Instacart Mastercard®: All You Need to Know About the Card and How to Apply

Instacart, one of the leading grocery delivery services in the U.S., has partnered with Mastercard® to create a credit card designed for shoppers who frequently use the platform. The Instacart Mastercard® provides a range of benefits, including cashback rewards, discounts, and exclusive offers for loyal customers. This article will provide a comprehensive guide on the […]

Everything You Need to Know About the Alliant Cashback Visa Signature Credit Card

In today’s competitive credit card market, consumers have a myriad of options to choose from, each offering different rewards, benefits, and features. One card that stands out for its straightforward and generous cashback program is the Alliant Cashback Visa Signature Credit Card. Whether you’re looking for a card to maximize your everyday purchases or seeking […]

Capital One Venture X Rewards Credit Card: Everything You Need to Know

The Capital One Venture X Rewards Credit Card is a premier travel rewards credit card that offers a range of benefits, making it one of the most attractive options for frequent travelers. If you’re considering applying for this card, understanding its features, benefits, and application process is crucial. This guide provides a comprehensive overview of […]

Everything You Need to Know About the Wells Fargo Reflect Card

When it comes to choosing a credit card that fits your financial needs, the Wells Fargo Reflect Card stands out as a compelling option for many consumers. Offering a unique blend of features, benefits, and financial flexibility, this card is designed to cater to individuals seeking to manage their spending while benefiting from significant savings […]

Earn while you eat with doordash rewards mastercard®

Experience enhanced dining with the Doordash rewards Mastercard®, a groundbreaking program that turns your meals into more than just eating; it’s a rewarding journey. This card ensures that each bite you take not only satiates your craving but also contributes positively to your reward points, making every dining experience a step toward fruitful benefits. With the Doordash rewards Mastercard®, you’ll unlock a new dimension of rewarding dining, tailor-made to elevate your everyday eating habits into an accumulating treasure of rewards. Embrace this innovative way to maximize your dining experiences!

Mobile payment security: what you need to know

In today’s digital age, the shift towards mobile payments has become more evident, highlighting the importance of mobile payment security. With transactions moving away from traditional methods, the convenience offered by mobile payments is undeniable. However, this convenience also raises significant concerns regarding the safety and security of users’ financial information. Ensuring mobile payment security is crucial for both users and providers, as it helps maintain trust and reliability in the technology. This article delves into the risks associated with mobile payments and offers insights into how users can safeguard their financial information in the digital realm.

Why you need homeowners or renters insurance

Understanding the importance of homeowners insurance is crucial for the security of individuals and families. This insurance acts as a safety net, offering peace of mind by protecting against unforeseen events. Our latest blog post explores the key reasons why having coverage, whether you own your home or rent, is essential. Dive into the essentials of homeowners insurance to ensure you’re fully informed about how to safeguard your home and possessions effectively.

How often should you check your credit report?

Monitoring your credit report is essential for maintaining financial health. Ideally, reviewing your financial statements regularly can prevent inaccuracies that might affect your credit standing. While there’s no one-size-fits-all answer to how often you should check, being proactive by monitoring your credit report periodically can help you catch and rectify any errors early, ensuring your financial integrity remains intact. This practice not only helps in safeguarding against identity theft but also plays a crucial role in maintaining your creditworthiness in the long run.

How to create a budget that works for you

Creating a budget that aligns with your lifestyle and financial objectives is crucial for achieving financial freedom. This guide offers valuable insights on how to craft a personalized spending plan that reflects your financial situation and goals. By learning to create a budget, you can manage your finances effectively, setting the path toward a secure financial future. Tailored budgeting strategies provided here will empower you to take control of your spending and savings, ensuring that your financial actions support your long-term ambitions.

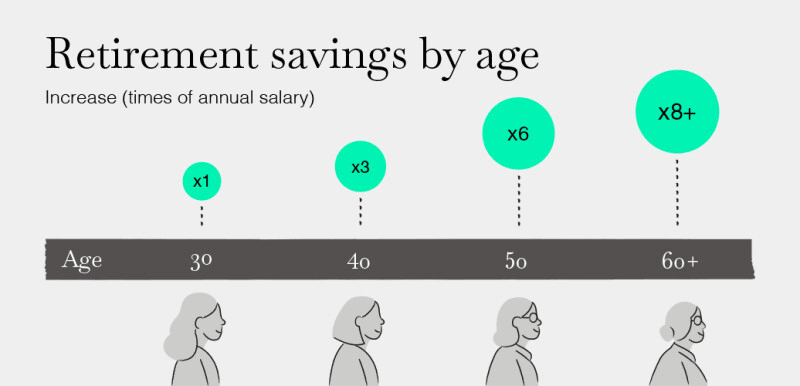

How much should you save for retirement?

Determining the right amount to save for retirement is essential for a comfortable future. This guide delves into crucial factors that influence how much you need to save. By understanding these aspects, you can tailor your retirement savings plan to ensure a secure and comfortable lifestyle post-retirement. Whether you’re just starting or nearing retirement, it’s never too late to adjust your savings strategy. Embrace the journey towards a financially secure retirement by making informed decisions today. Save retirement wisely to enjoy your golden years with peace of mind.