How to choose the best balance transfer card

Selecting the ideal transfer card is essential for effective debt management and reduction. This guide provides key insights to assist in making an informed decision that aligns with your financial requirements. Understanding the nuances of various transfer cards can vastly improve your strategy for tackling debt, ensuring you choose a solution that perfectly fits your needs. Discover how to leverage the benefits of transfer cards for optimal financial health.

Saving for the future as a single person

Securing a stable financial future, especially for individuals managing life independently, requires the crucial practice of saving. Emphasizing the importance of saving for the future not only reflects wisdom but is essential for achieving financial security. This approach guarantees a worry-free transition into the later stages of life, highlighting the significance of proactive financial planning. With the focus on saving future, the content underscores the need for individuals to prioritize their financial well-being, ensuring a secure and stable lifestyle ahead.

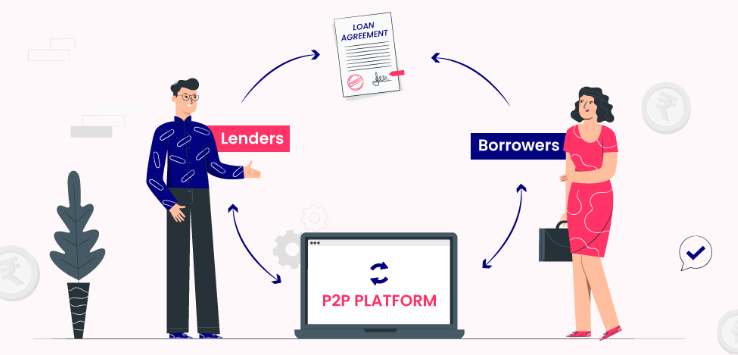

The basics of peer-to-peer lending as an investment

Peer-to-peer lending revolutionizes investment options by directly connecting borrowers with investors, bypassing traditional financial intermediaries. This groundbreaking method offers potential high returns, diversifying portfolios away from conventional markets. Understanding peer-to-peer lending is vital for those seeking innovative investment avenues. It opens doors to varied investment opportunities, enabling personalized risk management and contributing to a dynamic financial ecosystem. By embracing this model, investors gain access to a broader spectrum of borrowers, promising a blend of risk and reward tailored to individual preferences in the evolving landscape of investment strategies.

How to find the best deals on flights

Discovering the best deals on airfare can be a complex task, akin to navigating a constantly shifting maze. This guide simplifies the process, offering strategic advice to help travelers master the art of finding economical flight options. By understanding the dynamics of flight pricing and timing, you can unlock the secrets to securing the most budget-friendly fares, turning the daunting task of booking flights into a more manageable and rewarding experience. Learn to navigate the world of air travel with ease and confidence, ensuring you always find the best deals on your journeys.

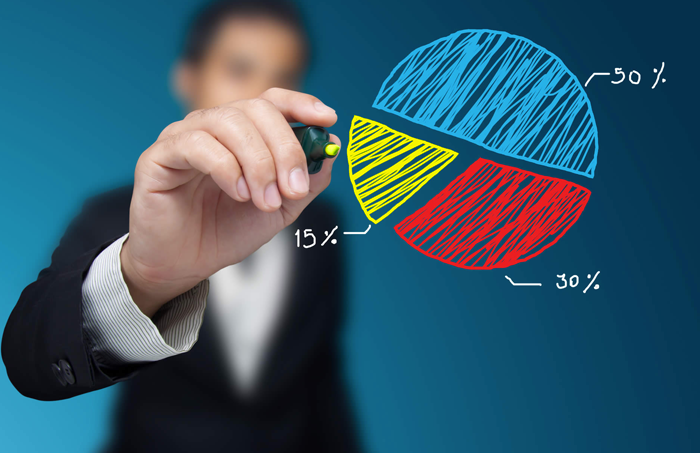

How to assess the risk and return of your portfolio

Understanding portfolio risk and its counterpart, potential returns, is essential for optimizing investments. This guide explores strategies to assess and balance risk versus reward, ensuring investors can make informed decisions. By evaluating portfolio risk, individuals can tailor their investment approaches to meet financial goals while mitigating potential losses. This high-value content offers insights into creating a balanced investment strategy that aligns with personal risk tolerance and return expectations, empowering investors with the knowledge to build a resilient portfolio.

The importance of investment diversification

Exploring diverse investment avenues is crucial for building a robust financial portfolio. Getting into varied types of investments not only expands financial holdings but also plays a vital role in safeguarding assets against unforeseen market volatilities. Embracing this strategy is key to achieving financial stability and growth over time. By getting involved in different investment opportunities, investors can mitigate risks and enhance their potential for generating wealth. This approach is fundamental for anyone looking to secure their financial future in an unpredictable economic landscape.

The importance of life insurance

Understanding the paramount significance of life insurance is crucial for securing a stable financial future for you and your loved ones. This overview highlights the multifaceted benefits of life coverage, emphasizing its undeniable importance. Life insurance not only provides financial stability in the event of unforeseen circumstances but also ensures peace of mind. Adopting life coverage is a strategic move towards safeguarding your family’s financial well-being, making it an indispensable element of financial planning. Explore how life insurance serves as a key to securing a protected and financially stable future.

Health insurance: choosing the right plan

Selecting the right health insurance plan is pivotal for your financial and health wellbeing. This guide explores essential aspects to consider, ensuring you make an informed decision that aligns with your needs and budget. With a focus on health insurance, it emphasizes the importance of understanding coverage options, deductibles, premiums, and out-of-network charges. By considering these factors, you are better equipped to choose a health insurance plan that not only provides comprehensive coverage but also fits your financial situation, ensuring peace of mind and security for you and your family.

The impact of inflation on your savings and how to combat it

In today’s economy, learning how to combat inflation is vital for securing your financial future. This guide explores the effects of inflation on savings and provides effective strategies to counter these impacts. By understanding inflationary trends and leveraging insights, individuals can take proactive steps to shield their financial assets. From investment tips to savings plans, this article arms you with the knowledge needed to navigate inflationary pressures, ensuring your financial well-being remains intact. Get equipped to combat inflation and protect your financial stability in these unpredictable times.

Navigating the world of online banking safely

In today’s digital era, online banking has significantly reshaped our financial management practices, emphasizing the convenience it brings over traditional methods. With the focus keyword “online banking,” this summary highlights the importance of understanding both the benefits and the necessary skills to navigate the digital financial landscape. As we move further into the age of digital convenience, learning to adeptly manage our finances through online banking platforms becomes increasingly crucial, offering a blend of efficiency and security in handling monetary transactions and savings.