Use technology to your advantage: Enhancing your financial health

In the digital age, technology offers unparalleled tools and resources to manage our finances more efficiently and effectively. From budgeting apps to investment platforms, the right technology can simplify the complexities of personal finance, offering a clear path to financial wellness. Here’s how you can leverage technology to your advantage in managing your finances. Budgeting […]

FIRE essentials: Living below your means

In the quest for financial independence and early retirement (FIRE), the concept of living below means FIRE emerges as a key strategy. This approach involves cultivating a lifestyle that prioritizes savings and investment over immediate consumption, thereby accelerating the journey towards FIRE. It underscores the importance of budgeting, reducing expenses, and making informed financial decisions. By adopting this principle, individuals can lay a strong foundation for achieving financial freedom well before the conventional retirement age, empowering them to enjoy a life of autonomy and financial security.

How to choose a credit card that suits your lifestyle

Choosing a lifestyle suitable credit card is crucial for effective financial management. This guide offers valuable insights to align your card choice with your spending habits and financial goals. With numerous options available, understanding how to select a card that complements your lifestyle can significantly enhance your financial well-being. By focusing on cards that offer rewards and benefits tailored to your spending patterns, you can maximize your financial resources and achieve your financial aspirations more efficiently.

Diversifying your stock portfolio

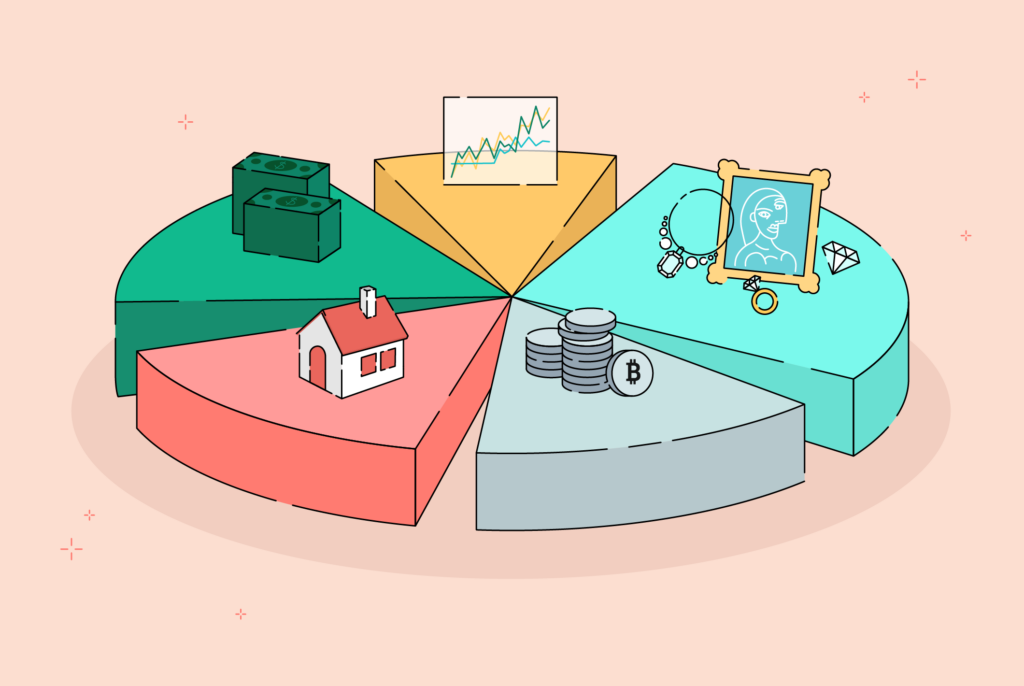

In the realm of investing, expanding your stock portfolio is crucial for establishing a solid financial foundation. Stock portfolio diversification acts as a strategic approach to minimize risks and boost potential returns. This guide explores the importance of diversifying your investments, underscoring how it can safeguard your finances against unpredictability in the market. By embracing stock portfolio diversification, investors can ensure a more stable and resilient financial future.