Getting the most out of credit card points

Maximizing credit card points is a key strategy for financially savvy consumers aiming to make the most out of their everyday spending. By focusing on credit card points maximization, individuals can unlock a host of benefits and rewards that go beyond simple cashback, turning routine purchases into valuable assets. This approach not only enhances the consumer’s purchasing power but also provides an avenue for savings and luxury experiences without additional expenditure. Understanding the best practices for credit card points maximization is essential for anyone looking to elevate their financial strategy and reap the rewards of their spending habits.

The role of cryptocurrency in financial planning

The rise of digital assets, especially cryptocurrencies, has significantly transformed cryptocurrency financial planning strategies. Investors now face a unique mix of challenges and opportunities within this new asset class. Understanding the intricacies of investing in cryptocurrencies is crucial for modern financial planning. This evolution underscores the importance of adapting traditional investment approaches to include these digital assets, offering innovative avenues for portfolio diversification and returns. However, navigating the volatile cryptocurrency market requires a nuanced understanding of its risks and potential rewards, highlighting the need for informed decision-making in contemporary financial planning practices.

Investment planning for the long term

Long-term investment planning is essential for achieving financial security and prosperity. This guide delves into the intricacies of the market, emphasizing the importance of a strategic approach that aptly balances risks and rewards over time. It underscores the need for well-thought-out long-term investment plans to navigate the complexities of the financial landscape effectively. By incorporating these insights, individuals can set a steady course towards financial growth, ensuring their investments are aligned with their future goals and financial aspirations.

Navigating the complexities of retirement accounts

Navigating the complexities of retirement accounts is crucial for ensuring financial security in your golden years. Understanding the intricate details of managing retirement savings plans can be challenging but is essential for making informed decisions. These decisions can greatly influence the quality of life during retirement, highlighting the importance of being well-informed about the various types of accounts and their management. Addressing retirement accounts complexities is not only about securing a comfortable future but also about optimizing your current financial strategies to achieve long-term goals.

Understanding the benefits of credit card insurance

“In today’s fast-paced society, understanding credit card insurance benefits is crucial for financial security. This protective layer, often overlooked, offers a safety net against unexpected events. As the prevalence of credit card use continues to rise, it’s essential to be informed about the insurance coverage that accompanies these financial tools. By delving into the intricacies of credit card insurance, users can ensure they are fully leveraging the benefits available to them, safeguarding their financial well-being against unforeseen circumstances. Stay informed and make the most out of your credit card insurance benefits for a more secure financial future.”

The basics of achieving FIRE

Embarking on the path to achieving FIRE basics is essential for anyone aiming to gain financial independence and early retirement. It involves a transformative approach to managing personal finances, emphasizing the importance of understanding the fundamentals behind the concept. Achieving FIRE basics requires dedication, strategic planning, and a deep dive into efficient financial practices. This journey not only secures one’s financial future but also offers an enlightening perspective on personal finance management.

The best credit cards for everyday spending

Discover the best everyday spending credit cards to elevate your financial savvy. This guide showcases top picks that stand out for their exceptional benefits, rewards, and savings opportunities tailored to daily expenses. Whether looking to maximize cashback, earn points on every purchase, or enjoy unique perks, these cards are designed to enhance your spending efficiency. Dive into our comprehensive exploration to find your perfect plastic companion for daily expenses, making smart financial management an accessible reality.

The importance of diversification in retirement planning

Understanding retirement planning diversification is crucial for a secure financial future. It’s not solely about the act of saving but significantly involves where and how these savings are allocated. This detailed exploration sheds light on the essence of diversification within retirement planning. By employing strategic diversification, individuals can mitigate risks and enhance potential returns, ensuring a robust financial foundation for their retirement years. Thus, mastering retirement planning diversification becomes a pivotal element of successful retirement preparation.

Achieving the FIRE dream: Investment strategies

Achieving financial independence and retiring early, commonly known as FIRE, is a goal within reach for those willing to embrace rigorous planning, disciplined saving, and astute investing. This guide delves into effective FIRE investment strategies, emphasizing the importance of creating a well-rounded portfolio. By focusing on smart financial practices, anyone looking to realize their dream of early retirement can find valuable insights and practical advice on navigating their journey toward financial freedom. Through strategic investment moves, disciplined approaches, and clear financial goals, attaining FIRE is not just a dream but an achievable reality.

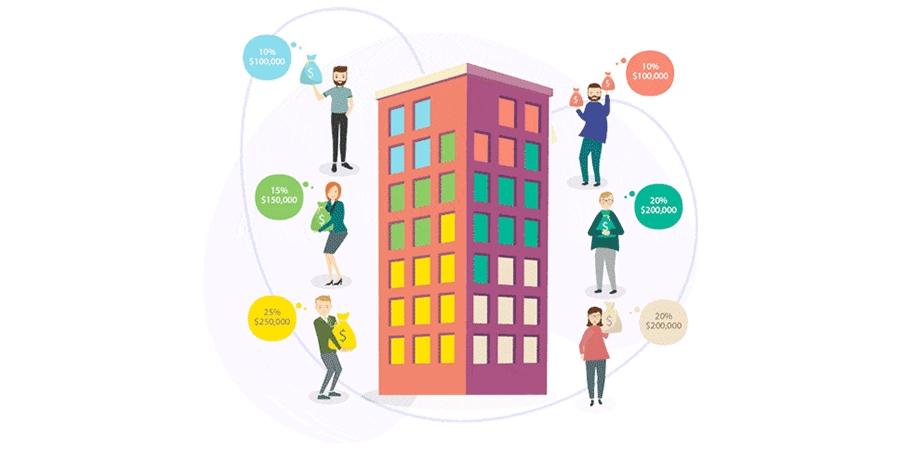

The basics of investing in real estate syndications

Understanding the real estate syndications basics is crucial for investors looking to diversify their portfolios through collective property ventures. Real estate syndication offers an opportunity to invest in large-scale properties without needing to manage the properties directly. This blog post highlights the fundamental aspects of real estate syndications, including the structure, benefits, and considerations for potential investors. By familiarizing themselves with these basics, investors can make informed decisions and potentially reap the rewards of participating in real estate syndications.