Annual fee:

$0

Intro offer:

$200

Rewards rate:

2% Cashback

Annual fee:

$0 intro annual fee for the first year, then $95.

Intro offer:

$250

Rewards rate:

1%-6% Cashback

Annual fee:

$0

Intro offer:

75,000 Miles

Rewards rate:

2x-5x Miles

The Power of Tangible Wealth: A Deep Dive into Real Estate as an Alternative Investment

February 25, 2026

No Comments

Hedge Funds and Their Role in Diversification: Navigating Complexity in Modern Portfolios

February 23, 2026

No Comments

Private Equity: Opportunities and Risks Explained

February 20, 2026

No Comments

Latests posts

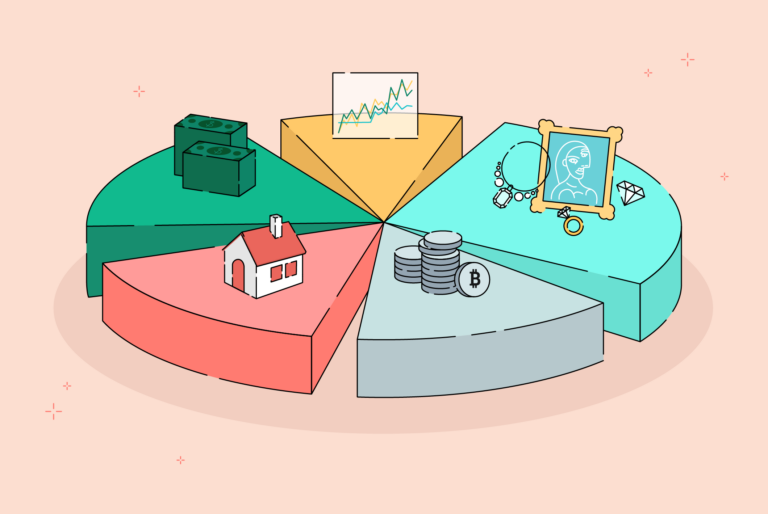

Strategies for a diversified investment portfolio

In the pursuit of financial stability, understanding diversified investment portfolio strategies is critical for success. This guide delves into the significance of crafting a strategic ...

Read More →

Written by

Gabe Miller

Budgeting for emergency fund

In this article on emergency fund budgeting, we explore the critical nature of being financially prepared for life's unpredictability. It provides in-depth guidance on establishing ...

Read More →

Written by

Gabe Miller

Managing credit card debt effectively

Managing credit card debt is essential for maintaining financial health. The ease of overspending with credit cards can quickly escalate into significant financial issues. However, ...

Read More →

Written by

Gabe Miller

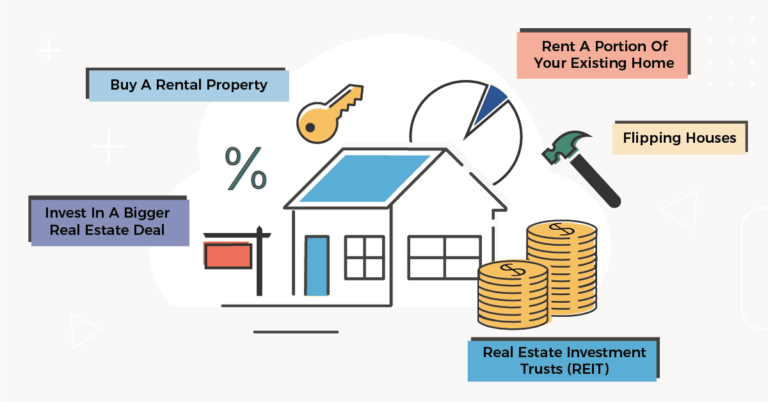

Getting started in real estate investment

Starting real estate investment offers a promising avenue for wealth creation, yet it demands meticulous planning and strategic execution. This blog serves as an essential ...

Read More →

Written by

Gabe Miller

Effective retirement planning strategies

To ensure your retirement planning effectiveness, it's crucial to grasp the fundamentals. Proper planning can transform this daunting task into a manageable process, allowing you ...

Read More →

Written by

Gabe Miller

How to analyze stock investments

In today's dynamic investing landscape, understanding stock analysis techniques is key to making informed decisions. This blog explores the essential methodologies and tools that investors ...

Read More →

Written by

Gabe Miller

Creating a passive income portfolio

"Building a passive income portfolio is an essential strategy for achieving financial freedom, enabling you to earn from various sources without constant involvement. This blog ...

