How to choose the best balance transfer card

Selecting the ideal transfer card is essential for effective debt management and reduction. This guide provides key insights to assist in making an informed decision that aligns with your financial requirements. Understanding the nuances of various transfer cards can vastly improve your strategy for tackling debt, ensuring you choose a solution that perfectly fits your needs. Discover how to leverage the benefits of transfer cards for optimal financial health.

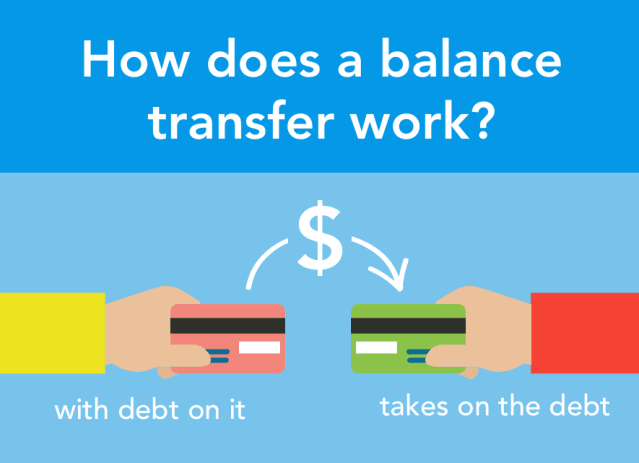

What are balance transfer credit cards?

Understanding balance transfers on credit cards is key to managing debt and enhancing financial flexibility. This guide explains the functionality and benefits of balance transfers, offering insights into how they can be a strategic option for debt management. By exploring the nuances of these financial tools, individuals can gain control over their finances, reduce interest payments, and potentially improve their credit scores. Engaging with balance transfers wisely can lead to significant financial advantages and smarter debt handling.

Comparing the best online banking platforms

In today’s digital-dominated world, choosing the optimal banking platforms is key to managing finances smoothly. This guide explores top online banking alternatives, highlighting their distinct features and advantages. With a focus on facilitating easy and secure transactions, these banking platforms offer a range of services tailored to modern financial needs. Whether you’re looking for user-friendly interfaces or robust security measures, understanding the unique offerings of each platform can significantly enhance your online banking experience.

The advantages of online banking

In the digital age, financial management is revolutionized by online banking, offering numerous advantages for an enhanced banking experience. This blog post explores how these innovative platforms are transforming personal finance, making operations more convenient, secure, and user-friendly. Discover the benefits and insights on navigating the future of financial transactions with online banking, emphasizing its pivotal role in modern finance management.

Choosing the best credit cards for rewards

Choosing the best credit cards for maximizing rewards involves a careful evaluation of offers in relation to your spending habits. To navigate this complex landscape, focus on cards that complement your lifestyle and financial objectives, ensuring every purchase yields the highest possible benefit. By carefully selecting among the best credit cards, you can transform routine buying into a strategic advantage, optimizing rewards and minimizing potential drawbacks. Remember, the key is to match the card’s features with your specific needs, maximizing returns on everyday expenses.