Annual fee:

$0

Intro offer:

$200

Rewards rate:

2% Cashback

Annual fee:

$0 intro annual fee for the first year, then $95.

Intro offer:

$250

Rewards rate:

1%-6% Cashback

Annual fee:

$0

Intro offer:

75,000 Miles

Rewards rate:

2x-5x Miles

Cryptocurrency as an Emerging Alternative Asset: The Dawn of the Institutional Era

March 2, 2026

No Comments

Investing in Commodities: Gold, Oil, and Beyond (2026 Guide)

February 27, 2026

No Comments

The Power of Tangible Wealth: A Deep Dive into Real Estate as an Alternative Investment

February 25, 2026

No Comments

Latests posts

The role of digital wallets in financial inclusion

Digital wallets have revolutionized financial inclusion in the age of technology, serving as a bridge for the underbanked. By providing easy access to electronic transactions, ...

Read More →

Written by

Gabe Miller

Integrating loyalty programs into digital wallets

In today's digital era, the fusion of loyalty programs with digital wallets is transforming the shopping experience. This innovative integration offers unparalleled convenience, significantly enhancing ...

Read More →

Written by

Gabe Miller

Digital wallets: not just for payments

Digital wallets have evolved significantly, transforming from simple payment platforms to versatile financial management tools. These advanced applications now facilitate a broad spectrum of services, ...

Read More →

Written by

Gabe Miller

Mobile payments around the world

Mobile payments have globally transformed financial transactions, offering unparalleled convenience and accessibility. This revolution impacts everyone, from city dwellers to remote village inhabitants, by enabling ...

Read More →

Written by

Gabe Miller

Cultural influences on mobile payment technology

In the digital realm, mobile payment technology emerges as a transformative force, drastically altering global transaction methods. This innovation is not only a reflection of ...

Read More →

Written by

Gabe Miller

Cross-border mobile payments

In the digital finance era, mobile payments stand out as a dominant force, bridging various economies and promoting a globally interconnected financial sphere. This blog ...

Read More →

Written by

Gabe Miller

Global trends in mobile payment adoption

In today's digital age, mobile payments adoption is transforming global transactions, revolutionizing the financial landscape by offering easier and more secure purchase options for consumers ...

Read More →

Written by

Gabe Miller

Crowdfunding for startups

Crowdfunding startups are revolutionizing the way entrepreneurs secure financial support, offering an alternative to traditional funding sources. This innovative approach enables young companies to tap ...

Read More →

Written by

Gabe Miller

The role of community in crowdfunding success

A crowdfunding community is crucial for the success of funding campaigns. This supportive group not only aids in raising essential capital but also provides validation ...

Read More →

Written by

Gabe Miller

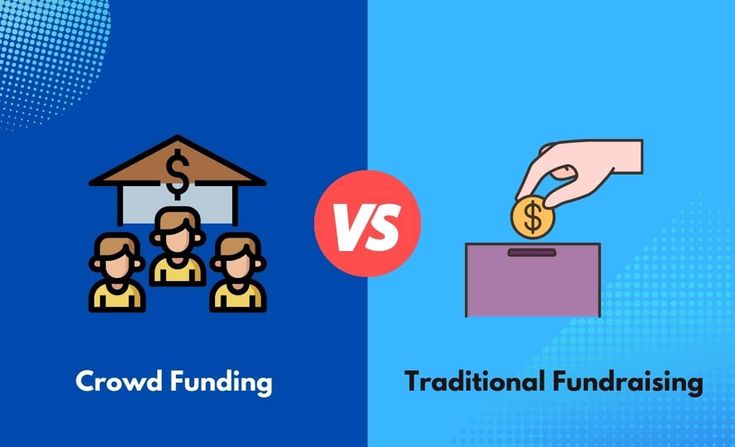

Crowdfunding vs traditional funding

In today's fast-paced entrepreneurial landscape, exploring various funding avenues is crucial. Crowdfunding funding emerges as a leading option, juxtaposed against traditional funding methods. This approach ...

Read More →

Written by

Gabe Miller

Strategies for a successful startup campaign

"In the competitive realm of startups, securing capital is crucial for success. This guide delves into the essentials of startup crowdfunding, offering entrepreneurs actionable insights ...