Read More →

Written by

Gabe Miller

Passive income through affiliate marketing

In today's digital realm, earning an affiliate marketing income has become a sought-after method for generating passive revenue. This guide explores the foundations and practical ...

Read More →

Written by

Gabe Miller

The allure of fix-and-flip real estate

The allure of fix-and-flip real estate ventures offers a lucrative opportunity within the investment landscape. This strategy focuses on acquiring underpriced properties, enhancing them through ...

Read More →

Written by

Gabe Miller

Optimizing credit card usage for finance

In today's intricate financial landscape, effectively optimizing credit card finance is crucial for managing personal finances wisely. This blog explores various strategies for maximizing the ...

Read More →

Written by

Gabe Miller

Daily budgeting tips for better money management

Mastering daily budgeting is crucial for financial stability and freedom. This guide provides practical strategies for effective daily budget management, emphasizing the importance of staying ...

Read More →

Written by

Gabe Miller

Navigating the ups and downs of stock investment

Navigating the ups and downs of stock investment can be challenging, yet mastering stock investment navigation is crucial for long-term success in the market's volatile ...

Read More →

Written by

Gabe Miller

The journey to FIRE: Saving vs. investing

Achieving financial independence and retiring early (FIRE) has sparked interest worldwide, yet individuals struggle with the saving vs investing FIRE dilemma. Striking the right balance ...

Read More →

Written by

Gabe Miller

Stock investment mistakes to avoid

Exploring stock investment mistakes is vital for anyone looking to thrive in the stock market. This guide delves into common pitfalls that investors encounter, emphasizing ...

Read More →

Written by

Gabe Miller

Side hustles for extra cash flow

In today's challenging economic environment, discovering methods to augment your income is essential. "Extra Cash Flow Side Hustles" presents an invaluable resource for those seeking ...

Read More →

Written by

Gabe Miller

Passive income ideas for financial growth

Discover key passive income ideas to elevate your financial portfolio in an era focused on wealth accumulation. This article explores diverse strategies to achieve financial ...

Read More →

Written by

Gabe Miller

Analyzing stock market trends

Navigating stock market trends is essential for investors seeking to optimize their investment strategies. By understanding the movements and directions of these trends, both novice ...

Read More →

Written by

Gabe Miller

Living the FIRE lifestyle responsibly

Embracing the FIRE lifestyle, for Financial Independence, Retire Early, is becoming increasingly popular among those aiming for financial freedom. This approach requires strategic planning and ...

Read More →

Written by

Gabe Miller

Budgeting tips for big financial goals

In today's economic landscape, achieving financial objectives requires strategic management of resources. This blog post delves into practical budgeting tips to guide you toward realizing ...

Read More →

Written by

Gabe Miller

Maximizing credit card cashback

Discover the ultimate secrets to maximizing your credit card cashback rewards with our comprehensive guide. Learn effective strategies to enhance your financial well-being by optimizing ...

Read More →

Written by

Gabe Miller

Long-term investing for financial security

In today's volatile economic landscape, long-term investing stands out as a crucial strategy for achieving financial security. This guide sheds light on the key principles ...

Read More →

Written by

Gabe Miller

Retirement accounts: Which one is for you?

Choosing the right retirement accounts is crucial for a secure financial future. This guide delves into various options to help make an informed decision. Understanding ...

Read More →

Written by

Gabe Miller

Real estate flipping: Making it work

Real Estate Flipping: A Lucrative Strategy in the Property Investment World. This blog post explores the essentials of making real estate flipping a success, highlighting ...

Read More →

Written by

Gabe Miller

Diversifying your stock portfolio

In the realm of investing, expanding your stock portfolio is crucial for establishing a solid financial foundation. Stock portfolio diversification acts as a strategic approach ...

Read More →

Written by

Gabe Miller

Credit Card Sapphire Preferred

The Sapphire Preferred Credit Card is a premium travel rewards card known for its distinctive features and benefits. It offers a sleek, metallic design with a deep blue color and the word "Sapphire" prominently displayed. The card is recognized for its generous sign-up bonus, where cardholders can earn a significant number of points after meeting a specified spending requirement within the first few months of opening the account.

Credit Card Wells Fargo Reflect

The Wells Fargo Reflect card is a credit card option notable for offering one of the longest introductory APR periods on the market. It's ideal for those looking to consolidate credit card debt or planning large purchases, as it allows users to enjoy an extended interest-free period on balance transfers and purchases. Additionally, the card encourages timely payments by extending the introductory APR period if monthly minimum payments are made on time.