Essential insurance policies everyone should have

In the realm of financial planning, securing the right insurance policies is paramount. This pivotal post delves into essential insurance policies that underpin a robust protection strategy. By exploring a broad spectrum of options, it highlights the critical role these policies play in safeguarding your financial future. Understanding these insurance policies is key to establishing a solid foundation for your financial well-being, ensuring you’re covered in every aspect of life.

How often should you check your credit report?

Monitoring your credit report is essential for maintaining financial health. Ideally, reviewing your financial statements regularly can prevent inaccuracies that might affect your credit standing. While there’s no one-size-fits-all answer to how often you should check, being proactive by monitoring your credit report periodically can help you catch and rectify any errors early, ensuring your financial integrity remains intact. This practice not only helps in safeguarding against identity theft but also plays a crucial role in maintaining your creditworthiness in the long run.

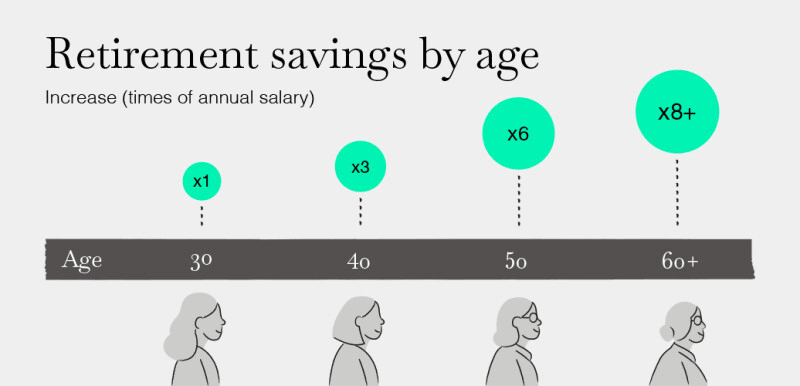

How much should you save for retirement?

Determining the right amount to save for retirement is essential for a comfortable future. This guide delves into crucial factors that influence how much you need to save. By understanding these aspects, you can tailor your retirement savings plan to ensure a secure and comfortable lifestyle post-retirement. Whether you’re just starting or nearing retirement, it’s never too late to adjust your savings strategy. Embrace the journey towards a financially secure retirement by making informed decisions today. Save retirement wisely to enjoy your golden years with peace of mind.