Annual fee:

$0

Intro offer:

$200

Rewards rate:

2% Cashback

Annual fee:

$0 intro annual fee for the first year, then $95.

Intro offer:

$250

Rewards rate:

1%-6% Cashback

Annual fee:

$0

Intro offer:

75,000 Miles

Rewards rate:

2x-5x Miles

Cryptocurrency as an Emerging Alternative Asset: The Dawn of the Institutional Era

March 2, 2026

No Comments

Investing in Commodities: Gold, Oil, and Beyond (2026 Guide)

February 27, 2026

No Comments

The Power of Tangible Wealth: A Deep Dive into Real Estate as an Alternative Investment

February 25, 2026

No Comments

Latests posts

Hybrid learning models post-pandemic

The global pandemic has significantly transformed the educational landscape, merging in-person and digital learning platforms. This shift not only accommodates various learning preferences but also ...

Read More →

Written by

Gabe Miller

Challenges and solutions in hybrid learning

In the evolving landscape of education, the shift towards hybrid models of learning has significantly impacted the integration of business AI. This article explores the ...

Read More →

Written by

Gabe Miller

Tech tools that are reshaping education

Innovative technological tools in education are revolutionizing the learning landscape, marking a significant shift in knowledge dissemination and absorption. This transformation not only boosts the ...

Read More →

Written by

Gabe Miller

Balancing online and in-person education

In today's educational landscape, blending digital and traditional classroom settings is essential for maximizing learning outcomes. This balance enhances team collaboration, a vital component for ...

Read More →

Written by

Gabe Miller

Maximizing ROI in digital advertising

In today's digital age, maximizing ROI in digital advertising is crucial for marketing success. Among various strategies, video marketing stands out as a highly effective ...

Read More →

Written by

Gabe Miller

Trends in digital advertising for 2024

In the rapidly changing digital landscape, marketers are gearing up for 2024 by integrating outdoor exercise into their online promotion strategies. As we delve into ...

Read More →

Written by

Gabe Miller

Analyzing digital ad performance

In today's digital era, optimizing online advertising campaigns is pivotal for marketers aiming to maintain a healthy work-life balance. This guide delves into essential methods ...

Read More →

Written by

Gabe Miller

Cost-effective advertising strategies online

This blog delves into cost-effective online promotion strategies, crucial for businesses wishing to expand their digital reach affordably. It highlights navigating the complexities of the ...

Read More →

Written by

Gabe Miller

Strategies for global market expansion

Expanding your business into global markets offers vast opportunities and challenges. One effective strategy to thrive internationally is leveraging remote work. This approach not only ...

Read More →

Written by

Gabe Miller

The role of digital platforms in global trade

In today's global marketplace, digital literacy plays a pivotal role in navigating the complexities of global trade. This vital skill set enables businesses and individuals ...

Read More →

Written by

Gabe Miller

Overcoming cultural barriers in business

In today's global market, businesses must overcome cultural differences to thrive. This blog delves into surpassing cultural obstacles in international operations, emphasizing the significance of ...

Read More →

Written by

Gabe Miller

Entering new markets: A step-by-step guide

Exploring new territories for business expansion, particularly in the wearable healthcare industry, offers significant opportunities and challenges. Success in venturing into uncharted markets hinges on ...

Read More →

Written by

Gabe Miller

The importance of mental health in fitness regimes

In today's fitness landscape, acknowledging the critical connection between physical well-being and mental health is paramount. This content showcases why mental health's role in contemporary ...

Read More →

Written by

Gabe Miller

Nutrition’s role in mental well-being

In recent years, the link between diet and mental health has been increasingly recognized, highlighting the importance of nutrition in both physical and mental well-being. ...

Read More →

Written by

Gabe Miller

Yoga and meditation for stress relief

In today's fast-paced world, adopting a zero-waste lifestyle not only contributes to environmental sustainability but also offers effective stress relief methods. Integrating ancient practices such ...

Read More →

Written by

Gabe Miller

Strategies for a balanced mind and body

In the digital age, integrating gaming education into mental and physical harmony practices offers a revolutionary approach. This blog delves into the significance of maintaining ...

