property ownership, making the dream of investing in real estate achievable for a broader audience.

Profitable real estate strategies for investors

Unlock the secret to maximizing your profits in the property market with the most effective real estate investor strategies. Perfect for both newcomers and seasoned veterans, this guide covers everything from long-term investments to quick flips. Dive into the world of successful real estate investment and transform the way you approach the property market. Discover the key strategies that will make you thrive as a real estate investor today.

Real estate investment tips for beginners

“Embarking on the real estate journey may feel daunting for newcomers, yet, with the correct approach, it offers great rewards. This blog post sheds light on vital beginner real estate tips, providing a roadmap for those eager to start their investment adventure successfully. From understanding market trends to financial planning, these insights are designed to equip novices with the confidence and knowledge needed to make informed decisions. Dive into the world of real estate with us and transform the overwhelming into the achievable.”

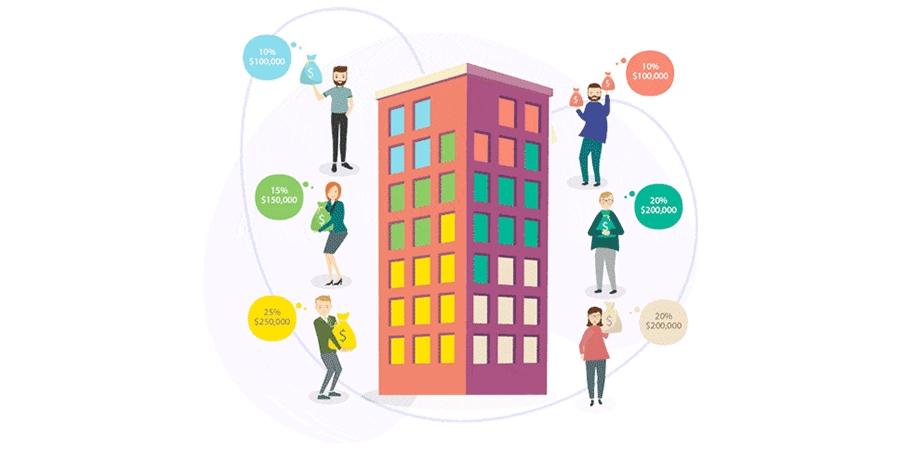

The basics of investing in real estate syndications

Understanding the real estate syndications basics is crucial for investors looking to diversify their portfolios through collective property ventures. Real estate syndication offers an opportunity to invest in large-scale properties without needing to manage the properties directly. This blog post highlights the fundamental aspects of real estate syndications, including the structure, benefits, and considerations for potential investors. By familiarizing themselves with these basics, investors can make informed decisions and potentially reap the rewards of participating in real estate syndications.