The future of AI: What to expect in 2025

The “Horizon of Artificial Intelligence: Minimalist Living Meets Technological Sophistication” explores the transformative potential of AI by 2025. This convergence is set to redefine minimalist living through the integration of advanced technology, ensuring simplicity and efficiency in every aspect of life. This blend promises a future where lifestyle minimalism and technological innovation coexist seamlessly, offering a unique approach to living that emphasizes sustainability and simplicity. As we approach 2025, the synergy between minimalist living and artificial intelligence is expected to create more organized, efficient, and stress-free living environments.

What makes neo-banks different?

In the rapidly changing financial services sector, neo-banks emerge as innovative challengers to conventional banking. These digital-only banks strive to transform our financial interactions, offering a more streamlined, user-friendly approach. Unlike traditional banks, neo-banks leverage cutting-edge technology to provide efficient, cost-effective services. This evolution signals a shift towards more accessible banking, highlighting the growing importance of adaptability in the digital age. As neo-banks continue to gain traction, understanding their unique offerings becomes crucial for anyone looking to optimize their financial management.

Mobile payment security: what you need to know

In today’s digital age, the shift towards mobile payments has become more evident, highlighting the importance of mobile payment security. With transactions moving away from traditional methods, the convenience offered by mobile payments is undeniable. However, this convenience also raises significant concerns regarding the safety and security of users’ financial information. Ensuring mobile payment security is crucial for both users and providers, as it helps maintain trust and reliability in the technology. This article delves into the risks associated with mobile payments and offers insights into how users can safeguard their financial information in the digital realm.

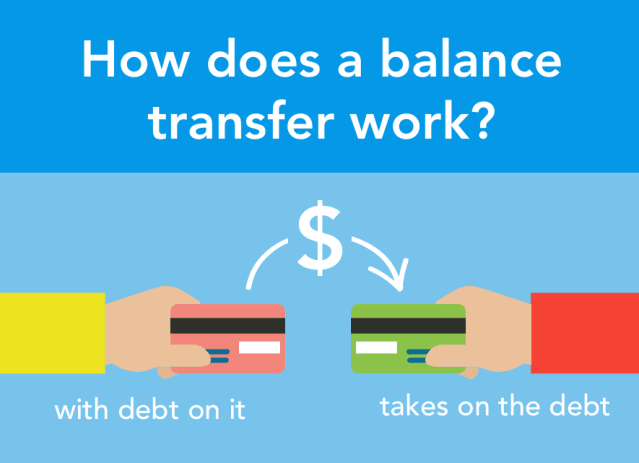

What are balance transfer credit cards?

Understanding balance transfers on credit cards is key to managing debt and enhancing financial flexibility. This guide explains the functionality and benefits of balance transfers, offering insights into how they can be a strategic option for debt management. By exploring the nuances of these financial tools, individuals can gain control over their finances, reduce interest payments, and potentially improve their credit scores. Engaging with balance transfers wisely can lead to significant financial advantages and smarter debt handling.

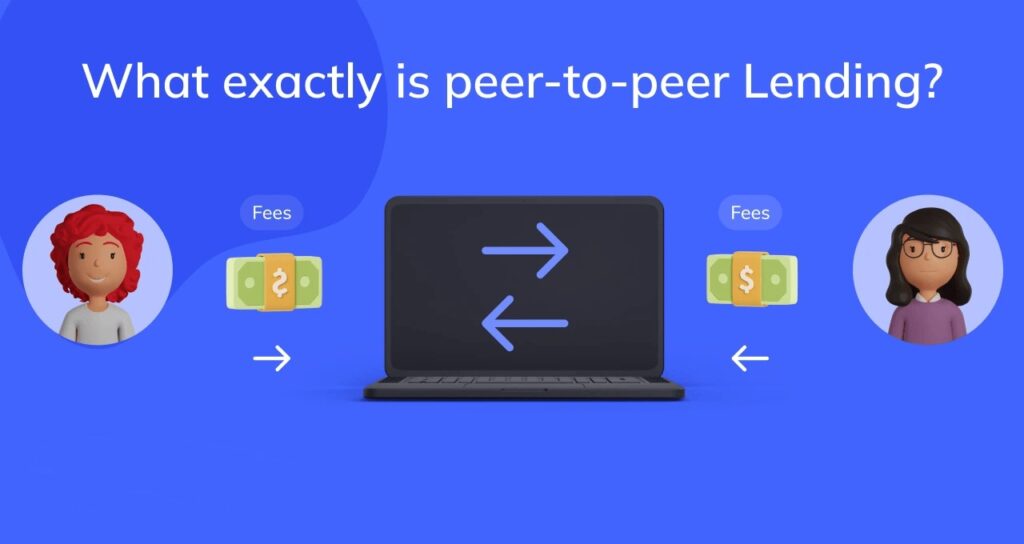

What is peer-to-peer lending?

Peer-to-peer (P2P) lending has emerged as a modern financial phenomenon, marking a shift from traditional financial systems fraught with complexities and barriers. This innovative lending and borrowing method has gained significant traction, offering a streamlined alternative for individuals seeking financial services outside the conventional banking framework. P2P lending facilitates direct transactions between individuals, bypassing traditional financial intermediaries, and thereby, reducing costs and increasing accessibility for both lenders and borrowers. This system not only democratizes financial services but also introduces a more personalized and efficient way of handling loans and investments.

What to do if your salary negotiation is unsuccessful

Navigating an unsuccessful negotiation, especially after a salary discussion, demands resilience and strategic preparation. This guide delves into essential steps and practical advice for both rebounding from a recent letdown and proactively bracing for potential disappointments. By focusing on the aftermath of an unsuccessful salary negotiation, it provides actionable strategies to regain confidence, reassess one’s approach, and effectively prepare for future negotiations. Learn to turn a negotiation unsuccessful into a valuable learning experience, ensuring readiness and improved outcomes in your next negotiation endeavor.

What is the FIRE movement and how to get started

The FIRE movement, standing for Financial Independence, Retire Early, is revolutionizing personal finance by providing a strategy for individuals to attain financial freedom before the conventional retirement age. This empowering blueprint emphasizes saving aggressively and investing wisely, allowing followers to live life on their terms much sooner. By adhering to the principles of the FIRE movement, people are transforming their financial futures, proving that early retirement is not just a dream but an achievable reality.

Cryptocurrency: what it is and how it works

In this guide, we dive into the world of cryptocurrency, aiming to demystify the complexities behind these digital currencies. As digital innovation continuously evolves, grasping the essence and mechanics of cryptocurrency becomes increasingly vital. We offer clarity and insight into how these currencies function, providing readers with the understanding needed to navigate the cryptocurrency landscape. This comprehensive overview is designed to enlighten both newcomers and seasoned enthusiasts about the ongoing digital revolution in the financial world.