Read More →

Written by

Gabe Miller

Minimalist living: Benefits and tips

In today's fast-paced world, embracing minimalism through urban gardening has gained popularity, offering a way to live more fulfilling lives with less. This lifestyle choice ...

Read More →

Written by

Gabe Miller

Minimalism in digital life: Reducing screen time

In today's screen-dominated world, embracing minimalism for enhanced well-being is crucial. This guide, focusing on strategies to minimize screen time, inadvertently highlights the significance of ...

Read More →

Written by

Gabe Miller

Adopting a minimalist wardrobe

Embracing a minimalist wardrobe significantly enhances life in the gig economy, simplifying personal style and supporting a flexible lifestyle. This fashion approach, ideal for individuals ...

Read More →

Written by

Gabe Miller

How to declutter your space effectively

In our fast-paced world, maintaining sleep health is crucial. This blog post delves into the significance of tranquility and organization in our personal spaces for ...

Read More →

Written by

Gabe Miller

E-learning trends shaping the future of education

In the ever-evolving digital landscape, e-learning has become a key aspect of modern education, revolutionizing the acquisition and dissemination of knowledge. This transformation is largely ...

Read More →

Written by

Gabe Miller

Personalized learning through AI technologies

In the era of technological revolution, educational VR enhances personalized learning through artificial intelligence (AI), revolutionizing education. This transformative approach allows students to engage with ...

Read More →

Written by

Gabe Miller

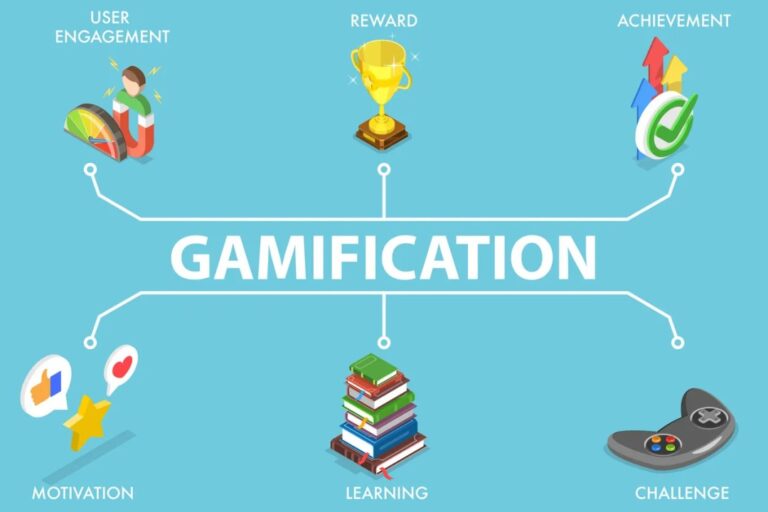

Gamification in learning: A new approach

In the educational sphere, a groundbreaking approach has emerged, seamlessly blending leisure elements with learning processes. This method has significantly transformed learner engagement, taking advantage ...

Read More →

Written by

Gabe Miller

The impact of VR on remote education

In this blog post, we explore how Virtual Reality (VR) technology is revolutionizing education in our era, with a particular focus on its synergy with ...

Read More →

Written by

Gabe Miller

Credit Card Sapphire Preferred

The Sapphire Preferred Credit Card is a premium travel rewards card known for its distinctive features and benefits. It offers a sleek, metallic design with a deep blue color and the word "Sapphire" prominently displayed. The card is recognized for its generous sign-up bonus, where cardholders can earn a significant number of points after meeting a specified spending requirement within the first few months of opening the account.

Credit Card Wells Fargo Reflect

The Wells Fargo Reflect card is a credit card option notable for offering one of the longest introductory APR periods on the market. It's ideal for those looking to consolidate credit card debt or planning large purchases, as it allows users to enjoy an extended interest-free period on balance transfers and purchases. Additionally, the card encourages timely payments by extending the introductory APR period if monthly minimum payments are made on time.