Read More →

Written by

Gabe Miller

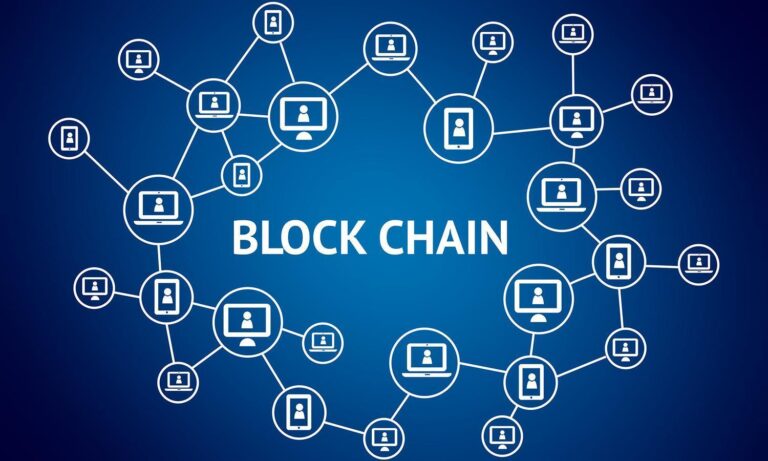

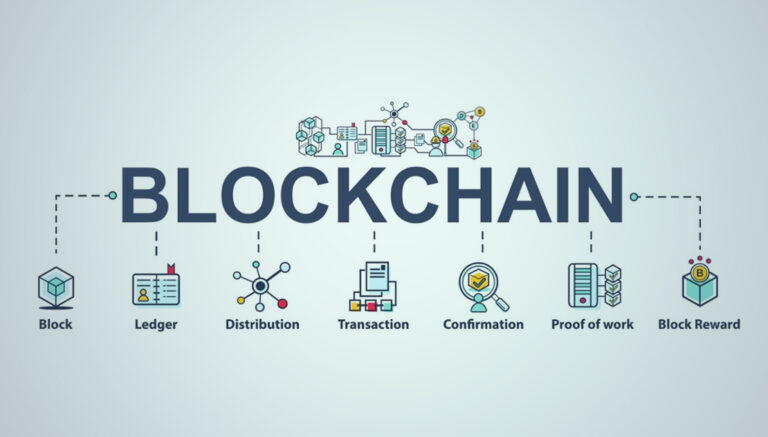

Blockchain’s role in fintech

The integration of blockchain in fintech has revolutionized the financial industry by significantly enhancing security, improving transparency, and boosting efficiency. This innovative technology offers a ...

Read More →

Written by

Gabe Miller

Blockchain and the future of transactions

In the rapidly evolving digital landscape, blockchain technology is revolutionizing the foundation of financial transactions. This innovative technology promises a future characterized by enhanced transparency ...

Read More →

Written by

Gabe Miller

How blockchain is enhancing security

In the digital era, blockchain security has emerged as a revolutionary solution to counter data breaches and cyber-attacks. This blog explores how blockchain technology is ...

Read More →

Written by

Gabe Miller

Innovations in blockchain for finance

In recent years, blockchain finance has revolutionized the financial landscape, marking a period of significant growth and modernization. This innovative wave, driven by technology, merges ...

Read More →

Written by

Gabe Miller

The future of peer-to-peer payments

The future of P2P payments indicates a major shift in personal finance and commerce, promising simplified and more seamless transactions. With the integration of these ...

Read More →

Written by

Gabe Miller

Integrating P2P payments in daily life

In today's fast-paced environment, Peer-to-Peer (P2P) payments have revolutionized the way we handle transactions, showcasing significant advances in financial technology. P2P payments have become integral ...

Read More →

Written by

Gabe Miller

The advantages of peer-to-peer payments

The shift towards digital finance has significantly spotlighted Peer-to-Peer (P2P) payments, offering a convenient method for conducting transactions. This blog post delves into the multifaceted ...

Read More →

Written by

Gabe Miller

How P2P payments are simplifying transactions

Peer-to-Peer (P2P) payments are revolutionizing the financial landscape, offering a seamless and efficient way for individuals and businesses to conduct transactions. In this era focused ...

Read More →

Written by

Gabe Miller

Enhancing security in digital wallets

Enhancing digital wallet security is crucial as they become integral to our financial lives. This blog delves into advanced strategies and tips to bolster the ...

Read More →

Written by

Gabe Miller

Trust and privacy in digital transactions

In the era of technological advancement, digital wallets have become increasingly popular, fostering both convenience and concerns regarding confidentiality in online transactions. As users navigate ...

Read More →

Written by

Gabe Miller

Preventing fraud in your digital wallet

In the technology-driven era, protecting your digital financial assets is critical due to the rise of digital wallet fraud, affecting millions worldwide. Strategies to prevent ...

Read More →

Written by

Gabe Miller

The latest in digital wallet security

In an era where financial interactions are mostly digital, the importance of digital wallet security cannot be overstated. This blog post explores the latest advancements ...

Read More →

Written by

Gabe Miller

Crowdfunding for social impactsocial impactCrowdfunding for social impact

Crowdfunding social impact projects have revolutionized how we support worthy causes in today's era of collective action and social entrepreneurship. This innovative funding method democratizes ...

Read More →

Written by

Gabe Miller

Credit Card Sapphire Preferred

The Sapphire Preferred Credit Card is a premium travel rewards card known for its distinctive features and benefits. It offers a sleek, metallic design with a deep blue color and the word "Sapphire" prominently displayed. The card is recognized for its generous sign-up bonus, where cardholders can earn a significant number of points after meeting a specified spending requirement within the first few months of opening the account.

Credit Card Wells Fargo Reflect

The Wells Fargo Reflect card is a credit card option notable for offering one of the longest introductory APR periods on the market. It's ideal for those looking to consolidate credit card debt or planning large purchases, as it allows users to enjoy an extended interest-free period on balance transfers and purchases. Additionally, the card encourages timely payments by extending the introductory APR period if monthly minimum payments are made on time.